Good morning. Happy Thursday.

The Asian/Pacific markets closed mostly up. Taiwan and Hong Kong each rallied more than 1%; China and Indonesia also did well. Europe is currently mostly up, but gains are relatively small. Futures here in the States point towards a negative open for the cash market.

The dollar is flat. Oil and copper are down. Gold and silver are down.

Day 3 of the government shutdown begins. For government workers who won’t get paid for these off days, the losses are starting to mount.

Wall St has been mostly quiet. The market expected the shutdown and therefore wasn’t surprised. The indexes are mostly flat so far this week, and the range is not overly big.

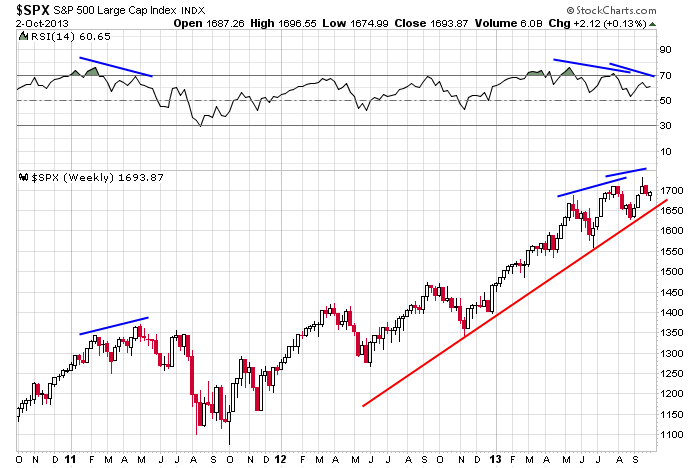

My first SPX target was 1680. That level was tested again yesterday and again the market bounced. Target #2 is 1650, per the weekly chart.

Even if the government were to reopen today, we’re not likely to get tomorrow’s employment report. The BLS doesn’t have the manpower to compile the data. Wall St is very routine oriented. It’s wants certain numbers on certain days of the week and month, so it’s be slightly knocked out of its comfort zone without access to certain numbers.

Overall I think the market is in good shape. The trend is solidly up, and the weakness over the last couple weeks is what I consider perfectly normal and healthy for a strong market. I’m not one to state odds, but I’d say new highs later this year are a very good possibility.

Here’s the weekly. Don’t let the talking heads on TV convince you the economy is doomed because of the shutdown or other reasons. Let the charts be your guide, and right now, the charts are in very good shape.

Stock headlines from barchart.com…

BlackBerry (BBRY +0.51%) was downgraded to “Underperform” from “Market Perform” at Bernstein.

DigiTimes reports that global photovoltaic installations are forecast to rise to a 3-year high in 2014 and exceed 40 GW for the first time, which should generate installation revenue of more than $86 billion.

Domino’s Pizza (DPZ +0.16%) was downgraded to “Perform” from “Outperform” at Oppenheimer.

Facebook (FB -0.28%) was downgraded to “Hold” from “Buy” at Pivotal Research.

Five Below (FIVE +3.53%) was upgraded to “Buy” from “Neutral” at Sterne Agee.

AllThingsD reported that Lenovo (LNVGY -0.38%) has selected a Qualcomm (QCOM +0.28%) chip for its new K-Series smartphone, a change from the previous version which had used Intel’s (INTC +0.26%) Atom chip.

Zsolt Rumy reported a 18.0% stake in Zoltek (ZOLT -0.18%) .

Randal Kirk reported a 26.2% stake in Oragenics (OGEN -1.29%) .

Whitestone REIT (WSR -1.04%) filed to sell 4 million shares of common stock.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

7:30 Challenger Job-Cut Report

8:30 Initial Jobless Claims

9:45 Bloomberg Consumer Comfort Index

10:00 Factory Orders

10:00 ISM Non-Manufacturing Index

10:30 EIA Natural Gas Inventory

4:30 PM Money Supply

4:30 PM Fed Balance Sheet

Notable earnings before today’s open: STZ

Notable earnings after today’s close: XRTX

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Oct 3)”

Leave a Reply

You must be logged in to post a comment.

Same numbers as yesterday. Til one of those levels breaks, we’re range-bound.

can we trust the charts or is it fantasy land again with world central bank intervention to stop a crash–the fed was wise to pump its beg month qe allotment in rather than tapper,but for how long

markets are very quite in europe tonite,but the euro just spiked

im just bored and like intraday volitility

On the other hand Jason, the charts in the fall of 2007 were also in good shape, you know the rest I hope. It is irrational to be too hopeful given what we know today.

Today the US dollar is down, 79.65, a break below the breakpoint 80. The dollar is a sign of the trust in the US and its Markets. The fear over the debt ceiling being insoluable for this Congress is great. It is all over Obamacare which the president has unilaterly changed seven ,7, times (inspite of now law allowing such action) and which the Senate refuses to negotiate. Will that poison debt ceiling on OCT 17th?? Do not be too sure that a ruin path is not opening. Be flat and cautious it is getting ugly in Washington DC.

Put call ratio is too high for a pullback

my soap box

the fat cat doctors over servicing and the drug companies pushing narcotics are outrageous

what do u think u are going to the carlton rex or waldorff when u go to hospital

nationalize it but means test it and make the rich pay for the waldoff histeria

ur standard of doctors and care is not as good as nationalized australia/england ect

kick backs coruption and pork barreling in usa

same goes for ur politicians police and judges

do we need to mention wall street

when a country has no justice,sence of fair play,ethics or morality its dead

read–rule by secrecy or none dare call it conspiracy ect by jimmy marr

there are qualities that make societies like people great

–compassion ,understanding,freadoms,self expression and pride, sence of self as a spirital being, tolerance,justice for all ect

does the materialistic west have any of these left

50 point drop in the nas 100 and got the lot short on high margin

below support and now for the crash of the fantasy tech bubble

closed all world shorts now flat

hope u dont think this had anything to do with the debt ceiling/sky

simply a matter of instos/hedgies conning the poor long only pension funds

crashing it and pinching their positions for fri weekly opts ex

go volitility

longs may now be bought intraday