Good morning. Happy Wednesday.

The Asian/Pacific markets closed up across-the-board. Hong Kong rallied 2%; China and Japan each moved up more than 1%. Europe is currently mostly up. Austria and Belgium are up more than 1%; France, Amsterdam, Italy, Spain, Switzerland, London and Czech Republic are also doing well. Futures here in the States point towards a gap up open for the cash market.

The dollar is down. Oil is down, copper up. Gold and silver are up.

It’s Fed day. Ironically the September meeting had the potential to be one of the most important Fed meetings in several years. Today’s announcement, in my opinion, is one of the least important. The Fed is data dependent. Because of the government shutdown, the data can’t be trusted, so they’re not going to taper. They’ll sit tight and do nothing and lay out their criteria for tapering. I don’t think they’ll taper in December either because of the holidays and because the numbers still won’t be good enough. They won’t taper in January because it’ll be Yellen’s first meeting as Chair. No reason to taper so soon on the job. That leaves tapering off the table until at least March, and even then it depends on the data. Wall St. likes the the punch bowl to remain spiked, so the market ought to continue doing well.

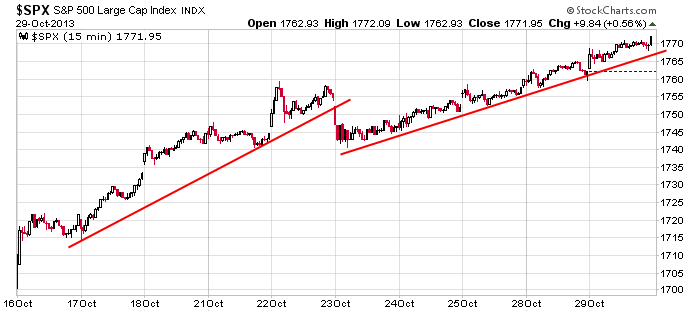

Unfortunately we’ll have to continue watching the paint dry until after today’s meeting. Here’s the 15-min S&P. Very tight and consistent channel. The machines are in control. It’s needs a jolt, that’s for sure.

Stock headlines from barchart.com…

General Motors (GM +0.73%) reported Q3 EPS of 96 cents, better than consenus of 94 cents.

Comcast (CMCSA -1.08%) reported Q3 EPS of 65 cents, better than consensus of 61 cents.

Exelon (EXC -0.07%) reported Q3 EPS of 78 cents, stronger than consensus of 67 cents.

Garmin Ltd (GRMN +0.56%) reported Q3 EPS of 69 cents, well ahead of consensus of 59 cents.

Facebook (FB -1.65%) was upgraded to ‘Buy’ from ‘Neutral’ at BTIG with a price target of $68 a share.

Genworth (GNW +1.32%) reported Q3 EPS of 24 cents, lower than consensus of 25 cents.

Take-Two (TTWO +1.53%) reported Q2 adjusted EPS of $2.49, well ahead of consensus of $1.72, and then raised guidance on fiscal 2014 to $3.50-$3.75, well ahead of consensus of $2.80. The company said the largest contributor to Q2 earnings were sales of Grand Theft Auto V which has shattered entertainment industry records and sold nearly 29 million units to date.

Flextronics (FLEX -1.45%) lowered guidance on Q3 EPS to 21 cents-23 cents, weaker than consensus of 25 cents.

Chicago Bridge & Iron (CBI unch) reported Q3 EPS with items of $1.08, below consensus of $1.10.

Electronic Arts (EA -2.82%) reported Q2 adjusted EPS of 33 cents, nearly three times consensus of 12 cents.

Gilead (GILD +1.12%) reported Q3 adjusted EPS of 52 cents, better than consensus of 48 cents.

Edison International (EIX -0.22%) reported Q3 EPS of $1.42, well ahead of consensus of $1.23, and then raised guidance on fiscal 2013 EPS view to $3.60-$3.70 from $3.25-$3.45, bette rthan consensus of $3.36.

Fiserv (FISV -0.02%) reported Q3 EPS of $1.56, better than consensus of $1.51.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

7:00 MBA Mortgage Applications

8:15 ADP Jobs Report

8:30 Consumer Price Index

10:30 EIA Petroleum Inventories

1:00 PM Results of $29B, 7-Year Note Auction

2:15 PM FOMC Announcement

Notable earnings before today’s open: ACCO, ADP, AEGR, AMT, AUDC, AUO, BAH, BWA, CEVA, CFR, CMCSA, DBD, EGN, EXC, GAS, GLW, GM, GPK, GRMN, H, HEP, HES, HPY, INGR, JNY, KCG, LGND, LPLA, LVLT, MCGC, MDXG, MSM, NICE, NOR, NVMI, PCG, PEG, PES, PSX, PX, S, SAVE, SEE, SO, SODA, SPW, TASR, TEL, TFX, WEC,WLT

Notable earnings after today’s close: ACTV, AFFX, ALL, ARII, ARRS, ATML, AXS, AXTI, BOOM, BYI, CAR, CAVM, CHUY, CJES, CNW, COHR, CROX, CSC, CUZ, CYH, DRE, DRIV, DXPE, EDMC, ELGX,ELX, EQR, ESS, EXEL, EXP, EXPE, FARO, FB, FLT, GLUU, GMED, HBI, HOS, HR, INT, IPI, IRF, ISIL, ITMN, ITRI, JAH, JDSU, JIVE, KEG, KEYW,KONA, KRFT, KS, MANT, MAR, MASI, MCHP, MDAS, MERU, MET, MMLP, MOH, MTGE, MUR, NEWP, NSR, OI, OIS, OTEX, PFPT, PGTI, PKI, PL, PPC, PRAA,PSMT, PVA, QUIK, RAIL, RATE, REG, RKUS, ROVI, SAM, SBUX, SGI, SHOR, SKUL, SPRT, SPWR, SSNI, SSW, STAA, STR, SU, SWKS, THOR, TRN, TSYS, TTMI, TTS, UNTD, V, VNR, WMB, WPZ, WTW, XL

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Oct 30)”

Leave a Reply

You must be logged in to post a comment.

SPX tgt of 1770, posted here on 10/10, achieved yesterday.

as god of the future,i am now short the universe

the cash or present market does not tell the full story

there were some very interesting spike capitualtion exhaustions in the land of the future overnite and europe

the future controls the present not visa versa