Good morning. Happy Tuesday.

The Asian/Pacific markets closed mixed. Australia, South Korea and Taiwan did well; there were no big losers. Europe is currently up across-the-board. Belgium and Greece are up more than 2%; Amsterdam and Switzerland are up more than 1%; Germany, Norway and London are also doing well. Futures here in the States point towards a flat-to-down open for the cash market.

The dollar is up. Oil and copper are down. Gold and silver are down.

Yesterday’s action was a hint the market has a lot of underlying strength. It gapped down because Washington had not a agreed on a budget over the weekend, but then it shook off the opening weakness and steadily climbed all day and posted moderate gains. Volume dropped – in fact it dropped for the third straight day – but the price action looked great. The market wants to move up. It wants last week’s low to be the low, and it wants to make a new high. It just needs Congress and the White House to agree on something and the shutdown to end.

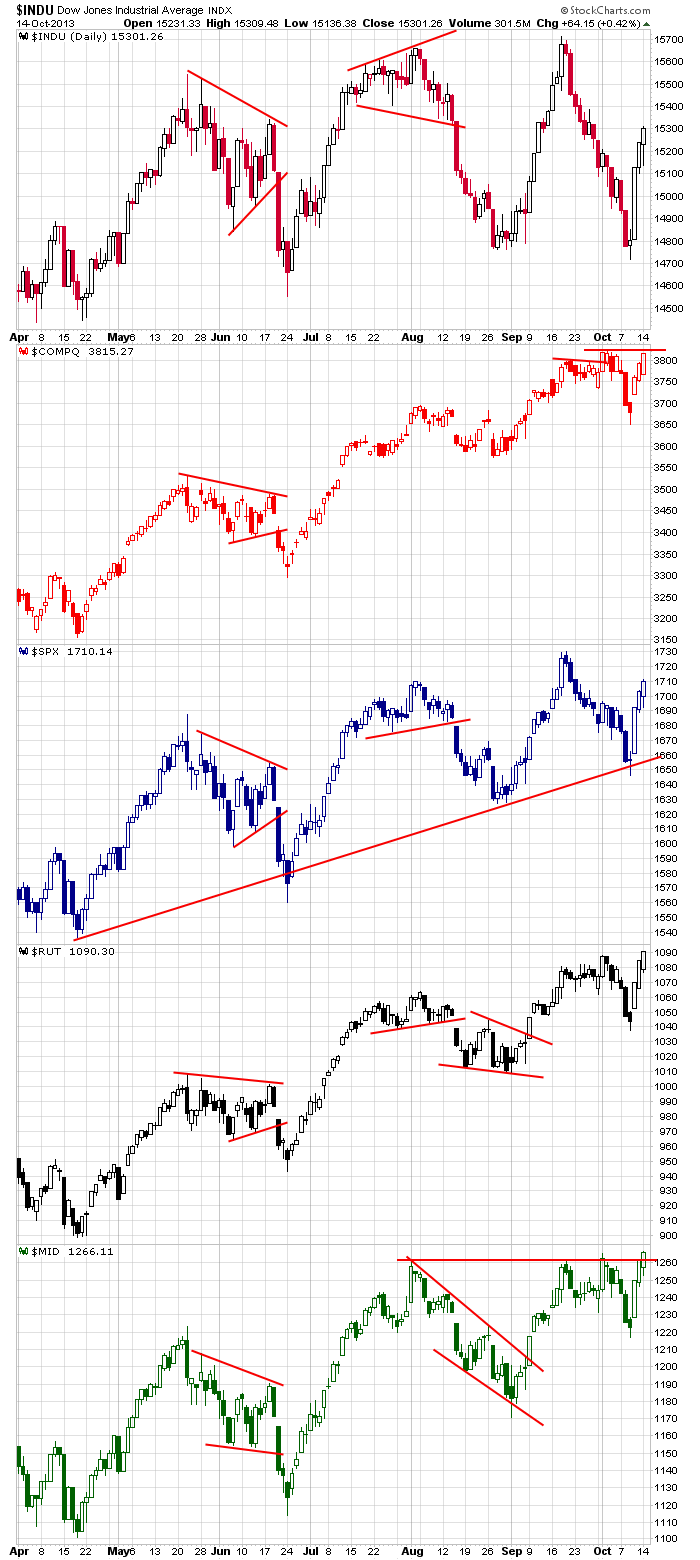

Here are the daily index charts. The small and mid caps are at new highs. The Nas isn’t far behind. The S&P and Dow are lagging but doing well. Money has been rotating from the large cap, dividend-paying stocks into smaller, more speculative companies – a clear sign of market health.

Stock headlines from barchart.com…

Transocean (RIG +0.51%) was downgraded to “Hold” from “Buy” at Argus.

Domino’s Pizza (DPZ +0.72%) reported Q3 adjusted EPS of 51 cents, weaker than consensus of 52 cents.

Tesla (TSLA +0.57%) was upgraded to “Outperform” from “Neutral” at Wedbush.

Texas Instruments (TXN +0.42%) was upgraded to “Neutral” from “Negative” at Susquehanna.

Microsoft (MSFT +0.94%) was upgraded to “Buy” from “Hold” at Jefferies who also raised their price target on the stock to $42 from $33.

Omnicon Group (OMC +0.39%) reported Q3 EPS of 82 cents, better than consensus of 81 cents.

Coca-Cola (KO +0.37%) reported Q3 EPS of 53 cents, right on expectations.

Macy’s (M -0.14%) said it will open most stores nationwide at 8pm on Thanksgiving evening.

Packaging Corp. (PKG +1.60%) reported Q3 adjusted EPS of 91 cents, better than consensus of 89 cents.

Brown & Brown (BRO +1.21%) reported Q3 EPS of 39 cents, below consensus of 40 cents.

Teradata (TDC -0.70%) fell 13% in after-hours trading after it said it sees Q3 EPS of 69 cents-70 cents, well below consensus of 81 cents, and cut its fiscal 2013 EPS view to $2.70-$2.80, below consensus of $3.05.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

7:45 ICSC Retail Store Sales

8:30 Empire State Mfg Survey

8:55 Redbook Chain Store Sales

Notable earnings before today’s open: C, DPZ, FRC, JBHT, JNJ, KO, OMC

Notable earnings after today’s close: CSX, IBKR, INTC, LLTC, YHOO

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Oct 15)”

Leave a Reply

You must be logged in to post a comment.

The fix is in and the crash is off of a while. The Q2 earnings are mixed so far. The longer range effects of the Fed policy, QE unabated, are currently a stimulant to the markets, but ultimately they will drive the velocity of money below what is now the lowest point in modern times, post 1932. This is one of the signs of excessive debt, capital tight due to debt service and low earnings (low levels of investment). Consumption is low and falling, Investment is low, Government spending is falling and exports are low. That Means GDP is falling. GDP = C+I+G+ (x-i). Very basic. Whatever happens in the current stand off the market will pay in 2014 or sooner. Am I invested? Yes, Mid Cap and dividends for a while, year end drive expected by institutitions. Careful, Congress in session and voting.

Nice long off the 930 am low. Target 1720, valid unless 1696 broken.

Resistance here at 1707. A break of 1710 invalidates that resistance.

All prices are SPX.