Good morning. Happy Thursday.

The Asian/Pacific markets closed mostly down. Indonesia did well while China, Hong Kong, Japan, New Zealand and South Korea lagged. Europe is currently mostly up. Belgium, France, Germany, Italy, Spain and Czech Republic are posting solid gains. Futures here in the States point towards a moderate gap up open for the cash market.

The dollar is up big. Oil and copper are up. Gold and silver are up.

The ECB cut a key rate from 0.5% to 0.25%.

Twitter (TWTR) is going public today at $26, which values the company at about $18B. The original range, $17-20, was raised to $23-25 and now to the current level. If anyone was wonder if they were following LNKD and leaving money on the table or FB and squeezing every last penny out of Wall St. they can get, IMO, they’re following FB. $18B valuation is a lot for a company that is a one-trick pony and has limited revenue options. I don’t care that they’re not profitable because my sense is they can change that quickly. I care that they do one thing great and otherwise don’t have any other markets to tap into. Let’s see what Wall St’s appetite is a “social” IPO. FB, LNKD and YELP are all doing great, so TWTR could not ask for a better time to go public.

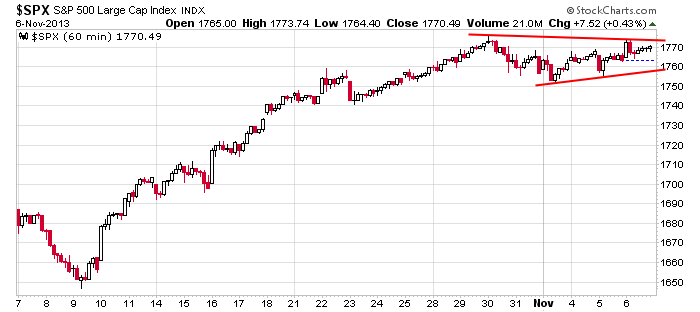

To the general market…here’s an update of the 60-min SPX chart. If this was an individual stock, I’d be very interesting in buying a breakout. The market looks great on all time frames, so for now there’s no reason to not be excited about continuing to play top stocks in top groups.

Employment numbers come out tomorrow morning.

Stock headlines from barchart.com…

International Game Technology (IGT +4.42%) reported Q4 EPS of 28 cents, weaker than consensus of 34 cents.

Windstream Holdings (WIN +1.65%) reported Q3 EPS of 8 cents, below consensus of 9 cents.

Scripps Networks Interactive (SNI +0.21%) reported Q3 EPS of 87 cents, better than consensus of 84 cents.

Tesoro (TSO -1.00%) reported Q3 EPS ex-items of 44 cents, well below consensus of 50 cents.

Transocean (RIG +1.70%) climbed over 4% in pre-market trading after it reported Q3 adjusted EPS of $1.37, well above consensus of $1.07.

Convergys (CVG +0.41%) reported Q3 EPS of 29 cents, above consensus of 26 cents.

American Water (AWK +0.53%) reported Q3 EPS of 84 cents, lower than consensus of 85 cents.

American Eagle (AEO -3.93%) jumped nearly 9% in after-hours trading after it raised its Q3 EPS outlook to 19 cents from 14 cents-16 cents, stronger than consensus of 15 cents.

Activision Blizzard (ATVI unch) reported Q4 EPS of 8 cents, more than double consensus of 3 cents, and then raised guidance on fiscal 2013 EPS to 89 cents from 85 cents-87 cents.

Tempur-Pedic (TPX -0.50%) reported Q3 adjusted EPS of 73 cents, above consensus of 68 cents.

Mondelez (MDLZ unch) reported Q3 adjusted EPS of 41 cents, above consensus of 40 cents, and then raised guidance on fiscal 2013 EPS to $1.57-$1.62, stronger than consensus of $1.55.

Andersons (ANDE -0.70%) reported Q3 EPS of 91 cents, well ahead of consensus of 61 cents.

Whole Foods (WFM +1.22%) plunged nearly 10% in after-hours trading after it reported Q4 EPS of 32 cents, better than consensus of 31 cents, but then lowered its fiscal 2014 EPS view to $1.65-$1.69 from $1.69-$1.72, well below consensus of $1.73.

