Good morning. Happy Wednesday.

The Asian/Pacific markets closed mostly up. China, Hong Kong, India, Indonesia and New Zealand did well. Japan and Singapore dropped. Europe is currently mostly down. France, Switzerland, London and Greece are down. Italy is doing well. Futures here in the States point towards a moderate gap down open for the cash market.

The dollar is up slightly. Oil and copper are down. Gold is up, silver flat.

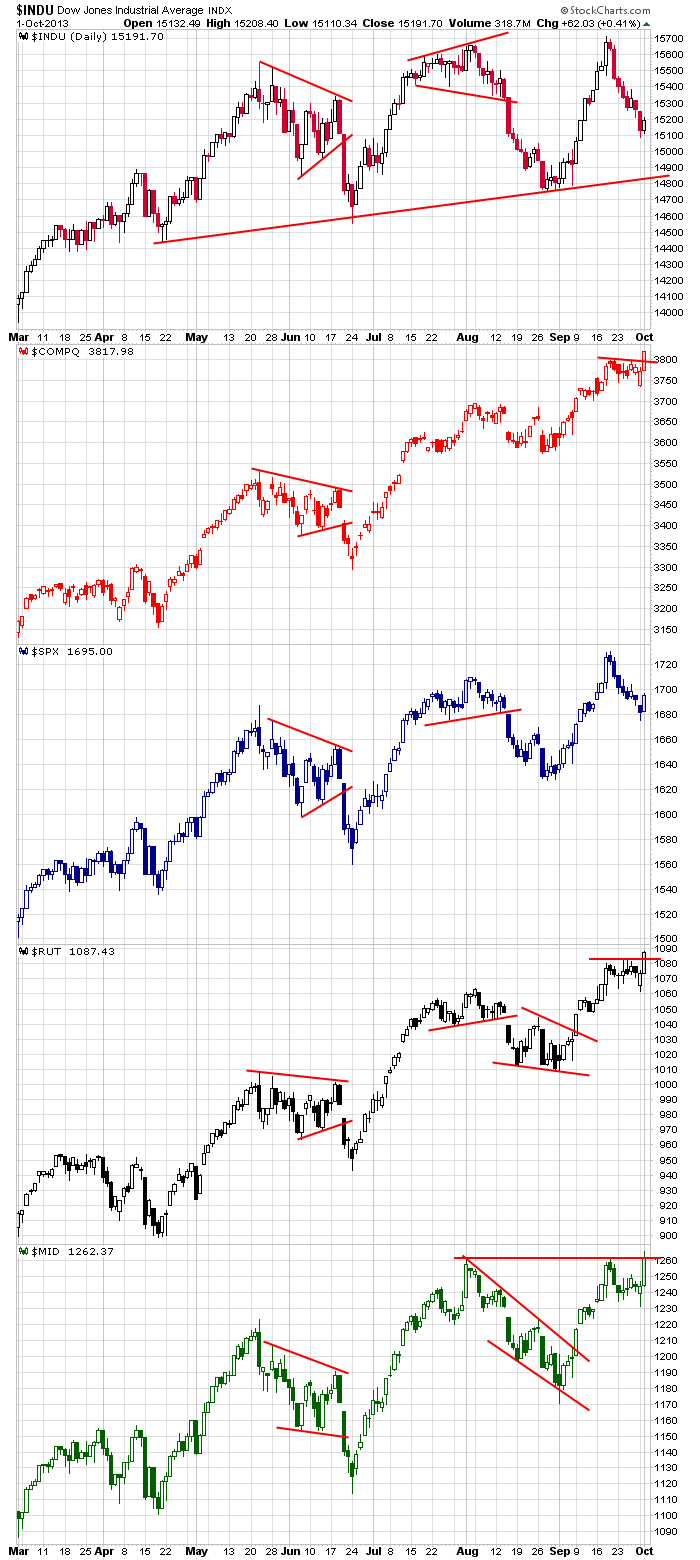

Day one of the government shutdown was uneventful on Wall St. The market did well and closed near its intraday highs. The small caps, mid caps and Nasdaq, which have been leading, did the best and closed at new highs. The small and mid caps closed at all-time highs. The dividend-paying Dow and S&P 500 lagged and for only the second time in 9 days registered a gain. Here are the dailies…

