Good morning. Happy Wednesday.

The Asian/Pacific markets closed mostly down. India, Indonesia, South Korea, Australia and Taiwan dropped the most. China moved up. Europe is currently down across-the-board. Spain and Greece are down more than 1%; Austria, Belgium, Stockholm and Italy are also down noticeably. Futures here in the States point towards a flat open for the cash market.

Be alerted of new content. Join out email list here.

The dollar is down slightly. Oil and copper are flat. Gold and silver are down.

Bernanke gave a speech last night. He reiterated the Fed’s plan to continue QE until unemployment gets below 6.5% and also said rates will be kept low for an even longer period time. Fantastic. Earning 0% interest on money in the bank will continue.

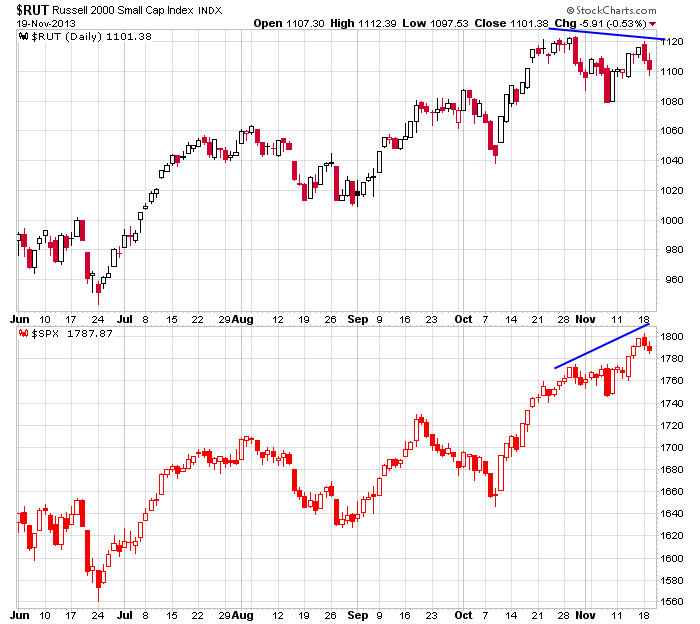

Here’s a re-post of the most ominous chart I see right now. It’s a divergence between the S&P 500 large caps and the Russell 2000 small caps. This tells me money is rotating from smaller speculative companies to larger, more established, dividend-paying companies. Short term this is bearish, so as long as it persists, the market isn’t likely to move up.

Overall I still like the market. Most of the indexes made new highs last week. Most important groups are doing well. The indicators are doing well. The Fed is not going to ease their policy, and many money managers are under-performing the market and will need to do something to salvage their meager gains between now and the end of the year.

A few leading stocks have started to lag, and the small caps are lagging. Otherwise I see no reason to change my long term stance.

Stock headlines from barchart.com…

Consolidated Edison (ED -0.65%) was downgraded to ‘Hold’ from ‘Buy’ at Argus.

Boeing (BA -1.00%) was downgraded to ‘Perform’ from ‘Outperform’ at Oppenheimer.

Priceline.com (PCLN -0.84%) was upgraded to ‘Conviction Buy’ from ‘Buy’ at Goldman.

Best Buy (BBY -10.97%) was upgraded to ‘Buy’ from ‘Neutral’ at Citigroup.

JM Smucker (SJM -0.29%) reported Q2 EPS of $1.52, below consensus of $1.59.

Lowe’s (LOW -0.88%) reported Q3 EPS of 47 cents, weaker than consensus of 48 cents.

JC Penney (JCP unch) reported a Q3 EPS loss of -$1.81, a wider loss than consensus of -$1.74.

Deere & Co. (DE -1.02%) reported Q4 EPS of $2.11, well ahead of consensus of $1.90.

Johnson & Johnson’s (JNJ +0.59%) DePuy Orthopaedics announced a $2.5 bllion U.S. settlement to compensate 8,000 hip system patients who had surgery to replace their their ASR hip, known as revision surgery, as of August 31.

Yahoo (YHOO -0.97%) climbed over 3% in after-hours trading after it said it will raise its share buyback program by $5 billion.

HealthSouth (HLS -1.39%) lowered guidance on fiscal 2013 EPS view to $2.43-$2.46 from $3.06-$3.09, but it is still above consensus of $1.89.

Herbalife (HLF -1.83%) rose over 3% in after-hours trading after William P. Stiritz reported a 6.38% stake in the company.

La-Z-Boy (LZB +0.25%) jumped over 6% in after-hours trading after it reported Q2 EPS of 31 cents, higher than consensus of 26 cents.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

7:00 MBA Mortgage Applications

8:30 Consumer Price Index

8:30 Retail Sales

10:00 Business Inventories

10:00 Existing Home Sales

10:30 EIA Petroleum Inventories

12:10 PM Fed’s Bullard: U.S. Economic and Monetary Policy

2:00 PM FOMC minutes

Notable earnings before today’s open: ADT, DE, JCP, LOW, SJM, SPLS

Notable earnings after today’s close: BV, GMCR, JACK, LTD, POST, VVTV, WSM

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Nov 20)”

Leave a Reply

You must be logged in to post a comment.

The Fed minutes will be 11 am PST from the October policy meeting where the monthly $85 billion bond buying should continue. Analysts are debating when the Fed may introduce “tapering” and the potential amount that may be started. Many believe that it will be March of 2014 with the initial reduction of $10 – $15 billion per month The Fed’s $85 billion monthly asset program has been continued for fear that the US economy could potentially backslide into a possible recession if the program was pulled too soon. Might go up too, but few believe that one. The next policy meeting is December 17th to 18th. Initially the Fed had said that the tapering may begin when the Unemployment Rate reaches 6.5 % and or inflation reaches 2.5 % and at this juncture perhaps we should heed their words. The E-Mini S&P 500 has traded up to the highs without faltering throughout the fiscal cliff, the sequestration, the shutdown and perhaps the debt ceiling still climbing to new highs. Yesterday’s high of $1799.75 seemed particularly important as the $1800.00 level had not been breached Who says the Fed, or fear of the Fed runs the markets??

Nothing from Congress on the budget and debt ceiling guess those items have disappeared off the agenda. By the way consumers are spending borrowed money again and it looks like the Season has been saved – just one report today, but …you know hope is the heart of Christmas.

Yesterday’s trading was a logjam. Trading rose to resistance (1797) and fell to support (1784) all day.

Expect one or the other to break today at the 2 PM FOMC Minutes announcement/release.

Be aware that a break of support can take the market down to 1750-55,

and from that level commence the seasonal rally into the end of the year. That

support level is deep (down to about 1744), so as long as that holds.

For today, until 2 pm, it’s reasonable to expect more of what we had yesterday.

Futures are +3.75 at 30 mins to the bell. Low of the night was -3.00, high was +5.25

“Fed’s plan to continue QE until unemployment gets below 6.5%”. With the numbers being manipulated these days the statement does not mean a lot.

Good observation Jason on the small caps lagging. I have some pet stocks that I watch which lead the market and they have been a little weak. The charts look like a major pullback to me. The indicators I watch however just do not support it.