Good morning. Happy Monday. Hope you had a great weekend.

The Asian/Pacific markets closed mostly down. Japan dropped 2.4%, China 1.8% and Indonesia 1.3%. Europe currently leans to the upside. Belgium, Italy and Spain are posting decent gains. Futures here in the States point towards a positive open for the cash market.

The dollar is flat. Oil is up, copper down. Gold is up, silver down.

After two holiday-shortened weeks, we finally have a full week of trading (although I’m going to have to duck out today to jump through some ex-pat hoops…it happens from time to time).

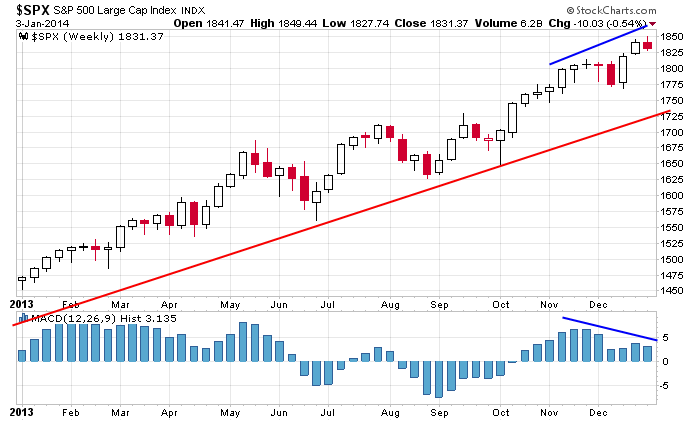

Here’s the weekly…rock solid uptrend…although it has run a little from it’s long term uptrend…and a negative divergence between the price and Histogram has formed.

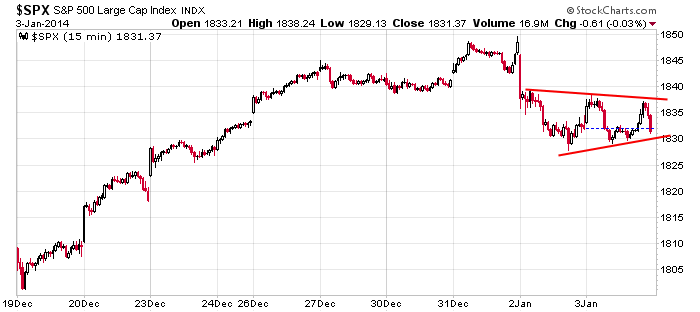

Here’s the 15-min chart that goes back two weeks. A steady uptrend was broken the first trading day of the year and now a bearish pennant pattern is forming. A measured move takes the S&P down to about 1815 – a very moderate move considering the recent gains.

Long term the market looks great. Short term there’s been some technical deterioration. And with it being a new year, you never know if a psychological shift has taken place in traders minds which can temporarily disrupt the market. Be on you toes here. More after the open.

Stock headlines from barchart.com…

Men’s Wearhouse (NW) began a cash $57.50 tender offer to the shareholders of Jos. A. Bank Clothiers (JOSB -0.46%), which represents a 5.7% premium to last week’s closing price. The companies continue their battle for control that began when Jos. A. Bank approached Men’s Wearhouse with a $2.3 billion buyout offer.

GE Healthcare (GE -0.07%) will acquire Thermo Fisher’s (TMO +0.38%) cell culture and gene modulation units for about $1.1 billon.

T-Mobile (TMUS -3.27%) will acquire certain 700 MHz A-block spectrum licenses for $2.365 billion from Verizon Wireless (VZ -1.18%).

Autonation (AN +0.95%) announced that its total retail new vehicle sales were up 6% in December.

Rockwell Collins (COL +0.96%) was added to Deutche Bank’s short-term buy list.

The Chinese government indicated continued support for the solar industry, according to a report on Saturday by Reuters, thus providing support for Chinese solar stocks such as JA Solar (JASO -2.41%).

Liberty Media (LMCA +0.62%) offered to acquire Sirius (SIRI +2.00%) as a wholly-owned subsidiary in a deal valued at $3.68 per share. Siruis rallyed 5% in after-hours trading on Friday on the acquisition news.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

10:00 Factory Orders

10:00 ISM Non-Manufacturing Index

Notable earnings before today’s open: none

Notable earnings after today’s close: SONC

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Dec 6)”

Leave a Reply

You must be logged in to post a comment.

Jason,

I assume that you need to set out on your “visa run”. I just returned from Nicaragua. I travelled through the border – had lunch and returned. Lots of stamps in my passport and border fees. Good for another 90 days when I return home.

Going all the way to the border and back would probably take less time (and definitely be less stressful) than standing in lines for hours in a typical inefficient Latin American country.

AD does not look too bearish. PC ratio is climbing. I don’t see too much either way.

A new beginning for the year? Or, more of the same?

”

March E Mini S&P- Last week’s pullback below the significant support level of 1825.50 offers insight into a possible ongoing corrective period for the March E Mini contract. Daily Stochastic & MACD readings suggest further pullback to test the 1816.75 level last seen on Dec 20th, 2013. This pullback could gain further momentum if the market continues to take its lead from the NASDAQ 100 futures, which are flirting with a significant breakdown. ”

So says my broker who is usually wrong. I think Stick with the basic indexes until we see the whites of their eyes as they fall, then cash and down a little more, consider the full hedge. Let the market lead this week and we will see what they have stomach for. More political posing to come.

Levels are the same as I posted Friday.

Tgt still 1862 as long as Thursday’s low is not violated.

Futures range overnight: -1.25 to +6 now +5.50

Could easily retrace after the gap up open.

LOL.

I am in Monteverde. We drove to La Fortuna – took the boat from Los Chiles to San Carlos Nic. Nobody was at the CR customs office on the way out – just walked in and got my pp stamped. Saw a lot of the country. Stayed at a hotel beneath the volcano Arenal in La Fortuna. On our way up the Rio Frio – stopped in at a Nicaraguan army post – a bit nervous with 18 year old kids carrying sub-machine guns.

I know all about standing in line here!! LOL Took me two hours to buy USD at the bank.

We’re heading to San Jose on Jan. 26 for a week touring the highlands and then off to the Pacific Coast for another week. Wayne and Jason, can you recommend a good lodge near San Jose where we can visit the coffee plantations and see the basic sights? We toured the Arenal area last January so don’t have to repeat that. Stayed at the Gingerbread Hotel…very cool place.

If you have any recs, please send them to me here: gdstuart at gmail dot com.

Thanks!

Geoff Stuart

Hammonton NJ

Geoff…there is no reason to stay in San Jose. At most get a hotel for one night on the day you arrive, but after that head to one of the coasts. I can recommend some place if you tell me where you’re headed.

Geoff,

I stayed at the Marriott in Alajeula – then headed to Monteverde. I didn’t spend any time in San Jose.

Jason lives near that area – he would have a lot more information for you than I can provide.

Safe journey!

Pura Vida!