If the government shutdown was not expected, it certainly wasn’t a surprise. But the expectation is concessions will be made quickly, the US will get back to work. The longer it lingers, the more it will weigh on the economy. So at first the shut down is no big deal. Then the response is WTF.

Does anyone have a study that involves the big divergence we see above?

Stock headlines from barchart.com…

Baxter (BAX -0.17%) was downgraded to “Neutral” from “Outperform” at Credit Suisse.

Alcoa (AA +0.62%) was downgraded to “Sell” from “Hold” at Deutsche Bank.

Valero Energy (VLO -0.91%) was upgraded to “Buy” from “Neutral” at Citigroup.

Tesla (TSLA -0.19%) was downgraded to “Neutral” from “Outperform” at RW Baird.

Barrick Gold (ABX -3.17%) was upgraded to “Buy” from Hold” at Deutsche Bank.

Progressive (PGR +0.44%) was downgraded to “Underweight” from “Equal Weight” at Barclays.

Bank of the Ozarks (OZRK +1.79%) raised its quarterly dividend 2 cents to 21 cents per share.

Polaris Capital reported a 9.5% passive stake in Southwest Bancorp (OKSB -0.41%) .

Delcath Systems (DCTH -6.06%) announced that the FDA has granted it orphan drug designation for its drug melphalan in the treatment of patients with hepatocellular carcinoma.

Global Payments (GPN -0.74%) reported Q1 EPS OF $1.00, better than consensus of 95 cents, and then raised guidance on its fiscal 2014 EPS view to $3.98-$4.05 from $3.93-$4.00, stronger than consensus of $3.94.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

7:00 MBA Mortgage Applications

8:15 ADP Jobs Report

10:30 EIA Petroleum Inventories

3:00 PM Bernanke Press Conference

Notable earnings before today’s open: MON

Notable earnings after today’s close: CAMP, TXI

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Oct 2)”

Leave a Reply

You must be logged in to post a comment.

Resistance at SPX 1696 exerted itself at 1230 yesterday. It is valid up to 1702, target is 1662.

The long @ 1678 has a failure at 1666. If we were to open here, we will be above the Long by about 4 points. Futures are -13 for ES. Still 30 mins to the bell. Things can change.

Two scenarios: The short maintains control, hits target, and breaks the long as it does so, and a short trend is established.

or

The long overpowers the short and breaks it by breaking 1702.

Price action will tell you all you need to know.

So far, so good. The divergences we are seeing in the indexes suggest that some institutions are picking favorites and attempting to hold them up. For example, look at the last 30 minutes of the day, yesterday, and the VIX got played with as did the push in indices particularly the Nasdaq where there is great interest in the biotech. Today not so bushy tailed. Holding core ETFs and making a list and checking it twice. Mexico is lovely on the coast, anyway. Keep an eye on Congress I think it may have been hijacked by a metal hospital and is being operated as loss investment. Just a suspicion.

Does anyone have a study that involves the big divergence we see above?

No but it is note worthy.

I don’t want to sound too doom and gloom but the NASDAQ was much stronger prior to the other indexes prior to the last two major bears.

all good comments

the biotechs may be needed for the mental hospital

the euro is playing its part to and much of the nas 100 is traded on german dax

where are apple shares cheapest –german /usa

the dax may have put in a secoundary high or wave 2

and 3250 in the nas 100 seems to have a strugle today

ftse and euro stoxx 50 are holding back the dji

instos dont like to throw in the towel till 2nd week earings,but also like to catch the pension funds long and traped