Good morning. Happy Wednesday.

The Asian/Pacific markets closed down across the board. China and Hong Kong dropped more than 1%; Australia, Japan, Singapore and South Korea also fell noticeably. Europe is currently mixed. France, Germany, Amsterdam, Switzerland, London and Czech Republic are doing well; only Greece is down much. Futures here in the States point towards a flat-to-up open for the cash market.

The dollar is flat. Oil is down, copper up. Gold and silver are down.

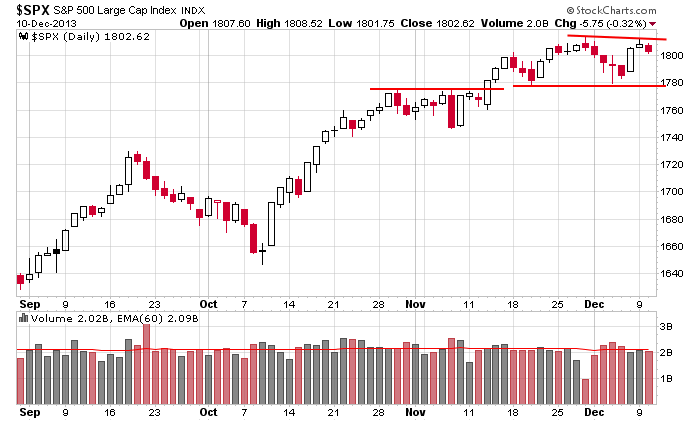

For the second time this week, the market traded quietly yesterday. I view this as perfectly normal and healthy activity for a strong market trending up. Here’s the S&P daily. Overall the index is enjoying a steady uptrend. In the near term it’s unchanged over the last couple weeks. I see nothing wrong here.

I like everything about the market right now. The unfortunate thing is stocks don’t have much of a runway to break out and rally. Next week’s FOMC meeting is likely to keep the market in a dull mode, and then the following week is Christmas. Then New Years is the next week, and that takes us into January. We don’t have an uninterrupted stretch for a couple weeks, so no matter what stocks do right now, something is looming that can slow down the move.

Stock headlines from barchart.com…

Joy Global (JOY +0.55%) reported Q4 EPS of $1.11, weaker than consensus of $1.12, and lowered guidance on fiscal 2014 adjusted EPS to $3.00-$3.50, below consensus of $3.68.

General Dynamics (GD +0.02%) was upgraded to ‘Fair Value’ from ‘Sell’ at CRT Capital.

Costco Wholesale (COST -1.33%) reported Q1 EPS of 96 cents, below consensus of $1.02.

Billionaire investor Carl Icahn reported that he bought 1.38 million shares of Nuance (NUAN -0.78%) and raised his stake in the company to 60.3 million shares.

The WSJ and the AP reported that House and Senate negotiators reached a budget deal replacing automatic spending cuts with longer-term savings.

Franklin Resources (BEN -1.27%) raised its quarterly dividend 2 cents to 12 cents per share and said the company board authorized a 30 million share repurchase program.

Scripps Networks (SNI +0.68%) surged over 13% in after-hours trading after Variety said Discovery DISCA is weighing a bid for the company.

BlackBerry (BBRY +3.83%) was downgraded to ‘Sell’ from ‘Neutral’ at Citigroup.

Qualcomm (QCOM +0.01%) was upgraded to ‘Buy’ from ‘Neutral’ at Citigroup.

MasterCard (MA +0.63%) moved up over 3% in after-hours trading after it announced a 10-for-1 stock split and said it will buy back up to $3.5 billion worth of stock.

BlackRock reported a 10.14% passive stake in Telecom Italia (TI +3.16%) .

H&R Block (HRB -0.76%) reported a Q2 adjusted EPS loss of -42 cents, a bigger loss than consensus of -37 cents.

Smith & Wesson (SWHC -0.66%) shot 5% higher in after-hours reported Q2 EPS of 28 cents, well above consensus of 21 cents.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

7:00 MBA Mortgage Applications

10:30 EIA Petroleum Inventories

1:00 PM Results of $21B, 10-Year Bond Auction

2:00 PM Treasury Budget

Notable earnings before today’s open: COST, JOY

Notable earnings after today’s close: ASYS, CWTR, MW, SIGM, VRA

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Dec 11)”

Leave a Reply

You must be logged in to post a comment.

The Congressional budget plan is out, but not ” in” with the markets or the public. No progress on on debt management this period, or in the out years when it starts to rise again. This is a sign of what the future holds – more debt & taxes. The Fed has no known policy but taper of some size, so the traders sold yesterday, some was institutional selling – some hedge funds have liquidation wired – sell into markets they have heavily shorted. Dollar fell a little and gold rose. This might become a trend up to 1350 +. Bought calls on PAAS. QQQ might be breaking out. Holding core index etfs with stops, and a dividend portfolio. Debt ceiling debate which could be the bad news for Q1 ’14. Stay alert. My artificial intelligence model says 2014 could be an up year, if things calm down a little.

Market danced around 1803 Tues, not getting much traction to the upside, even less to the downside. After hours, tho, the futures broke that level at 4 am and have since bounced up into resistance.

That new resistance starts at 1804 and extends to 1807.

For support: the lower level of the 1803 support is 1800. If broken, we could do down (this is cut and pasted from my post Tues) to 1794.50. That support extends down to 1790.

If that layer breaks, then headed lower to last Wed’s low.

Range overnight: +5 to -4, in that order. Now: +1.00

Daddy Paul, if you want to discuss trading gaps, contact me: straddle2003@yahoo.com

insto bank prop traders are all drunk on vodka,whilst closing their books

even their high frequency computers are being fed vodka ,whilst preparing to be closed down

all are celebrating the passing of the volka glastegal bill and their sacking

at the fed the plunge protection team having lost the suport of the insto traders are on anti depresents to help their insanity,whilst hoping to get on medicade insurance to help their sacking

insto bank prop traders are all drunk on vodka,whilst closing their books

even their high frequency computers are being fed vodka ,whilst preparing to be closed down

all are celebrating the passing of the volka glastegal bill and their sacking

at the fed the plunge protection team having lost the suport of the insto traders are on anti depresents to help their insanity,whilst hoping to get on medicade insurance to help their sacking