Good morning. Happy Wednesday.

The Asian/Pacific markets closed mixed. China dropped, Indonesia and Japan did well. Europe is currently mostly up. Austria, France, Norway, Stockholm, Switzerland, Czech Republic, Greece and Italy are doing the best. Futures here in the States point towards a solid gap up for the cash market.

The dollar is down. Oil and copper are up. Gold and silver are up.

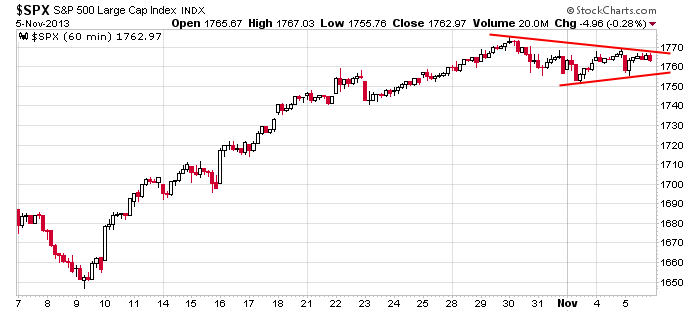

The market remains in consolidation mode while lots of opposing forces sort themselves out. Here’s the 60-min SPX chart. The index rallied 130 points and has since been trading quietly in a tight range. Once again, it’s correcting with time, not price. Instead of pulling back to shake the tree a little and cast a little doubt on the bull’s staying power, it has moved sideways to accomplish the same thing.

Today’s open will be near resistance at 1770, which is much more interesting than trading in the middle of the range.

Otherwise my opinion of the market hasn’t changed. Near term there are questions; I could argue for a move in either direction. But long term I like the market and think the end of the year will be good for the bulls.

Stock headlines from barchart.com…

Time Warner (TWX -0.64%) reported Q3 EPS of $1.01, much better than consensus of 89 cents.

Hospira (HSP -0.52%) reported Q3 EPS of 51 cents, better than consensus of 44 cents.

Duke Energy (DUK -0.03%) reported Q3 EPS of $1.46, below consensus of $1.51.

Humana (HUM -0.19%) reported Q3 EPS of $2.31, well ahead of consensus of $2.16.

Abercrombie & Fitch (ANF +0.26%) fell over 5% in after-hours trading after it said it sees Q3 EPS at the higher end of 40 cents-45 cents range, better than consensus of 40 cents, but then said it sees Q4 EPS of $1.40-$1.50, below consensus of $1.47.

C.H. Robinson (CHRW -1.30%) reported Q3 EPS of 69 cents, below consensus of 73 cents.

Life Technologies (LIFE -0.01%) reported Q3 EPS of $1.02, better than consensus of 97 cents.

Live Nation (LYV -1.12%) reported a Q3 EPS of 22 cents, well below consensus of 34 cents.

OfficeMax (OMX -0.26%) reported Q3 adjusted EPS of 15 cents, weaker than consensus of 22 cents.

Fossil (FOSL +2.93%) reported Q3 EPS of $1.58, well ahead of consensus of $1.36.

DaVita (DVA -0.39%) reported Q3 EPS of 98 cents, stronger than consensus of 96 cents.

Office Depot (ODP -0.53%) reported Q3 adjusted EPS of 2 cents, well below consensus of 6 cents.

Tesla (TSLA +0.92%) plunged 10% in pre-market trading after it reported Q3 EPS of 12 cents, higher than consensus of 11 cents, but said it delivered about 5,500 of its Model S vehicles in Q3, below some estimates of as much as 5,850 cars.

21st Century Fox (FOXA -0.18%) fell nearly 2% in after-hours trading after it reported Q1 adjusted EPS of 33 cents, weaker than consensus of 35 cents.

Ternium (TX +0.49%) reported Q3 EPS of 50 cents, better than consensus of 48 cents.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

7:00 MBA Mortgage Applications

10:00 Leading Indicators

10:30 EIA Petroleum Inventories

Notable earnings before today’s open: ABMD, AUXL, AVA, CHK, CLH, CNP, CSTE, CWH, DUK, DVN, END, EZCH, GEO, GGS, HCLP, HFC, HSNI, HSP, HUM, KELYA, LAMR, MGA, MMC, NAVB, NPSP,OGE, PKD, PNK, POM, POWR, POZN, PWE, RL, SBGI, SKYW, STRZA, SUNE, SUSP, SUSS, TAP, TLM, TSRA, TWX, VG, VOYA, WRES, XEC

Notable earnings after today’s close: ACLS, ACXM, ALNY, ALSK, AMTG, ANDE, ATO, ATVI, AWAY, AWK, BALT, BIOS, BKD, CBS, CECO, CKP, CLR, CODI, CPE, CTL, CVG, CXO, CXW, DCTH, DGIT,DK, DVR, DXCM, ENS, ERII, EVC, FLTX, FTK, G, GA, GNK, HIMX, HNSN, HT, INWK, IO, LPSN, MAA, MDLZ, MKL, MRIN, NDLS, NVTL, OAS, OILT,OSUR, PDLI, PHH, PMT, PMTC, PRI, PRU, QCOM, RIG, RJET, ROSE, RST, SCTY, SLCA, SN, TCAP, TEG, TPX, TS, TSO, TWTC, UHAL, WAC, WES, WFM,WG, WTI

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Nov 6)”

Leave a Reply

You must be logged in to post a comment.

Twitter rally, no earnings or assets so it is the theme stock of this market. Say anything and they will buy it 35 dollars/share? The story of oil is coming winter months, but no backwardation, contango rules. My LNG is up 400% so export will keep going. As for the indexes: when Yellen takes the chair it is QE forever, but no inflation. The money is locked up for the most part, no bank loans except for margin accounts. Indices are like up from here on as far as the eye can see. But no inflation, deflation, as there is no transmission for the money to the market. The more they pump, the fewer the jobs. The paradox of liquidity bottled up in banks. The witches brew. But watch Friday, its the latest creation of the BLS and BEA will say it is true. Holding midcaps,energy,tech and health care stocks. A few tax free bonds in munis.

SPX Futures (ES) broke that important resistance level (1769) overnight and are bullish prior to the open at +8. Anticipate a pop at the open, and then a drop to SPX 1762 neighborhood. Then a climb into the 1770s. (If we go lower than 1760 on the pullback, something is amiss and the climb is in jeopardy.)

The lower target I’ve been mentioning in the 1750s is off the table.