Good morning. Happy Tuesday.

The Asian/Pacific markets closed mixed. India rallied 1.7%; Australia, Indonesia and Japan dropped around 0.5%. Europe is currently mostly up. Greece is down 1.6%. Italy and Spain are up more than 1%, Austria, Belgium, France, Germany, Amsterdam, Norway and London are also doing well. Futures here in the States point towards a slight up open for the cash market.

The dollar is up. Oil is down, copper is up. Gold and silver are down.

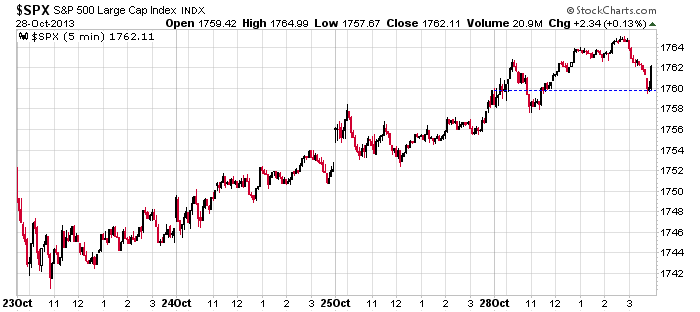

Here’s the S&P intraday chart. The market has been grinding higher…no forceful moves, no energy, no enthusiasm…just a grind higher.

There’s still a lack of good set ups to play. There are a few but not as many as there should be given the strong trend and recent new highs.

The out-performance of some safe-haven groups is worth noting. Utilities, health care, consumer staples have done very well. Either money is rotating from higher risk groups to the safety of lower risk groups or there’s so much money floating around that has to find a home, it’s being funneled into safe-havens because there’s nowhere else for it to go.

Yesterday AAPL had earnings. Revenue was a little light but earnings beat. The stock is up a couple bucks premarket.

The FOMC starts its 2-day meeting today which will culminate in a statement tomorrow. This may keep volatility low for at least another day.

The trend on all time frames is up, but the risk/rewards for new entries is not as good as it was a couple weeks ago.

Stock headlines from barchart.com…

Pitney Bowes (PBI -1.08%) reported Q3 EPS of 49 cents, better than consensus of 41 cents.

Cummins (CMI -0.50%) reported Q3 EPS of $1.94, well below consensus of $2.11.

Pfizer (PFE +0.42%) reported Q3 EPS of 58 cents, stronger than consensus of 56 cents.

Archer-Daniels Midland (ADM -0.23%) reported Q3 EPS of 46 cents, weaker than consensus of 48 cents.

Occidental Petroleum (OXY +0.68%) reported Q3 EPS of $1.97, better than consensus of $1.90.

Aetna (AET -0.06%) reported Q3 EPS of $1.50, below consensus of $1.53.

Apple (AAPL +0.75%) was little changed in after-market trading yesterday after reporting mixed news in its post-close earnings report. On the disappointing side, the company forecast of gross margins of 36.5-37.5% was below the consensus of 38%. Apple initially fell 5% on the report, but then recovered back to unchanged after Apple’s CFO said the lower margins were the result of a new accounting method.

Herbalife (HLF +2.34%) fell 1% in after-hours trading despite beating the Q3 earnings consensus and raising its full-year earnings guidance.

Michael Kors (KORS +0.21%) rallied more than 3% in after-hours trading after news the company will replace NYSE Euronext (NYX) in the S&P 500 on Nov 1.

Blyth (BTH +21.47%) rallied 3% in after-hours trading on a report by Bloomberg that the company received a $16.75 per share takeover offer.

Seagate (STX +0.10%) fell 4% in after-hours trading after a disappointing earnings report.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

FOMC meeting begins

7:45 ICSC Retail Store Sales

8:30 Producer Price Index

8:30 Retail Sales

8:55 Redbook Chain Store Sales

9:00 S&P Case-Shiller Home Price Index

10:00 Consumer Confidence

10:00 State Street Investor Confidence Index

1:00 PM Results of $35B, 5-Year Note Auction

Notable earnings before today’s open: ACI, ACT, AET, AGCO, AGN, ALLT, ALR, AME, AMTD, APD, BP, CIE, CMI, CRS, CRY, CVLT, CYNO, DAN, DDD, DIN, ECL, ETR, EXAS, FDP, FIS,FLWS, GOV, GT, HCP, HRS, HUN, ICON, IIVI, IVR, JBLU, JCI, LLL, LYB, MDC, MSO, MWV, NGD, NOK, OXY, PAG, PBI, PCAR, PFE, RTIX, SCHN,SNH, ST, SUI, TECH, TRI, TRW, TWI, UBS, UDR, UTHR, VLO, VSH, WM, X, XRAY, XYL

Notable earnings after today’s close: ACMP, AFG, AFL, AJG, AMP, AUY, BGFV, BIDU, BWLD, BXP, CACI, CALX, CAP, CBG, CBI, CBT, CEMP, CLD, CRL, CRUS, CVD, CZR, DLB, DLR, DWA,EA, EIX, ENTR, FEIC, FISV, FLEX, GILD, GNW, GPRE, HTS, IACI, INVN, KIM, LNKD, LOCK, LOPE, MOVE, MWA, MX, NANO, NBIX, NUVA, PRXL, QCOR, QGEN,RBCN, RPXC, RRC, RYL, SFLY, SIMG, SKT, SM, SONS, SWI, TGI, TRLA, TTWO, UHS, ULTI, VPRT, VRTX, WBMD, WNC, WSH, WU, XCO, XXIA, YELP

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Oct 29)”

Leave a Reply

You must be logged in to post a comment.

No Fed change expected.Earnings season Revenues are behind and earnings seemed forced. My small cap portfolio is up 33% YTD and I want to stay in and keep it all, if it can be done. Gold looks like it wants the top of the Fib, .618 = $1500 or so. Bonds 10 and 30yr seem to want to move to 130/140. TLT might be a play. Meanwhile I am riding VXF which is weakening, and Biotechs, Utilities, and consumer staple ETFs. The data suggest a weak Christmas season, the budget seems weak too, and the debt ceiling? who knows? Meanwhile Obama is listening to the phone calls of his former friends around the world. I am going fishing today off of Ixtapa but not on the phone.