Good morning. Happy Thursday.

The Asian/Pacific markets closed mostly up. Australia rallied 2%, Japan 1.7% and Indonesia, New Zealand, and Taiwan also did well. China and Hong Kong dropped about 1%. Europe is currently up across-the-board. Italy, Spain, Austria, France, Germany, Stockholm, Switzerland and London are up 1% or more. Futures here in the States point towards a flat-to-down open for the cash market.

The dollar is up big. Oil is up, copper down. Gold and silver are down.

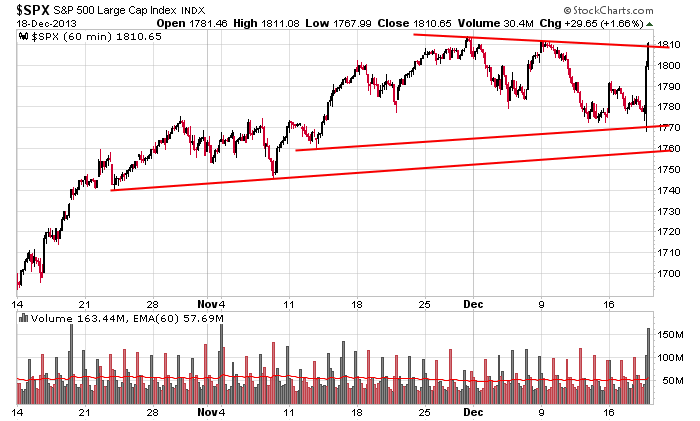

So the market rallied huge yesterday after the FOMC announcement. The Fed is indeed tapering their asset purchases by $10B (starting next month). I didn’t think they’d do it, but I’m glad they did. Here’s the 60-min SPX chart. The index traveled from the bottom of its pattern to the top in one of its biggest price and volume moves of the year.

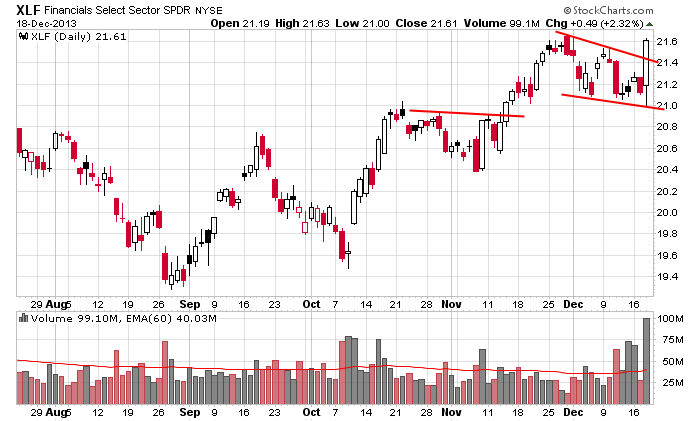

Many groups did well. Among them, the financials in particular did great. And why wouldn’t they? The prospect of low interest rates allows them to pay me nothing for the money I have in the bank while using my money to make a couple percent on the other side. It’s free money for them.

The big question now is whether yesterday’s move was the beginning of the market’s next leg up. The long term trend has been up for a long time. The short term trend has been nonexistent (call it neutral because the indexes were flat over several weeks). Now we got a big up move, and there are many tailwinds at the market’s back. An accomodative Fed, fund managers under performing, the tendency to rally into the end of the year – lots of reasons to expect the market to do well going forward.

But the market typically gets the Fed wrong. Its knee-jerk reaction to whatever the Fed does and says is usually reversed the next day. Be on the lookout for that today. More after the open.

Stock headlines from barchart.com…

Darden (DRI +1.13%) reported Q2 EPS of 15 cents, well below consensus of 20 cents, and said it sees fiscal 2014 EPS down 15%-20% compared to 2013.

Rite Aid (RAD +1.41%) said it sees fiscal 2014 EPS of 17 cents-23 cents, below consensus of 24 cents.

Callaway Golf (ELY +0.63%) was upgraded to ‘Strong Buy’ from ‘Outperform’ at Raymond James.

Pier 1 Imports (PIR -0.10%) reported Q3 EPS of 26 cents, weaker than consensus of 28 cents, and then lowered guidance on fiscal 2014 EPS view to $1.21-$1.27 from $1.29.

Accenture PLC (ACN +2.19%) reported Q1 EPS of $1.12, above consensus of $1.09, and then raised guidance on fiscal 2014 EPS to $4.44-$4.56 from $4.42-$4.54, above consensus of $4.47.

Dow Jones reports that Target (TGT +3.08%) was hit by theft of customers’ credit card data over Black Friday weekend, and the data breach was extensive.

Trulia (TRLA -0.39%) rose 4% in after-hours trading after SAC Capital reported a 5.2% passive stake in the company.

AK Steel (AKS +2.43%) rose over 6% in after-hours trading when it raised guidance on Q4 EPs to a gain of 2 cents-6 cents, better than consensus of a -3 cent loss.

Cascade Investment raises its stake in Deere (DE +1.26%) to 8.1% from 7.0%.

JPMorgan Chase (JPM +2.73%) was downgraded to ‘Neutral’ from ‘Buy’ at SunTrust.

Oracle (ORCL +2.88%) gained over 1% in after-hours trading after reported Q2 adjusted EPS of 69 cents, stronger than consensus of 67 cents.

Herman Miller (MLHR +0.72%) reported Q2 adjusted EPS of 42 cents, above consensus of 40 cents.

Paychex (PAYX +0.98%) reported Q2 EPS of 43 cents, better than consensus of 42 cents.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

8:30 Initial Jobless Claims

9:45 Bloomberg Consumer Comfort Index

10:00 Existing Home Sales

10:00 Philly Fed Business Outlook

10:00 Leading Indicators

10:30 EIA Natural Gas Inventory

1:00 PM Results of $29B, 7-Year Note Auction

4:30 PM Money Supply

4:30 PM Fed Balance Sheet

Notable earnings before today’s open: ACN, BRLI, CAG, CCL, DRI, KBH, NEOG, PIR, RAD, SCHL, WGO, WOR

Notable earnings after today’s close: AIR, CTAS, NKE, RHT, TIBX

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Dec 19)”

Leave a Reply

You must be logged in to post a comment.

First time claim 378000 up, but the BLS says don’t believe it. OK its better maybe.

http://www.zerohedge.com/sites/default/files/images/user5/imageroot/2013/12/Fed%20perspective_2_0.jpg

Will it happened, tapering, does it matter? More emotional than practical. But we did learn that Fed Funds rate means nothing and the Fed will not make judgments based on it. They will use RePo rates to decide where the cost of money is headed. That is because real money assets are pledged in the Repo and they reflect better cost of money. With all the dead money in banks no one buys Fed Funds anymore. Deflation or disinflation is moving or the

mechanics of money have changed since the Fed ruined its money machine.

Up today and likely the end of the year? Hope so.

Got a definitive answer yesterday. Pretty violent reaction at the announcement, but once the downdraft was finished they rallied the SPX over 40 pts in the last 2 hours.

Hard to think otherwise: the seasonal rally is here, and we’re on the way to 1840.

For today, bulls need to hold above 1800. Much lower than that we may drop to the low end of the range.

The day’s pop was enjoyable, but as you say the next (post-FOMC) day is usually a reversal. I thought the most notable hole in the bulls’ case was the NYSE new hi/low number, which was

only moderately positive. As recently as Tuesday there were more lows than highs! Several months back we had days when new highs were in the 400s. Talk about lack of breadth!