Good morning. Happy Monday. Hope you had a nice weekend.

The Asia/Pacific markets closed mixed. Australia, China and South Korea dropped while Hong Kong, India and Indonesia did well. Europe currently leans to the down side. Greece is up almost 2%; Belgium, London, Czech Republic and Italy are down the most. Futures here in the States point towards a flat-to-down open for the cash market.

Be alerted of new content. Join our email list here.

The dollar is up. Oil is flat, copper down. Gold is down, silver up.

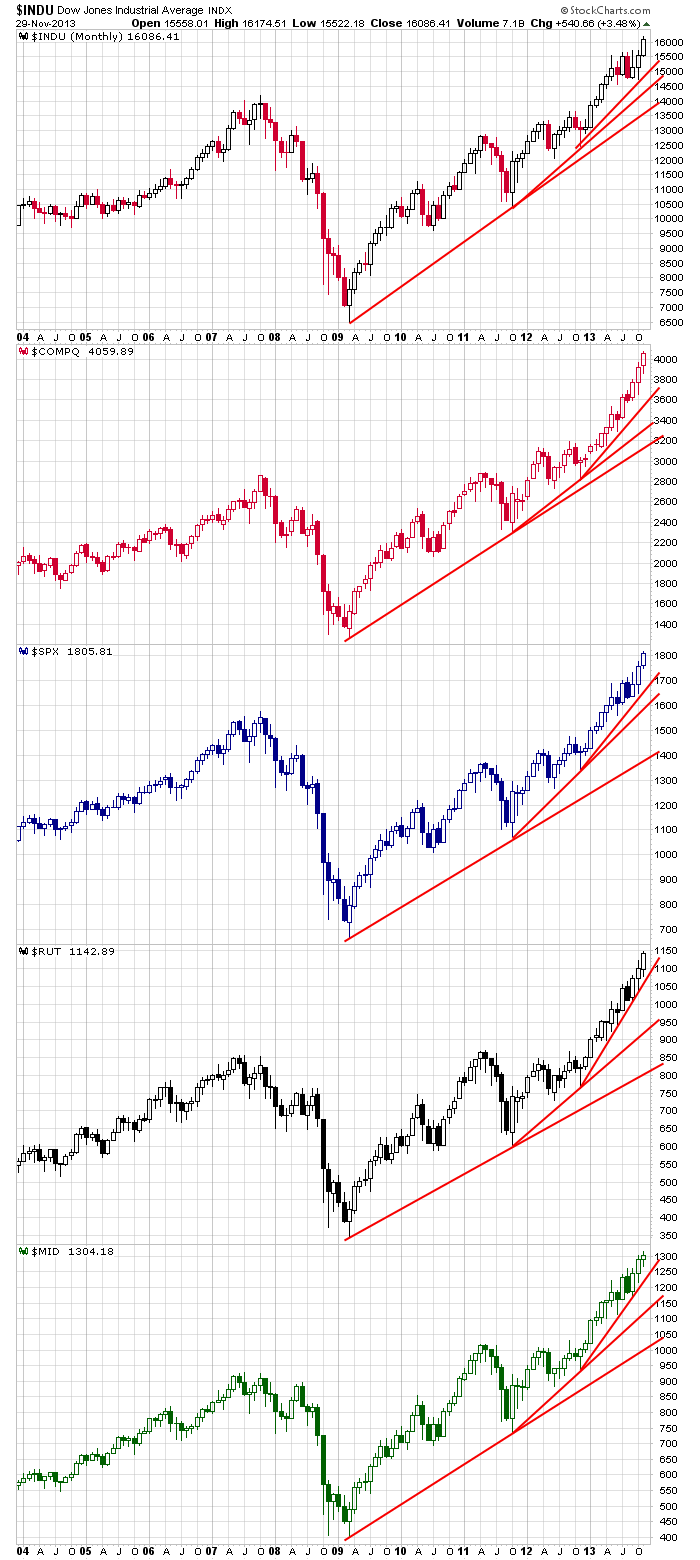

The S&P has now rallied 8 straight weeks, and now the monthlies look like they’re in the beginning stages of going parabolic. But this doesn’t mean I’m calling a top like so many bearish idiots are doing. If the market goes parabolic, the move can last several months and tack on another 10-20% before topping. Here are the charts.

Over the weekend, Amazon announced plans to deliver packages via drone in under 30 minutes. Goldman upgraded the stock and raised its price target from 400 to 450. I’ll talk about this after today’s close.

Long term the uptrend looks solid.

