Good morning. Happy Friday.

The Asian/Pacific markets closed down across the board. Hong Kong dropped 2.2%; China, Indonesia, Malaysia, Singapore and South Korea dropped more than 1%. Europe is currently mostly up across the board. Italy is up more than 1%; Austria, France, Germany, Amsterdam and Stockholm are doing moderately well. Futures here in the States point towards an up open for the cash market.

The dollar is down. Oil is up, copper down. Gold and silver are up.

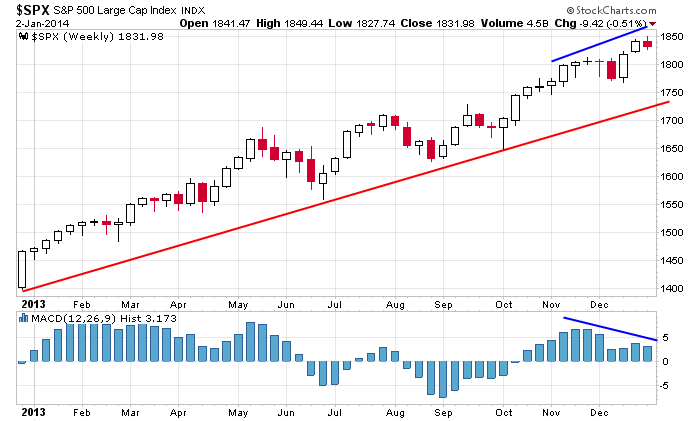

Last week was a light-volume up week; this week is shaping up to be a light-volume down week. The net change is +13 for the S&P. Here’s the weekly, which has bearish short term implications.

Overall the trend is obviously up. In the near term I don’t want to read too much into movement because volume has been so light, and we’ve had a few days off. But the first five days of January have historically been a pretty accurate tell for the rest of the year, so we can’t completely dismiss yesterday, today and the first three days of next week.

I’m looking forward to next week…a full week with no days off and normal volume.

We still have some good trades going. I also have a few waiting in the wings that I’ll be posting this weekend. As far as I’m concerned, it’s business as usual. We trade in the direction of the trend by buying dips or breakouts, and we play good defense. It’s nice to nail a big move once in a while, but we don’t assume big moves will always play out. Until something happens that causes the personality of the market to change, we should stay the course. Eventually it’ll stop working, and then we’ll have to make a slight adjustment. Until then, keep going. More after the open.

Stock headlines from barchart.com…

Google’s (GOOG -0.68%) price target was raised to $1250 from $1100 by Bank of America/Merrill and the stock was reiterated as a Buy on Android monetization and stable revenue growth from other categories.

Airlines are facing possible U.S. tax on baggage fees as the government looks for more revenue via user fees, according to Bloomberg.

Jamba Juice (JMBA -0.72%) entered a master franchise development agreement with Foodmark to develop 80 Jamba Juice stores over the next 10 years across the Middle East.

FireEye (FEYE -5.69%) rallied 22% in after-hours trading after announcing a deal to acquire cybersecurity firm Mandiant and raising its guidance.

China Finance Online (JRJC -12.08%) rallied 8.5% in after-hours trading after reporting a smaller quarterly loss than the year-earlier.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

Auto sales

10:30 EIA Natural Gas Inventory

11:00 EIA Petroleum Inventories

1:30 PM Fed’s Lacker: Economic Outlook

2:30 PM Bernanke: ‘The Changing Federal Reserve: Past, Present

Notable earnings before today’s open: LNN

Notable earnings after today’s close: none

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jan 3)”

Leave a Reply

You must be logged in to post a comment.

VIX is up as is the PC ratio. Don’t look for a real big pull back here just a slight one.

Watch the international markets; there are soft spots in EU, Russia, Japan and maybe China. Overall, favor long the USA indexes and a few of Jason’s best. But most of all, come Monday next the vacationing brokers come back and they will attempt to make things look a little better and set the bet for Q! ’14.

Hi everybody.

SPX hit the target 1840 I posted on Dec 19 on Dec 27; and on Dec 20 I refined it to 1843, which was hit Dec 31.

Yday’s pullback tapped support which projects a tgt at 1862 as long as yday’s low holds.

Resistance for today will run from 1837 thru 1841.

Futures +3.75 at 9 am.