Good morning. Happy Wednesday.

The Asian/Pacific markets closed mixed. China dropped 1%. Hong Kong, Indonesia and Taiwan also dropped noticeably. Europe is currently mostly down. Belgium is up 0.8%; France, Italy, Stockholm, Switzerland and Greece are leading to the downside. Futures here in the States point towards a moderate gap up open for the cash market.

The dollar is down. Oil is up, copper down. Gold and silver are down.

The day has come. If you believe the MSM (main stream media), today is supposedly the day the US could run out of money, default on its debt payments and set off a chain of events that will lead us to a depression. I have no idea if a budget will be agreed on today. I have no idea if the debt ceiling will be raised. I can tells you there is no chance whatsoever that the US defaults on its debt. The Treasury brings in more than enough to make debt payments, and given our debt is by far the single more important bill the government pays every month, there is no chance in the world we don’t make good on the payment. If the President has to step up and prioritize spending such that that bill is paid first, then he’ll do it. Any talk about the US defaulting is just pathetic fear mongering. It will never happen. Ever.

Hopefully agreements are made at the 11th hour, and the political climate can get back to normal…and the country can focus on more important things.

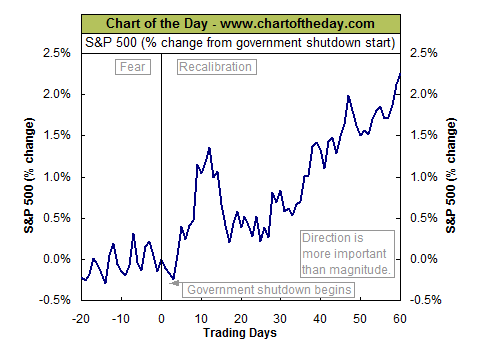

Here’s a chart put out by Chart of the Day. It shows the market’s average performance surrounding the last 17 government shutdowns. Technically today is day 16. It’s interesting to look at, but two things need to be kept in mind. 1) This is an average. In reality, the market was up 60 days later only 10 of 17 times. 2) The average shutdown was only 6 days; the current shut down is much longer. It would be interested to see a chart that used the end of the shutdown as the baseline rather than the beginning of the shutdown.

Let’s hope things get back to normal soon and we can focus on more important things, such as who’s going to the World Series. 🙂

Stock headlines from barchart.com…

Reuters reported that Dallas Fed President Fisher said “reckless” U.S. fiscal policy will likely force the Fed to stand pat on monetary policy this month.

PNC Financial Services Group (PNC -0.64%) reported Q3 EPS of $1.79, well ahead of consensus of $1.62.

Pepsico (PEP -0.60%) reported Q3 EPS of $1.24, stronger than consensus of $1.17.

Bank of America (BAC -0.77%) reported Q3 EPS of 28 cents, better than consensus of 21 cents.

Mattel (MAT -0.93%) reported Q3 EPS of $1.16, stronger than consensus of $1.11.

Stanley Black & Decker (SWK -2.26%) reported Q3 EPS of $1.39, better than consensus of $1.38.

The WSJ reported that JPMorgan Chase (JPM -0.76%) has agreed to pay the Commodity Futures Trading Commission $100 million to settle charges related to the bank’s failed London Whale trade.

CNBC reports that Twitter (TWTR) will be listed on the NYSE.

Gabelli reported a 6.16% stake in Lennar (LEN -2.83%) .

CSX (CSX +0.31%) reported Q3 EPS of 46 cents, better than consensus of 43 cents.

Yahoo (YHOO -1.82%) rallied 2% in after-hours trading after it reported Q3 EPS of 34 cents, better than consensus of 33 cents.

Intel (INTC -0.26%) fell 1.5% in after-hours trading after it reported Q3 EPS of 58 cents, better than consensus of 53 cents, but then said manufacturing snags will delay its new Broadwell line of processors.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

7:00 MBA Mortgage Applications

9:00 Treasury International Capital

10:00 NAHB Housing Market Index

2:00 PM Fed’s Beige Book

Notable earnings before today’s open: ABT, ASML, BAC, BK, BLK, CMA, GWW, KEY, MAT, MTG, NTRS, PEP, PNC, STJ, SWK, USB

Notable earnings after today’s close: ALB, AXP, CCK, CLB, CYS, EBAY, EPB, EWBC, IBM, KMP, NE, RLI, SCSS, SLM, SNDK, STLD, UMPQ, URI, XLNX

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Oct 16)”

Leave a Reply

You must be logged in to post a comment.

Let’s hope things get back to normal soon and we can focus on more important things, such as who’s going to the World Series. Don’t look for the Tigers to win it. Where I live in Michigan everyone pulls for the Tigers but in Football The Packers and Vikings are king.

Good writeup, Jason, as always. But today especially WRT ur comments about default and will never happen.

Well, as you can see from yesterday’s levels, they were playing sloppy and broke the upper resistance only to sell off and completely bust the lower support. Even those were day levels, they should’ve held — but this is an abnormal environment.

There is a significant long level, but we have to go lower to trigger it. For info, it’s at 1688, certainly within reach today. Not predicting, just saying. Its tgt in mid 1700s. Failure 1680 ish.

What they did trigger, but not cleanly, yesterday at the mid afternoon low is another long, and they bounced off it in the after hours with the ES futures at 7pm. So watch that low at 1696.

Futures are very bullish at 9 am: +11.5 ES (SPX) +105 YM (Dow)

Jason – Thanks for pointing out that a default could only occur if the Treasury prioritized spending the money the government receives every month for something other than interest payments. Why the smartest people in the room keep talking about default is a mystery to me unless it’s to scare low information voters.

If we get back to normal (the circus goes on) and the national debt grows another .7 to $1 trillion this year. There needs to be a sense of awareness that historical normal is gone, and the new world has dawned when you can not afford to attend a ball game because you are able to afford the gate. My last Yankee admission was 150 bucks for a very poor seat, and the $8 beer? Sure you want to go there?

We will live with higher taxes and a definite bifurcated society, haves, and have-nots. Why so much longing for forgetting the mess we call Now?? We need political awareness of what we have let happen.

generic for lipitor amoxicillin online lisinopril