Good morning. Happy Wednesday. Happy Fed Day.

The Asian/Pacific markets closed mixed. Japan rallied 2%, India 1.2%. There were no big losers. Europe is currently mostly up. Italy, Spain, France, Germany, Stockholm, Switzerland and the Czech Republic are doing well. Futures here in the States point towards a positive open for the cash market.

The dollar is up. Oil is up, copper down. Gold and silver are up.

So it’s Fed Day. We’ll find out if the Fed is going to start the tapering process now or delay it at least 6 more weeks. I’d be surprised if they taper. The data doesn’t support it, and the personality of the Fed is that they are more likely to err on the side of tapering too late than too soon. We’ll see.

Regardless of what they do, I like the market long term. Some shorter term indicators are lagging, but overall I see no reason the uptrend will not continue.

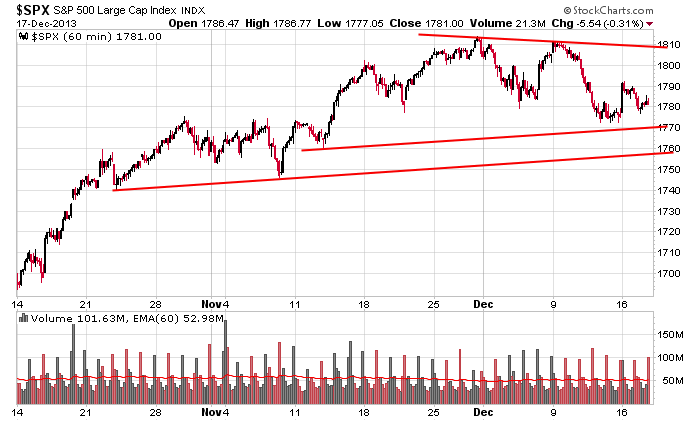

Here’s 60-minute SPX chart. A solid fall rally has been followed by a few weeks of consolidation. A lower high and higher low has been put in place, so pressure is building.

Keep in mind the first reaction to the Fed is often the wrong reaction.

Stock headlines from barchart.com…

Intel (INTC +0.86%) was added to the short-term ‘Buy’ list at Deutsche Bank.

The WSJ reported that British Petroleum (BP -1.11%) will write off $1.08 billion in expenses relating to a failed Brazilian well which found no commercial quantities of oil or gas.

Avon Products (AVP -0.35%) was downgraded to ‘Neutral’ from ‘Buy’ at BofA/Merrill.

Southern Copper (SCCO +0.04%) was upgraded to ‘Buy’ from ‘Neutral’ at Citigroup.

Lennar (LEN +0.57%) reported Q4 EPS of 75 cents, well above consensus of 62 cents.

Johnson Controls (JCI +0.73%) lowered guidance on fiscal 2014 EPS to $3.15-$3.30, below consensus of $3.31.

General Mills (GIS -0.66%) reported Q2 EPS of 83 cents, weaker than consensus of 87 cents.

FedEx (FDX -0.54%) reported Q2 EPS of $1.57, below consensus of $1.64.

Deutsche Bank downgraded the Semiconductor sector to ‘Neutral’ from ‘Overweight’ saying valuations in the sector are already pricing in a strong 2014 recovery.

Reuters reports that Citigroup (C -0.41%) and Bank of America’s (BAC -0.39%) Merrill Lynch unit will face civil fraud charges from the U.S. Department of Justice over the sale of mortgage securities ahead of the financial crisis.

AllThingsD reported that Facebook (FB +1.95%) acquired SportStream. Terms of the deal were not disclosed.

Raytheon (RTN +0.18%) was awarded a$172.68 mllion contract modification to manufacture and deliver the AN/TPY-2 Radar #12 with associated spares.

Jabil Circuit (JBL +0.20%) slumped over 13% in after-hours trading after it said it sees Q2 EPS of 5 cents-15 cents, well below consensus of 52 cents, and said it sees Q2 revenue of $3.5 billion-$3.7 billion, below consensus of $4.28 billion.

VeriFone (PAY +0.08%) slipped over 4% in after-hours trading after it lowered guidance on fiscal 2014 EPS to $1.35-$1.40, well below consensus of $1.56.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

7:00 MBA Mortgage Applications

8:30 Housing Starts

10:30 EIA Petroleum Inventories

1:00 PM Results of $35B, 5-Year Note Auction

2:00 PM FOMC Announcement

2:00 PM FOMC Forecast

2:30 PM Bernanke Press Conference

Notable earnings before today’s open: FDX, GIS, LEN

Notable earnings after today’s close: ORCL, PAYX, SCS

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Dec 18)”

Leave a Reply

You must be logged in to post a comment.

Review:

Bulls: support held Thurs/Fri and launched from it on Monday. Tues they held higher support (1777 SPX).

Bears: held resistance at Mon’s high (1792). Tuesday’s 930 was another resistance level which held. A new level (1784-1787) has developed which bears need to hold today.

Summary: We are bound by these levels. Bulls need to take out 1787 and Mon’s high 1792. Bears need to break support at 1776 to 1772.

Expect plenty of volatility after 2 pm and one of these levels to be decisively broken.

Futures range -1.50 to +6.0, now +3.25

A cut in bond buying today or next session of the Fed. No change in short term interest rates. But coming next year is the start of a labor shortage that will drive costs higher, Labor driven cost push. The Boomers retiring and the gen X Y are not very productive. Inflation is possible followed by deflation when output declines based on slow sales. BUT

Gary Shilling is a bit more up tempo – US the best economy available globally, so US infrastructure stocks is his call for portfolios. When Ben talks you will not hear this sort of stuff so think past his miserable ramble. Still long my index ETFs and Dividend stocks and staying alive.