Good morning. Happy Friday.

The Asian/Pacific markets closed mixed. Australia, Hong Kond and South Korea did well; there were no big losers. Europe is currently mostly up. Spain is down; Amsterdam, Italy, Czech Republic and Greece are doing the best. Futures here in the States point towards a flat open for the cash market.

The dollar is down. Oil is down, copper up. Gold and silver are up.

Be alerted of new content. Join our email list here.

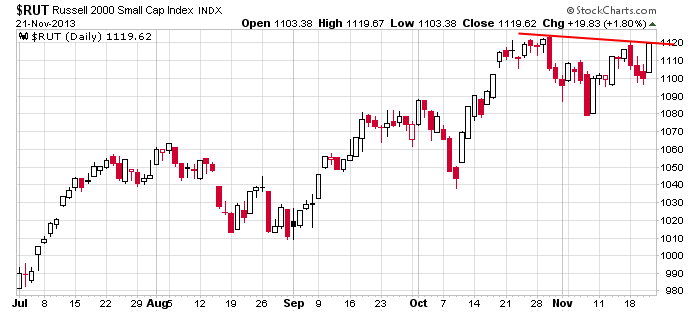

A couple days ago I posted a divergence between the SPX and RUT. After an additional down day, the Russell rallied huge yesterday and is now poised to bust out. The lagging small caps were the biggest obstacle to the market legging up again. Here’s the current chart. A breakout would be a big lift to the overall market (as if it needed it).

We’re starting to get into the feel-good holiday time of year (although I don’t feel it here in Costa Rica). Stocks tend to do well this time of year, and given everything else (strong trend, supportive groups, supportive indicators, and other factors) it would not be wise to be anything but bullish as we head into the last six weeks of the year. Yeah there’ll be bumps along the way, perhaps some stiff sell-offs, but overall, why fight the trend.

I’ve also seen significant improvement from individual stocks. For a few weeks, the trend was up, but there weren’t many good set ups to be had. This is changing. There are now many very good set ups that will make for great trades into 2014.

Don’t think too much. Don’t over-analyze. You are not as smart as you think you are. Go with the flow, and right now the flow is up.

Stock headlines from barchart.com…

PetSmart (PETM +1.44%) reported Q3 EPS of 88 cents, higher than consensus of 86 cents.

Dollar Tree (DLTR -4.48%) was upgraded to ‘Overweight’ from ‘Equal Weight’ at Barclays.

Yum! Brands (YUM +3.60%) rose over 1% in pre-market trading after it was upgraded to ‘Buy’ from ‘Hold’ at Deutsche Bank.

Micron (MU +6.33%) was downgraded to ‘Neutral’ from ‘Buy’ at BofA/Merril due to valuation.

GameStop (GME -6.94%) was upgraded to ‘Buy’ from ‘Hold’ at Needham.

VeriFone (PAY +0.83%) was upgraded to ‘Buy’ from ‘Hold’ at Jefferies.

Target (TGT -3.46%) was downgraded to ‘Underperform’ from ‘Neutral’ at BofA/Merrill.

Bloomberg reports that South Korea is likely to buy 40 F-35 fighter jets from Lockheed Martin (LMT +1.08%) .

Ross Stores (ROST -1.30%) tumbled over 7% in pre-market trading after the company lowered guidance on Q4 EPS to $1.01 from $1.03, below consensus of $1.08.

Intel (INTC +2.73%) fell 1.5% in after-hours trading after the company said revenue in 2014 will be approximately unchanged from this year.

Hess Corporation (HES +1.25%) has been awarded a maximum $378.82 million government contract utilizing block purchases for electricity.

UPS (UPS +1.00%) said it will raise its rates an average net of 4.9% in 2014.

Marvell (MRVL +3.98%) reported Q3 adjusted EPS of 32 cents, well above consensus of 25 cents.

Gap (GPS +1.50%) reported Q3 EPS of 72 cents, higher than consensus of 70 cents.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

10:00 E-Commerce Retail Sales

10:00 Job Openings and Labor Turnover Survey

11:00 Kansas City Fed Mfg Survey

Notable earnings before today’s open: ANN, FL, HIBB, PETM, SIRO, TNP

Notable earnings after today’s close: none

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Nov 22)”

Leave a Reply

You must be logged in to post a comment.

What happened?…So, when the Philly Fed came in woefully below expectations and the Employment component was even worse, the result was simple – a weak Philly Fed likely meant that there would be no “Dectaper.”

That gave the green light to buyers to buy, but the good news was limited to the Dow, the rest of the indexes hung back. They must know that the nuclear option by Senate Dems yesterday means the budget and debt ceilings are going to be difficult. I agree.

Keeping a core index investment and dividends. Nothing happening really, but staying alive.

Learning for the day: Bad news is good news, so invest? Be careful it is catching.

Bulls answered the call. Broke resistance outlined y’day at 1793 and futures held their gains overnight. Nothing big.

No pullback came after breaking that resistance, so unless you were onboard at the open, there wasn’t much that could be done. Possible could get that pullback today.

The break of resistance defined new support at the 1780 level (around Wed’s close/Thurs open) which projects a target at 1812.

Re a pullback: could see a retrace to 1793-1792. If that is broken could retrace to 1788-85. If 1785 broken could retrace to Wed’s close, 1781.

As long as Wed’s lo holds, the signal is long.