Good morning. Happy Monday. Hope you had a nice weekend.

The Asian/Pacific markets closed mostly up. India rallied almost 2%, Japan 1.5% and Taiwan 0.9%. Europe is currently up across-the-board. Greece is up 2.6%. Austria, Belgium, Germany and Switzerland are also doing well. Futures here in the States point towards a moderate gap up open for the cash market.

Be alerted of new content. Join our email list here.

The dollar is up. Oil and copper are down. Gold and silver are down.

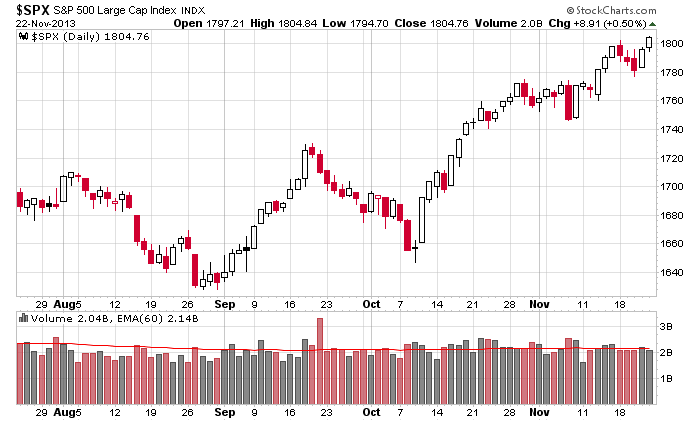

The beat continues on. The S&P has now moved up 7 consecutive weeks.

Several indexes are sitting at all-time highs. The Nas, Nas 100 and S&P 400 mid caps haven’t quite gotten there yet.

Many stocks that led the market over the summer and fall months (TSLA, LNKD, YELP, FB, Z) are well off their highs while safe-havens such as PG, CL, PFE and several other drug stocks are leading. Is this a warning?

It could be, but uptrends can persist for a long time; over-bought can stay over-bought for a long time. Here’s the S&P daily. I see no reason to be anything but long. The trend, the Fed, seasonality forces, under-performing money managers – you name it, there’s a long list a reasons the current move can continue.

There’ll be bumps along the way, but resist the temptation to over-analyze and think too much. The tren is up. Go with it. Period.

Stock headlines from barchart.com…

FBR Capital reiterated its ‘Outpeform’ rating on Flour (FLR +0.81%) and raised its price target on the stock to $97 from $90.

Time Warner Cable (TWC +9.98%) was downgraded to ‘Hold’ from ‘Buy’ at Argus.

Piper Jaffray kept its ‘Overweight’ rating on DaVita (DVA -0.62%) and raised its price target on the stock to $73 from $63.

Brocade (BRCD +0.45%) was downgraded to ‘Neutral’ from ‘Buy’ at ISI Group.

Caterpillar (CAT +0.93%) was upgraded to ‘Buy’ from ‘Neutral’ at BofA/Merrill.

R.R. Donnelley (RRD +0.12%) was upgraded to ‘Buy’ from ‘Hold’ at Benchmark Co.

Campbell Soup (CPB +1.23%) was downgraded to ‘Neutral’ from ‘Buy’ at Goldman.

Clorox (CLX -0.22%) was downgraded to ‘Sell’ from ‘Neutral’ at Goldman.

Alcoa (AA +1.32%) was upgraded to ‘Buy’ from ‘Neutral’ at Goldman.

Allegion (ALLE) will replace J.C. Penney (JCP -3.27%) in the S&P 500 Index as of the 11/29 close.

Bloomberg reports that the FDA approved the Influenza A Virus Monovalent Vaccine made by a unit of GlaxoSmithKline (GSK +0.26%) for the prevention of H5N1 influenza, commonly known as avian or bird flu.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

10:00 Pending Home Sales

10:30 Dallas Fed Manufacturing Outlook

1:00 PM Results of $32B, 2-Year Note Auction

Notable earnings before today’s open: NM, QIHU, SDRL

Notable earnings after today’s close: CPRT, HI, NUAN, PANW, PWRD, VNET, WDAY

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Nov 25)”

Leave a Reply

You must be logged in to post a comment.

https://us-mg6.mail.yahoo.com/ya/download?mid=2%5f0%5f0%5f1%5f215999%5fAOb1i2IAABCHUpC4PQAAAGtdjDU&pid=3&fid=Inbox&inline=1&appid=yahoomail

Attached I hope is a showing that the NH for the SnP are lagging, but the index rose.Not a good sign, but also ambigious too. Jason says learn to love the bomb. I think not.

The Iranian Accord will drive the market today. Day trade on dips. Where are the

markets headed? Up for a while, but how long is unknowable. Be nervous and use stops.

Still headed for 1812 target mentioned Friday.

May pop higher at the open (futures +5.50 at 15 prior to the bell) and go for it or drift lower to the area of Friday’s close around 1804 before tagging tgt, then proceed higher.

Either way, 1812 looks to be in their crosshairs.

Gap ups have for the most part been sold off. Gap downs have been bough into.

This rally is getting stale but don’t look for a crash this week.

We are reaching records but Decline volume exceeds advance. Put call ratio remains high but dropping.

No time to get bearish yet Perhaps next week.