Good morning. Happy Thursday.

The Asian/Pacific markets closed down across the board. India, Indonesia and Japan dropped more than 1%. Australia, Hong Kong, Malaysia, South Korea and Taiwan also dropped noticeably. Europe is currently down across the board. Austria, Germany, Italy, Spain, Stockholm, Switzerland, London, Czech Republic and Greece are down the most. Futures here in the States point towards a flat-to-down open for the cash market.

The dollar is flat. Oil is up, copper down. Gold and silver are getting killed.

We finally got a big smack down day yesterday. The overall trend has been up for a long time, but the short term trend mostly oscillates between being up and being neutral. Lately it’s been neutral. We have had very few good set ups to trade, and many breadth indicators have not supported higher prices. Hence why I’ve been cautious lately.

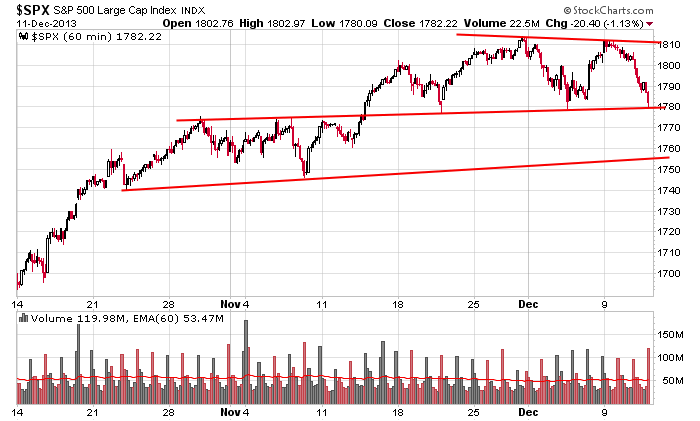

Here’s the 60-min S&P chart. A consolidation pattern in late October/early November resolved up, and now we’ve gotten another consolidation pattern. In the grand scheme of things this is perfectly normal and healthy movement for a strong stock market. I’d love an opportunity to buy stocks at lower prices, so I’m secretly hoping for a break of support and at least a month down to the mid 1750’s.

Be patient.

Stock headlines from barchart.com…

lululemon (LULU -1.11%) dropped 10% in pre-market trading after it cut guidance on fiscal 2013 EPS to $1.94-$1.96, below consensus $1.96, and said it sees fiscal 2013 revenue of $1.605 billion-$1.61 billion, weaker than consensus of $1.64 billion.

Southwest (LUV -3.28%) was upgraded to ‘Buy’ from ‘Neutral’ at BofA/Merrill.

Marathon Oil (MRO -1.14%) and Apache (APA -1.66%) were both downgraded to ‘Neutral’ from ‘Buy’ at Citigroup.

Oracle (ORCL -0.69%) was downgraded to ‘Sector Perform’ from ‘Outperform’ at RBC Capital.

Micron (MU -2.77%) was upgraded to ‘Buy’ from ‘Neutral’ at Nomura.

Danaher (DHR -1.62%) lowered guidance on fiscal 2014 EPS to $3.60-$3.75, below consensus of $3.81.

Moody’s Investors Service has placed on review for downgrade the general obligation rating of the Commonwealth of Puerto Rico.

Men’s Wearhouse (MW -1.92%) reported Q3 adjusted EPS of 90 cents, higher than consensus of 86 cents.

UNS Energy (UNS -0.99%) soared 30% in after-hours trading after it announced that it will be acquired by Fortis for $60.25 per share.

Athenahealth (ATHN -2.15%) slumped over 12% in after-hours trading after it lowered guidance on fiscal 2014 EPS to 98 cents-$1.10, well below consensus of $1.38.

Alliance Data Systems (ADS -1.45%) rose 3% in after-hours trading after it was announced that it will replace Abercrombie & Fitch (ANF -0.98%) in the S&P 500 after the market close on December 20.

Mohawk Industries (MHK -1.06%) climbed 2.5% in after-hours trading after it was announced that it will replace (JDSU -1.14%) in the S&P 500 after the market close on December 20.

Facebook (FB -1.71%) gained over 4% in after-hours trading after it was announced that it will replace Teradyne (TER -1.12%) in the S&P 500 after the market close on December 20.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

8:30 Retail Sales

8:30 Initial Jobless Claims

8:30 Import/Export Prices

9:45 Bloomberg Consumer Comfort Index

10:00 Business Inventories

10:00 Quarterly Services Report

10:30 EIA Natural Gas Inventory

1:00 PM Results of $13B, 30-Year Note Auction

4:30 PM Money Supply

4:30 PM Fed Balance Sheet

Notable earnings before today’s open: CIEN, HOV, LULU

Notable earnings after today’s close: ADBE, ZQK, RH

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Dec 12)”

Leave a Reply

You must be logged in to post a comment.

What happened yesterday?? Stanley Fischer who has some hard ideas, they say.

The WSJ reported that earlier this year, Mr. Fischer had some serious concerns about the Fed’s new tool – forward guidance. “You can’t expect the Fed to spell out what it’s going to do,” Mr. Fischer said. “Why? Because it doesn’t know.” Uh oh, that doesn’t sound good.

However, the real key was the fact that Fischer had called QE3 “dangerous but necessary” earlier in the year. (closer than you thought!)

During an interview at the WSJ CEO Council last month, apparently Fischer had stressed that the Fed’s QE efforts, which he termed “extraordinary” were not without risks. “Without the Fed, we’d have had a much deeper recession. Without the extraordinary things that it’s done, the economy would be in much worse shape today and we need to remember that.”

This is all well and good. But it’s the next part that gave traders pause. Mr. Fischer went on to say, “Precisely how to get out of it [QE], at what speed to get out of it, is a much harder thing to measure and to calculate. No one has the map that points to home.

So long equities for a while because even the Fed can go slow and see what happens.

This is cut and pasted from Wed’s post “For support: the lower level of the 1803 support is 1800. If broken, we could go down (this is cut and pasted from my post Tues) to 1794.50. That support extends down to 1790.

If that layer breaks, then headed lower to last Wed’s low.”

We came within a point of last Wed’s low yesterday.

Today is D Day for the bulls. That low needs to be defended or, at the lowest, 1765, or we will continue to bleed lower.

Next firm area of support is 1759 (and that layer extends down to 1746.)

There is plenty of upside resistance as well.

However, you know bulls can slice through resistance just as easily as bears thru support. Never lean too far to one side and don’t overthink it. Jason’s taught me to trade what I see, not what ought to be. The market is always right.

Overnight range -5.25 to +3.25 in that order. Now -.50

“I’m secretly hoping for a break of support and at least a month down to the mid 1750’s.”

Chances are very good. A lot of internals look weak.

cheif crazy bear is holding a barbaque

london ftse 100 ,eurostocks 50,aussie xjo 200 and dji fat bulls are being served

next week nas 100 ,which is usually late capitulating ,plus dax will be served