Good morning. Happy Thursday.

The Asian/Pacific markets closed mostly down. Japan rallied almost 2% while India dropped 2% and South Korea and Taiwan dropped more than 1%. Europe is currently mostly down. Greece, Austria and Amsterdam are up; Belgium, Norway and Stockholm are down. Futures here in the Stats point towards a moderate gap up open for the cash market.

Be alerted of new content. Join out email list here.

The dollar is down. Oil and copper are up. Gold and silver are up.

Yesterday the FOMC minutes hinted tapering may happen sooner rather than later. Even though the Fed agreed at the last meeting to continue buying $85B in assets, there was a lot of discussion about tapering “before an unambiguous further improvement in the [labor-market] outlook was apparent.” Also, many voting members agreed a slower pace of asset purchases could take place at one of its next couple meetings if the data was supportive.

The market reacted negatively to the news, but with all things Fed, we know the initial knee-jerk reaction often gets reversed the next day. We’ll see.

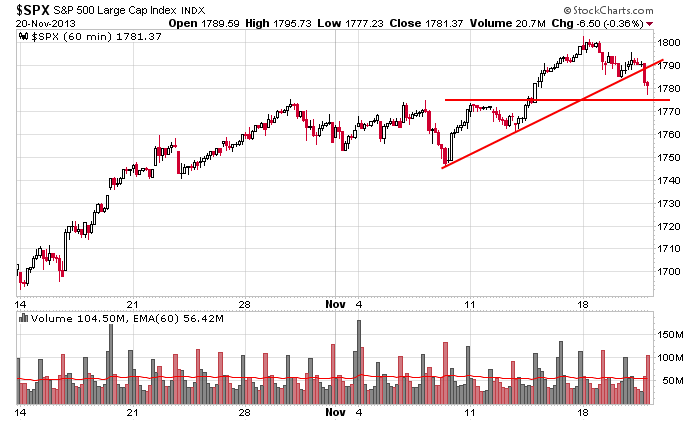

Here’s the 60-min S&P chart. The key upper level is 1790ish; the key lower level is 1774/1775. A bounce up to 1790 which stalls may be a good entry for a short down to the mid 1170’s.

So far the drop off the high has been perfectly normal for a healthy market trending up. I see no reason to abandon my long term bias, which of course is up.

Near term things are less clear. The divergence between the Russell small caps and S&P large caps I posted yesterday is reason to be more cautious in the near term.

Stock headlines from barchart.com…

Dollar Tree (DLTR -0.66%) reported Q3 EPS of 58 cents, weaker than consensus of 60 cents.

Abercrombie & Fitch (ANF -0.54%) reported Q3 EPS of 52 cents, higher than consensus of 44 cents.

Target (TGT -0.21%) reported Q3 EPS of 54 cents, below consensus of 62 cents.

Reuters reports that U.S. regulators are considering whether to give banks more time to comply with the Volcker rule.

Donaldson (DCI -0.53%) reported Q1 adjusted EPS of 41 cents, better than consensus of 39 cents.

Raytheon (RTN -0.11%) announced that its board authorized the repurchase of up to an additional $2 billion of the company’s outstanding common stock.

Jack in the Box (JACK +0.27%) reported Q4 adjusted EPS of 45 cents, higher than consensus of 39 cents.

L Brands (LTD +0.61%) reported Q3 EPS of 31 cents, stronger than consensus of 28 cents.

Williams-Sonoma (WSM -0.27%) rose 3% in after-hours trading after it reported Q3 EPS of 58 cents, better than consensus of 55 cents.

Green Mountain (GMCR +0.65%) jumped nearly 5% in after-hours trading after it reported Q4 adjusted EPS of 89 cents, well above consensus of 75 cents.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

8:00 Fed’s Bullard: U.S. Economic and Monetary Policy

8:30 Initial Jobless Claims

8:30 Producer Price Index

9:00 PMI Manufacturing Index Flash

9:45 Bloomberg Consumer Comfort Index

10:00 Philly Fed Business Outlook

10:30 EIA Natural Gas Inventory

4:30 PM Money Supply

4:30 PM Fed Balance Sheet

Notable earnings before today’s open: ANF, BKE, BONT, CYBX, DCI, DLTR, GIL, GME, LQDT, PDCO, SPB, TGT

Notable earnings after today’s close: ADSK, ARUN, ASYS, BERY, GEOS, GPS, INTU, MENT, MRVL, NGVC, P, ROST, SPLK, TFM, VMEM

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Nov 21)”

Leave a Reply

You must be logged in to post a comment.

First time claims down 23000 and inflation is stable. BUT the Trouble is, the US stock market looks rather overvalued says GMO says it too high 1100 SP is fair value.

That’s certainly the view in the latest quarterly letter from GMO, a US asset management firm. GMO’s founder, Jeremy Grantham, has an impressive record of calling market movements successfully.

He avoided the Japanese property and stock market bubbles in the late ‘80s, as well as the US internet bubble in the late-‘90s. More importantly, he’s not a ‘stopped clock’ – in early 2009, he argued it was time to get back into the market and invest, so he pretty much called the bottom too.

GMO uses a model that looks at return on sales and the replacement costs for a company’s assets. In its latest letter, Grantham’s colleague Ben Inker suggests that fair value for the US S&P 500 index is just 1,100.

Look at gold as a sell down to about 1000. It is overbought too.

Thanks for sharing that, Whidbey.

SPX broke support yesterday afternoon. However, looks like we’ll go up out of the gate.

Agree with Jason’s upper level at 1790, bulls will attempt to conquer it. That resistance goes to 1793. Two scenarios:

Unless 1793 is taken out, looking at a tgt of 1770-72.

If 1793 is taken out, expect a pullback to 1785 + or – soon after, and then a move potentially to previous highs near 1800. A pullback lower than about 1782 says “not an ordinary pullback” and we could proceed down to 1770-72 tgt.

Bulls need to answer today. The break of support gives the ball to the bears.

Futures + 5 at 30 mins to the bell.

Every significant gap up for the past month has been sold off.. Until today.

The inverse has also been true. Are we in a new trend or just a game of numbers?

I think we have an answer. The NASDAQ A/D is very high and P/C is about .8.. Unlikely this market is going down for a few days.