Qualcomm (QCOM +1.07%) fell nearly 4% in after-hours trading after it reported Q4 adjusted EPS of $1.05, below consensus of $1.08, and then lowered guidance on Q1 adjusted EPS to $1.10-$1.20, below consensus of $1.29.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

Chain Store Sales

8:30 Initial Jobless Claims

8:30 GDP Q3

9:45 Bloomberg Consumer Comfort Index

10:30 EIA Natural Gas Inventory

3:00 PM Consumer Credit

4:30 PM Money Supply

4:30 PM Fed Balance Sheet

Notable earnings before today’s open: AAWW, AEE, AES, AMCX, AMRC, AMSC, ANSS, APA, APO, ARQL, ATK, BCE, BDBD, BKCC, BR, BZH, CBB, CCO, CMLP, CNK, CNQ, CNSL, COTY, CPN, CQB, DYN, EOG, FCN, FLO, FLY, FNP, FSYS, FUN, FUR, FWLT, FWM, GLP, GOLD, GTN, HII, HNT, IGT, IRC, IT, JRCC, KIOR, KLIC, LNT, LRN, MFC, MLM, MT, MWIV, MWW, NVAX, NWN, NXTM, RDN, RGEN, RGLD, ROK, SFUN, SMG, SNI, SSYS, STWD, THI, TICC, TK, TTI, TW, USAC, VC, VNDA, VTG, WEN, WIN, WLK, WMC, WWAV

Notable earnings after today’s close: ADES, ADUS, AIRM, AL, ALJ, ANAC, ARAY, AREX, ARNA, ATLS, ATW, AUQ, AVG, BCEI, BEBE, BIO, BNNY, BPZ, CFN, CLNE, CUBE, DAR, DIS, DMD, EAC, EBS, ECPG, ELON, ENOC, EZPW, FEYE, FF, FUEL, FXEN, GERN, GRPN, GXP, HTGC, IL, KRO, KTOS, LCI, LFVN, MCP, MDRX, MITK, MNST, MNTX, MSCC, NES, NFG, NKTR, NOG, NVDA, OCLR, OLED, PCLN, PEGA, PODD, RNDY, SF, SGMS, SLXP, SNTS, SQNM, SWIR, TSRO, TUMI, UBNT, UNXL, VVC, WIFI, WR, WTR, XNPT, XTEX, YRCW

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Nov 7)”

Leave a Reply

You must be logged in to post a comment.

ECB lowers interest rates .025% due to disinflation and grave fears for their banks. The problem seems to be that banks are more important in the EU than in the US. And the SEC plans on fines for EU banks for playing with the discount rate. In Any case, this rate hike is not a good sign for anyone globally.

Meanwhile, GDP at 2.5%,which is more of same.In the US the first time claims are flat but the inventories are building. Why? Consumer sales are down or flat. On Wall Street the traders delighted, more QE which they love to put it mildly. Be careful today looks up based on futures, but in fact there is fear out there, it could start a rush for the exits later today. We all know the markets are no longer correlated? Use stops and keep watching the US budget and debt ceiling, the 2016 elections are driving the hate and discontent and do not underestimate the chanery likely.

The ECB rate cut put some luster in the futures, which went from flat to +6 (SPX futures) in 10 minutes. They’re holding the bulk of their gains. In the process, they also hit the target I was looking for yesterday but was not achieved prior to the closing bell. So we should open with another pop today into mid 1770s.

Would expect a pullback to the 1770 region, and assuming the bullishness persists, another run at a new high, circa high 1770s/lo80s.

I agree with you, Whidbey, this doesn’t make sense, but you have to trade what the boyz are doin’ and they’re pushing higher. SPX tgt projects to 1788 which seems nutso, but that appears to be their bull’s eye for now.

fat bulls explode

and provide food for the bears

false break highes everywhere

aint the bears magnificent

whidbey.. Good post

Wed the market gaped up and could not hold it. Then at least the NASDAQ went flat. I had not seen this in years and I lost my hourly charts from 10 years ago. I remember it being a very bearish signal.. Perhaps I was correct.