Cyber Week Special….click here.

Good morning. Happy Wednesday.

The Asian/Pacific markets closed mostly down. Japan dropped more than 2%; Indonesia, New Zealand and South Korea dropped more than 1%. China rallied 1.3%. Europe is currently down across-the-board. Austria, Belgium, Czech Republic are down more than 1%; France and Switzerland are also down noticeably. Futures here in the States point towards a down open for the cash market.

The dollar is flat. Oil and up, copper down. Gold is down, silver up.

Be alerted of new content. Join our email list here.

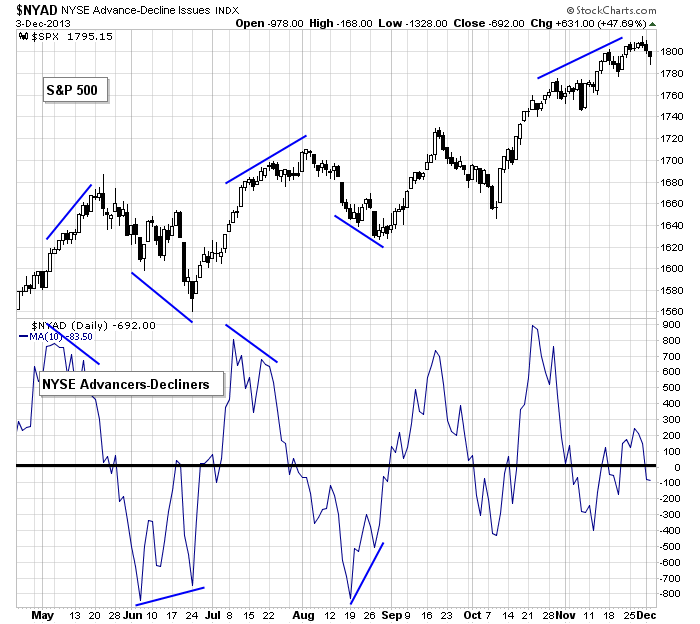

For only the second time in 10 weeks the market has fallen three straight days. Other than short term trades or traders who didn’t listen to the warnings from the market the last couple days, this isn’t a big deal. The trend remains rock solid, so it’ll take much more than a couple down days for the market to change its stripes. All intermediate and long term signs point to a continuation of the trend. You as a trader just need to manage things when these inevitable pullbacks play out.

The 10-day MA of the NYSE AD line is one example of one of the warnings flashed this past weekend. The market was at a new high while the AD line wasn’t very far above 0. The absolute level was obvious, so was the divergence. The indicator has now moved below 0, so beneath the surface, there’s been a lack of confirmation. Over the weekend I said I could argue a bullish and bearish case but concluded the numbers don’t lie. The upside was limited.

Don’t mentally fight lower prices.

Stock headlines from barchart.com…

Express (EXPR +0.94%) reported Q3 EPS of 23 cents, below consensus of 25 cents.

Ross Stores (ROST -1.93%) was downgraded to ‘Neutral’ from ‘Outperform’ at Credit Suisse.

AT&T (T -0.17%) was downgraded to ‘Neutral’ from ‘Overweight’ at JPMorgan.

eBay (EBAY +1.13%) was downgraded to ‘Equal Weight’ from ‘Overweight’ at Evercore.

U.S. Bancorp (USB -1.76%) was upgraded to ‘Conviction Buy’ from ‘Neutral’ at Goldman.

Citigroup (C -0.93%) was downgraded to ‘Neutral’ from ‘Conviction Buy’ at Goldman.

ComScore reported holiday season U.S. retail e-commerce spending from Thanksgiving through Cyber Monday, online buying from desktop computers totaled $5.3 billion, up 22% versus last year.

ESL Partners lowered its stake in Sears Holdings (SHLD -7.72%) to 48.4% from 55.4%.

J.C. Penney (JCP +1.00%) rose over 5% in after-hours trading after it reported November same-store-sales rose 10.1% y/y.

United Natural Foods (UNFI -0.23%) reported Q1 EPS of 56 cents, better than consensus of 54 cents.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

7:00 MBA Mortgage Applications

8:15 ADP Jobs Report

8:30 International Trade

10:00 New Home Sales-Sep

10:00 New Home Sales-Oct

10:00 ISM Non-Manufacturing Index

10:30 EIA Petroleum Inventories

2:00 PM Fed’s Beige Book

Notable earnings before today’s open: BF.B, EXPR

Notable earnings after today’s close: ARO, AVGO, GES, MFRM, SNPS, VRNT, WTSL

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Dec 4)”

Leave a Reply

You must be logged in to post a comment.

ADP comes in below (120,000) forecasted employment. Trade deficit -43billion. Mortgage apps down. Mixed bag, but jobs on Friday is expected to be 200,000 new jobs (bank economist) I don’t believe anything the government reports on jobs. Obama wants higher Minimum wage – it about the 2016 elections.

Lots of propoganda from China – now market driven with party control over only certain things like finance, prices, jobs and income, and family size, and travel. oh, and no one is a citizen for voting purposes, that is for party members. We watch, no buying in China on happy talk.

Now the US market is all shook up, down yesterday, and not looking too good today. Watch don’t play today maybe something long for Friday since I think the numbers will be up on jobs. Enjoy.

“I don’t believe anything the government reports on jobs.” Got to agree the numbers have been manipulated.

I did some research. The market gaps up 60% of the time. Today is not one of those times. There must be a way to make money off of this.

I said this yesterday “If that is broken (1790), Jason’s tgt of 1785 should be in their sights. There may be a bounce after breaking 1790 to get the bulls’ hopes up, so watch for a reversal.

We broke 1790 & got the bounce right after 2 pm, but overnight the futures have revisited that lower area and have made a new low. There was a bounce following the ADP report at 815, but no telling if that’s a start of a new uptrend (doubt it) or they’ll tag the 1785 area (think so).

If we drop down to 1785, that support extends down to 1777-75. Same same, if that support is broken, don’t be surprised to see a bounce. How high it goes tells us the answer to the question “Is this a new uptrend?”

If we go higher today, there is plenty of resistance. First test will be 1790-92. Higher, at yesterday’s close: 1795, still higher at 1797, all the way to 1800.

All of these overhead layers can be broken when they want to do it. And by the way, there are lots of support levels below, so it all depends on which one “da boyz” decide to bounce from. We have to let them show us their hand.

Futures: -4.5, lo/hi of night -6.50/+4.25

all the bulls will now disappear until their reserfacing in 2100