Good morning. Happy Thursday.

The Asian/Pacific markets closed mostly down. Japan dropped 1.5%; China, Hong Kong, South Korea and Taiwan also lost ground. Europe is currently mostly up. Austria, Italy, Spain and Stockholm are leading the way. Futures here in the States point towards a moderate gap up open for the cash market.

The dollar is down. Oil is down, copper up. Gold and silver are up.

The first five days of the year are in the books, so we can finally stop talking about that indicator. It’s not helpful anyways because even if the odds favored 2014 being an up year, it doesn’t tell us what the path will be. The market could slowly drop 10% and then rally the last two months of the year and satisfy the indicator, but most of the movement could have been to the downside.

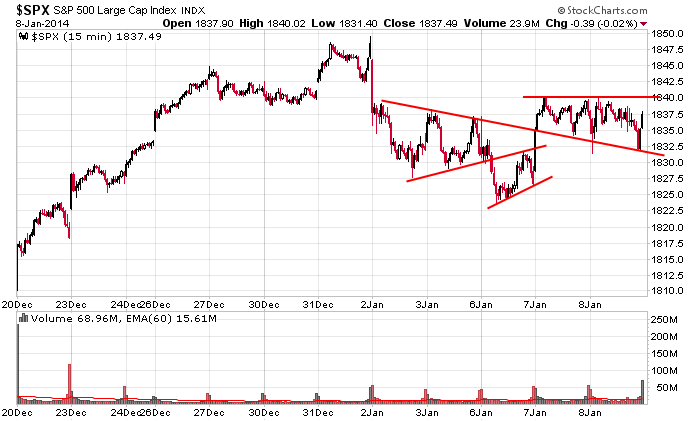

Here’s the 15-min S&P chart. The index has traded in a 15-point range the first week of the year and an 8-point range the last two days. So much for things dying down at the end of 2013 and then volatility picking up in 2014. It’s been mostly a slow year for the overall market.

Overall I like the market, but there are some cross-currents to deal with. This is not a “go all in” time. Play it safe here. My sense is the market has yet to establish a personality here in the new year.

Stock headlines from barchart.com…

Aetna (AET +1.02%) was upgraded to ‘Outperform’ from ‘Neutral’ at Credit Suisse.

Cantor Fitzgerald named Thermo Fisher Scientific (TMO +1.54%) its top stock pick for 2014 and raised its price target for the stock to $128 from $112.

Valspar (VAL +0.34%) was upgraded to ‘Outperform’ from ‘Neutral’ at RW Baird.

Yum! Brands (YUM -0.04%) was downgraded to ‘Equal Weight’ from ‘Overweight’ at Morgan Stanley.

McDonald’s (MCD -1.01%) was upgraded to ‘Overweight’ from ‘Equal Weight’ at Morgan Stanley.

NVIDIA (NVDA +1.36%) was downgraded to ‘Hold’ from ‘Buy’ at Canaccord due to valuation.

Pier 1 Imports (PIR +0.82%) lowered guidance on fiscal year 2014 EPS to $1.07-$1.12 from $1.21-$1.27, well below consensus of $1.23.

Sprint (S +1.11%) was downgraded to ‘Hold’ from ‘Buy’ at Deutsche Bank due to valuation.

Jefferies upgraded Public Storage (PSA +0.18%) to ‘Buy’ from ‘Hold’ citing the recent pullback in shares and strong fundamentals.

Macy’s (M -0.65%) rallied 5% in after-hours trading after reiterating its fiscal-year EPS guidance and announcing cost-savings measures involving cutting 2,500 employees. The company’s fiscal-2014 EPS guidance also beat estimates thanks to the cost-savings measures.

Global Payments (GPN -0.74%) rallied 5% in after-hours trading after a positive earnings report.

Bed Bath & Beyond (BBBY +0.59%) fell 8% in after-hours trading after missing earnings expectations.

United Airlines (UAL +6.02%) reported that December traffic rose +4.1%.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

Chain Store Sales

7:30 Challenger Job-Cut Report

8:30 Initial Jobless Claims

9:45 Bloomberg Consumer Comfort Index

10:30 EIA Natural Gas Inventory

4:30 PM Money Supply

4:30 PM Fed Balance Sheet

Notable earnings before today’s open: AYI, FDO, SVU

Notable earnings after today’s close: AA, ANGO, PSMT, SNX

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jan 9)”

Leave a Reply

You must be logged in to post a comment.

http://www.prometheusmi.com/images/pages/commentary/images/daily/2014/01/08/sp500_high_risk_periods.png

The Friday NFP is what is attracting all the attention. Forecasted to be 198000 new jobs. So look at the graph saying that the market is at one of its all time highs. Phooy, these are not normal times. See you can not even warm a man. Dow down 68 yesterday and the futures say up 50 something today. Buy the IWN the R2K is doing OK these days.

Overnight, futures broke resistance I have been citing (1836-1841) and also hit my ST tgt 1845 [all numbers are converted to spx values]. That action is invisible to the cash trader but it will have a definite effect on trading today. Be expecting a pullback — do not read it as a sign of a downtrend. It will be a normal move to tap the next level of support.

However, for bulls, the move should go no lower than 1835. It should bounce above that and move higher to 1847, next ST tgt. Still targeting 1862. With tomorrow’s non-farm payrolls report due at 830, never say never.

Futures range overnight: -3.75 to +6.5, now +4