Good morning. Happy Wednesday.

The Asian/Pacific markets closed mostly up. Japan rallied almost 2%, Hong Kong 1.25% and Singapore almost 1%. Europe is currently mostly up. Greece is up 2.7%, Austria 1.4% and the Czech Republic 0.7%. Futures here in the States point towards a slight down open for the cash market.

The dollar is up. Oil are copper are up. Gold and silver are down.

Today is the last day of the first five days of 2014. Historically, when the first five days post a net gain, the market posts a gain for the year 80% of the time. If the market is to post a gain this year, the S&P will have to rally 11+ points today – doable but no small feat.

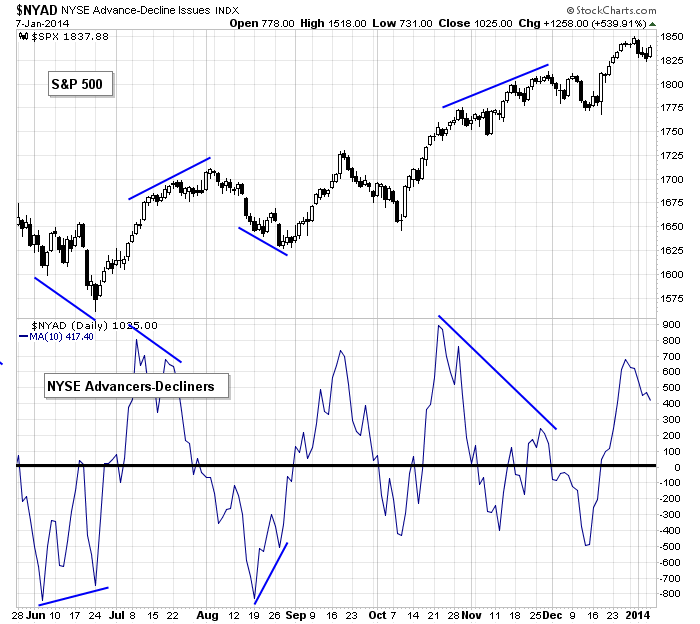

Several crosscurrents exist right now. Here’s the SPX vs. the 10-day MA of the NYSE AD Line. The indicator has rolled over and is moving down, so the recent breadth has weakened. But the sensitivity of this indicator is suspect. In September, the market rolled over at the same time, but in October and November, it took a month and a negative divergence before the market corrected (with time). In both cases the market corrected, but the timing was different. Don’t ignore this. It doesn’t mean something will happen right now, but odds favor something happening soon.

I think playing it safe is best right now. The personality of the new year has not been established yet. More after the open.

Stock headlines from barchart.com…

Citigroup (C +0.69%) was named a Top Pick at Credit Suisse in the category of U.S. Large-Cap Banks.

Hess Corp (HES +1.18%) filed for a tax-free spin-off of its retail unit Hess Retail Corporation.

Twitter (TWTR -7.29%) was downgraded to Sell from Hold at Cantor due to excessive valuation.

Constellation Brands (STZ +1.92%) reported Q3 EPS of $1.10, well above the consensus of 91 cents.

NuPathe (PATH -0.92%) disclosed that it received a a takeover offer from its rival Teva ({=TEVA) and is reviewing the offer.

Ford (F -1.28%) rallied 1% in after-hours trading after CEO Alan Mulally said he plans to stay at Ford through 2014 and will not be leaving for Microsoft {=(MSFT=}). The news pushed Microsoft 1% lower.

Micron Technology (MU +5.13%) rallied 7% in after-hours trading after reporting above-consensus EPS and revenue.

Apollo Education (APOL -0.48%) rallied 10% in after-hours trading after reporting fiscal Q1 EPS that beat estimates.

Container Store (TCS +6.54%) fell 8% in after-hours trading after providing disappointing fiscal-year revenue guidance.

Rubicon (RBCN +0.88%) fell 6% in after-hours trading after filing to sell $28 million worth of common stock.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

7:00 MBA Mortgage Applications

8:15 ADP Jobs Report

10:30 EIA Petroleum Inventories

1:00 PM Results of $21B, 10-Year Bond Auction

2:00 PM FOMC minutes

3:00 PM Consumer Credit

Notable earnings before today’s open: AZZ, GBX, MON, MSM, RPM, SCHN, STZ

Notable earnings after today’s close: BBBY, GPN, RT, TXI, VOXX, WDFC

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jan 8)”

Leave a Reply

You must be logged in to post a comment.

Resistance layer from 1836-1841 (see yday’s post) held bulls: HOD 1840. If bears push it, their target is 1820.

Bulls need to hold 1831-29. If so, ST tgt 1845,then 1862.

Range +2.50 to -3.50 following ADP report. Now -1.25

The ADP jobs were UP, The rest of the world mixed. Senate to argue the need for more unemployment so a fight probably in the house. Not good for stockholders.

Sold covered calls yesterday; the day was a show of strength, but also volatility. Stay the course until we see who or what is driving things. The January effect so far is not hopeful, but it is overall up 52% of the time anyway so ignore it. Freeze is falling away maybe we see some buying or selling.

Whidbey, can i ask what stock that you sold covered calls? thx jims