Good morning. Happy Monday. Hope you had a great weekend.

The Asian/Pacific markets closed mostly up. Indonesia rallied 3.2% and India 1.8%. Malaysia, New Zealand, South Korea and Taiwan also did well. Europe is currently mostly up. Austria, Spain and the Czech Republic are leading; most indexes are up a small amount. Futures here in the States point towards a down open for the cash market.

Be alerted of new content. Join our email list here.

The dollar is flat. Oil and copper are down. Gold and silver are down.

The market moved up last week, but trading was mostly sloppy. In fact it’s been sloppy all year. Individual stocks have done well, but the indexes has churned in place.

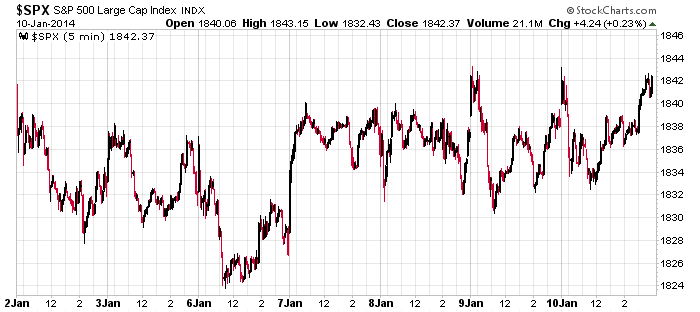

Here’s the 7-day, 5-min chart. Yuck!

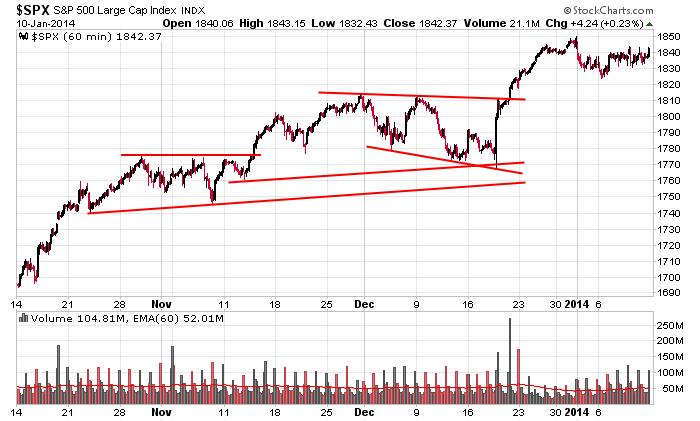

Backing up to the 60, you can see the S&P rallied 80 points the last two weeks of December and is now in consolidation mode. Overall this chart looks great. The bears have been unable to push prices down even a little.

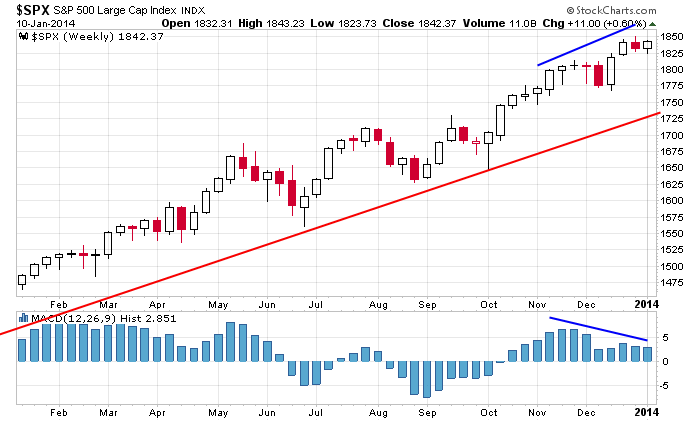

Backing up more, the negative divergence on the weekly remains in place.

The overall trend remains up and strong. Short term, things have neutralized. We have some good set ups heading into this new week. Let their level of success hint at what comes next. More after the open.

Stock headlines from barchart.com…

Symantec (SYMC -0.17%) was downgraded to ‘Underweight’ from ‘Equal Weight’ at Morgan Stanley.

MGM Resorts (MGM +1.52%) were upgraded to ‘Buy’ from ‘Neutral’ at BofA/Merrill.

Lululemon (LULU +3.92%) dropped 5% to $56.50 in pre-market trading after the compnay cut its outlook for Q4 EPS to 71 cents-78 cents from 78 cents-80 cents, below consensus of 79 cents.

Jacobs Engineering (JEC +0.76%) was upgraded to ‘Buy’ from ‘Neutral’ at UBS.

Cree (CREE +0.81%) was downgraded to ‘Hold’ from ‘Buy’ at Stifel.

Express (EXPR +2.26%) cuts fiscal 2013 EPS view to $1.37-$1.41 from $1.46-$1.51, below consensus of $1.50, due to ‘deeper than anticipated’ traffic drop in Q4.

Marsh & McLennan (MMC -0.74%) was downgraded to ‘Neutral’ from ‘Outperform’ at Credit Suisse.

Marriott (MAR +0.59%) was downgraded to ‘Underperform’ from ‘Hold’ at Jefferies.

General Motors (GM -1.14%) is recalling 370,000 of its 2014 model-year Chevrolet Silverado and GMC Sierra pickup trucks, citing software that could pose a fire risk.

EnPro (NPO +4.28%) surged over 34% in after-hours trading Friday after a judge in the EnPro case says $12 million satisfies the company’s liability obligation.

PVH (PVH -0.67%) cut its Q4 revenue view to $2.06 billion from $2.08 billion, and lowered guidance on fiscal 2013 to $8.22 billion from $8.24 billion.

St. Denis J. Villere & Company reported a 8.44% passive stake in Sanchez Energy (SN +1.43%) .

Select Medical (SEM -7.37%) lowered guidance on fiscal 2014 EPS to 84 cents-93 cents, weaker than consensus of 96 cents.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

2:00 PM Treasury Budget

Notable earnings before today’s open: XRTX

Notable earnings after today’s close: DRWI

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jan 13)”

Leave a Reply

You must be logged in to post a comment.

http://stockcharts.com/c-sc/sc?s=IWC&p=D&b=5&g=0&i=p83429509075&r=1389610940509 (Leading ETF in December) Small caps are leading Look at IJT, IWC, IWO. With stops

What could destroy this paradise? Will, I went shopping in Hawaii yesterday after paying 200/day to tie up, and they said sales were awful now selling everything 65% off with 15% more for Saturday/ Sunday (Macy’s). What is up? Nationally same thing >1.3% retail sales in December. This a good view of Personal Consumption Expenditures (PCE) and profits 6-24 weeks later. Suggests weakness See Ellis’s “Ahead of the Curve”. For some reason things are softening. Keep Yellen away from the switch. Can not wait for Easter, our merchants are so religious about supporting holy days.

the writing was there in the charts\

the bulls are headed for exitingsion

Jason

do we have a monthly opts ex report

calls out no puts greatly i beleive