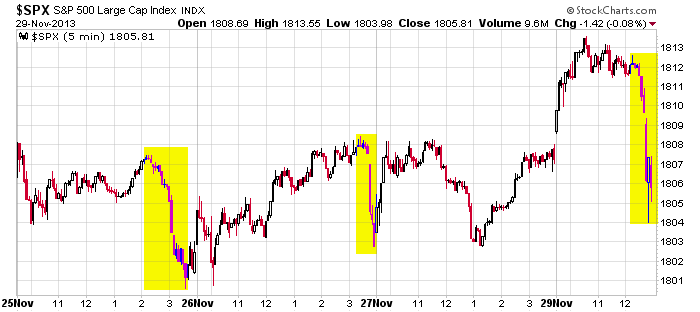

Short term there are reasons to believe a little give back is in the works. A few indicators are lagging, and three times last week the market sold off hard late in the day. Here’s the 5-min SPX chart.

That’s it for now. I like this market…we just need to get through a potential soft patch in the near term.

Stock headlines from barchart.com…

Travelers (TRV -0.27%) was downgraded to ‘Neutral’ from ‘Buy’ at Goldman due to relative valuation.

Marathon Petroleum (MPC -1.90%) was upgraded to ‘Buy’ from ‘Hold’ at Deutsche Bank.

Genesco (GCO +0.70%) was downgraded to ‘Neutral’ from ‘Overweight’ at Piper Jaffray

American Eagle (AEO +1.06%) was upgraded to ‘Buy’ from ‘Neutral’ at Janney Capital.

Sprint (S +0.36%) was downgraded to ‘Neutral’ from ‘Outperform’ at Macquarie.

Petrobras (PBR +1.01%) was downgraded to ‘Underperform’ from ‘Outperform’ at Credit Suisse.

Goldman Sachs reiterated its ‘Buy’ rating on Amazon.com (AMZN +1.79%) and raised its price target on the stock to $450 from $400.

Monster Beverage (MNST -1.12%) rose 2.4% in pre-market trading after it was upgraded to ‘Overweight’ from ‘Neutral’ at JPMorgan.

EBay (EBAY +2.47%) was upgraded to ‘Buy’ from ‘Neutral’ at SunTrust.

Ebay (EBAY +2.47%) rose 2.2% and Amazon.com (AMZN +1.79%) climbed 1.0% in pre-market trading after data from Comscore showed online spending on Black Friday rose +15% to a record $1.2 billion.

Allegion (ALLE) will replace J.C. Penney (JCP +1.09%) in S&P 500 as of last Friday’s close.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

9:00 PMI Manufacturing Index

10:00 ISM Manufacturing Index

10:00 Construction Spending-Sep

10:00 Construction Spending-Oct

Notable earnings before today’s open: none

Notable earnings after today’s close: ASNA, KKD, THO

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Dec 2)”

Leave a Reply

You must be logged in to post a comment.

As one of the idiots, I look at one fundamentals that even the insightful technical should not ignore:

“The markets are keeping an eye on Friday’s release of the November jobs data. The reason for the added attention is that it could signal whether the Federal Reserve Bank will taper its $85 billion monthly bond-buying stimulus program known as “quantitative easing” (“QE”).

Joe LaVorgna, Chief US Economist at Deutsche Bank, believes non-farm payroll increases for the month of November will be strong enough for the Fed to begin tapering in December.”

Joe is usually wrong, but if he proves correct, one should have stops. Now follow Jason and the charts. I am long, but not without protection. The fiscal mess is still a mess, and we know QE or the hope of QE, drives the market like cocaine, (crazy in technical lingo) Welcome to December, if anyone has not shopped yet, remember sales in stores were short, so shop for Wall Street for god’s sake. This a difficult season if you have not noticed.

I am watching the P/C ratio. The bulls will run until the total PC ratio drops to around 0.6. Then look for a nice pull back. A/D does support more upside but not a lot.

Came within a stone’s throw of Friday’s target 1814 (1813.5 was the high) and then selling started. Wouldn’t get too bearish just yet. Could be profit-taking on thin volume.

Here are the numbers: resistance at 1808-1810. If it holds, target near 1800-1802.

Support is in the same area of the resistance’s target (1800-1802) so it’s going to be ambiguous to determine whether they’ve hit the target and doing a normal bounce, or if the support has taken control and is determining the new target, which is 1817-1818.

The key is resistance: if it holds, we’ll go lower. If it breaks, 1817-1818 likely destination.

First day of new month is typically bullish. No guarantees, just sayin’.

In recent times your price of gold and silver has all too often been contradicted by the market. Today you said gold would be down and silver would be up. Silver has taken a heck of a tumble since opening.

Tom I offer the gold and silver levels per about 90 minutes before the open of the stock market, so things can change.