Good morning. Happy Friday. Happy Employment Numbers Day.

The Asian/Pacific markets closed mixed. China dropped 0.7%; Indonesia and New Zealand rallied better than 1%. Europe is currently up across the board. France, Germany, Norway, Switzerland, London, Italy and Greece are posting solid gains. Futures here in the States point towards a moderate gap up open for the cash market, but this of course will change when the employment data is released.

The dollar is up. Oil and copper are up. Gold and silver are up.

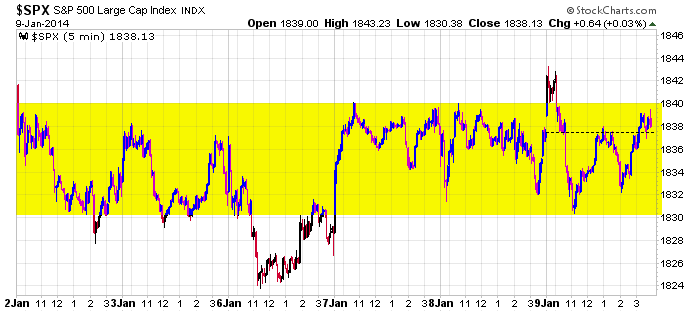

Here’s the rut the market has been in the last week. The breadth indicators started to roll over at the end of December, and instead of correcting with a price decline, the market has been correcting with time. Progress is being made, but more time is needed for the indicators to completely cycle.

This is perfectly normal movement for a strong and healthy market.

Here are the employment numbers…

unemployment rate: 6.7% (was 7.0% last month)

nonfarm payrolls: +74K

private payrolls:

average workweek: down 0.1 hour to 34.4

hourly wages: up 2 cents to $24.17

labor participation rate drops to 62.8%

November job gain raised from 203K to 241K

October job gain unchanged at 200K

These are not good numbers…S&P futures dropped from being up 7.5 to being down 3, and now they back up to +4.

As I stated yesterday, the weekly jobless claims number is more important than the monthly unemployment data, so these numbers, in my opinion, are food for the media to chew on. But no doubt the lower unemployment rate will be the headline number, which could bring more buyers to the market if they believe the train is leaving the station.

News trumps the charts. Let’s see what shakes out the first hour.

Stock headlines from barchart.com…

Tiffany (TIF +0.34%) said holiday sales were up 6% y/y and that it sees fiscal 2013 EPS ex-items $3.65-$3.75, well above consensus of $3.52.

Microsoft (MSFT -0.64%) was upgraded to ‘Overweight’ from ‘Equal Weight’ at Barclays.

Infosys (INFY +0.70%) rose 3% in pre-market trading after it reported Q3 EPS of 81 cents, better than consensus of 75 cents, and raised its fiscal 2014 revenue growth outlook to 11.5%-12% from 9%-10%.

Target (TGT +1.04%) was upgraded to ‘Buy’ from ‘Neutral’ at Goldman.

Eli Lilly (LLY +1.12%) was downgraded to ‘Underweight’ from ‘Equal Weight’ at Barclays.

Citigroup raised its price target on Monsanto (MON -2.90%) to $133 from $122 and keeps its ‘Buy’ rating on the stock.

ESPN reported that Notre Dame will sign an equipment deal with Under Armour (UA +1.14%) to wear the company’s gear in all sports when the university’s current deal with Adidas (ADDYY -1.37%) expires at the end of the school year.

Abercrombie & Fitch (ANF +0.88%) jumped over 13% in after-hours trading after it hiked its fiscal year adjusted EPS view to $1.55-$1.65 from $1.40-$1.50, above consensus of $1.47.

Royce & Associates reported a 7.17% passive stake in GSE Holding (GSE -5.50%) and a 6.65% passive stake in Genesco (GCO -0.55%) .

Sears (SHLD -3.18%) plunged 14% in after-hours trading after it said it sees a full year adjusted EPS loss of -$7.64 to -$8.61, a larger loss than consensus of -$6.20.

Paychex (PAYX -0.51%) was downgraded to ‘Underperform’ from ‘Sector Perform’ at RBC Capital.

Shoe Carnival (SCVL -1.90%) fell over 8% in after-hours trading after it lowered guidance on Q4 diluted EPS to 3 cents-6 cents, well below consensus of 21 cents.

SYNNEX (SNX +1.93%) reported Q4 EPS of $1.20, better than consensus of $1.18.

Alcoa (AA -1.29%) fell over 5% in after-hours trading after it reported Q4 adjusted EPS of 4 cents, below consensus of 6 cents.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

8:30 Nonfarm payrolls

8:30 Nonfarm private payrolls

8:30 Unemployment Rate

8:30 Hourly Earnings

8:30 Average Workweek

10:00 Wholesale Trade

Notable earnings before today’s open: INFY

Notable earnings after today’s close: none

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jan 10)”

Leave a Reply

You must be logged in to post a comment.

In shock: low new jobs number 8700, yet unemployed fall to 6.7? Christmas shopping season was very slow – no hiring? Still, the BLS needs to consider some simplification of its reporting, smoothing by quarter might be a good start. The politicians have ruined everything but the beer and they are working on that.

Reset to thinking for ourselves. The Fed will feel compelled to “do something”. What?? Nothing we hope.

Still in the indexes and buying some of Jason’s best. Just waiting and staying invested.

Thurs, market fell thru my stated support and instead bounced at recent support 1830-1831 and overnight the futures ran back up to the target established by that support.

The jobs number/unemployment release showed a typical hefty reaction by the futures, which have tapped another level of support which projects a target to 1853.

Futures were about +10 overnight, now +3.5.

Once again could dip after the open.

Will not be able to post until late Monday. Have a nice and safe weekend.