Options expire this Friday, so let’s take a look at the open-interest on SPY, DIA, QQQ and IWM to see if they hint at movement the rest of the week. Here’s the theory: the market conspires to cause the most pain, to cause the most number of people to lose the most amount of money. If the market is to accomplish this, what does it need to do this week?

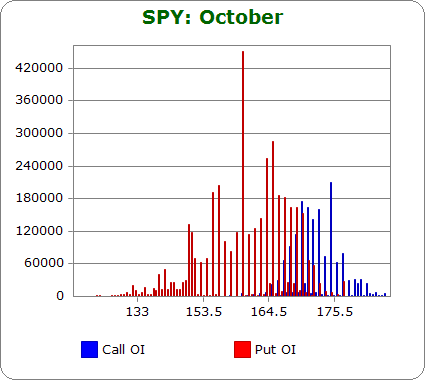

SPY (closed 170.94)

Puts out-number calls 2.0-to-1.0 – about the same as last month.

Call OI is highest between 168 and 175.

Put OI is highest at 150, 151 and between 155 and 170.

There’s some overlap between 168 and 170; otherwise the puts dominate the lower strikes and the calls dominate the higher strikes. A close in the middle of the overlap zone will cause the most number of calls and puts to expire worthless, which is exactly what the invisible hand of the market wants. Today’s close was at 170.94, slightly above the zone. A close here would cause lots of pain. A slight move down would cause even more.

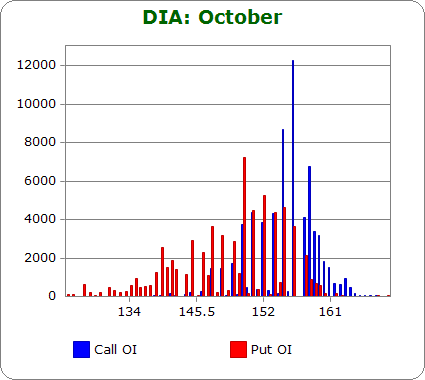

DIA (closed 152.80)

Puts “out-number” calls 0.9-to-1.0 – less bearish than last month.

Call OI is highest at 154, 155 and 157, and it’s moderately strong at 151, 152 and 153.

Put OI is highest 150 and then it’s moderately strong at 151, 152 and 153.

For what it’s worth (not much because option volume on DIA is so light), there’s overlap in the low 150’s. If DIA closes at 152, most of the calls and puts will expire worthless, including the biggest spikes. Today’s close was at 152.80 – exactly where it needs to be. No movement is needed to cause max pain.

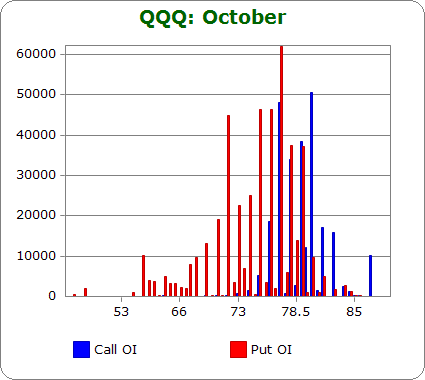

QQQ (closed 79.79)

Calls out-number puts 1.1-to-1.0 – less bearish than last month.

Call OI is highest between 77 and 80.

Put OI is highest at 72 and between 75 and 79.

There’s overlap between 77 and 79, so a close near 78 would cause the most pain (calls and puts are about equal, so no need to close in the top or bottom half of the range). Today’s close was at 79.79, slightly higher than ideal. A small move down is needed for max pain.

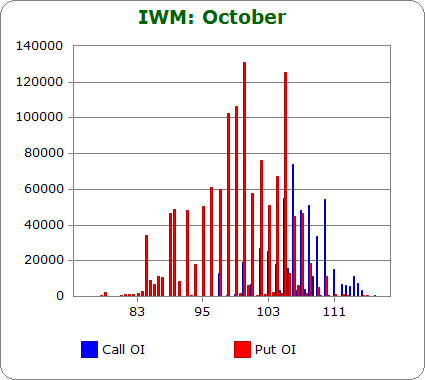

IWM (closed 108.22)

Puts out-number calls 2.3-to-1.0 – more bearish than last month.

Call OI is highest between 106 and 108 and at 110.

Put OI is moderately high between 90-97, is highest at 98, 99, 100 and 105 and is moderately high between 101-104.

Puts dominate. There’s overlap 105-106, but as long as most puts expire worthless, a lot of pain will be felt. Today’s close was at 108.22, higher than ideal. No net change the rest of the week would enable a few of the lower strike calls to be in the money. A move down would cause those calls to expire worthless without allowing many puts to be in the money.

Overall Conclusion: These option numbers matter much less this week than under ordinary circumstances. At any time, the market could surge or plunge based on news from Washington. Nevertheless, the put/call open-interest numbers suggest the market is currently sitting at a level that will cause a lot of pain for option buyers, but max pain will only be achieved with a small move down.