Good morning. Happy Thursday.

The Asian/Pacific markets closed mixed. Australia was the only country to post a decent gain. Indonesia and Malaysia dropped the most. Europe is currently mixed. Greece and the Czech Republic are down the most. Belgium and Amsterdam are up the most. Futures here in the States point towards a down open for the cash market.

The dollar is flat. Oil is up, copper down. Gold and silver are down.

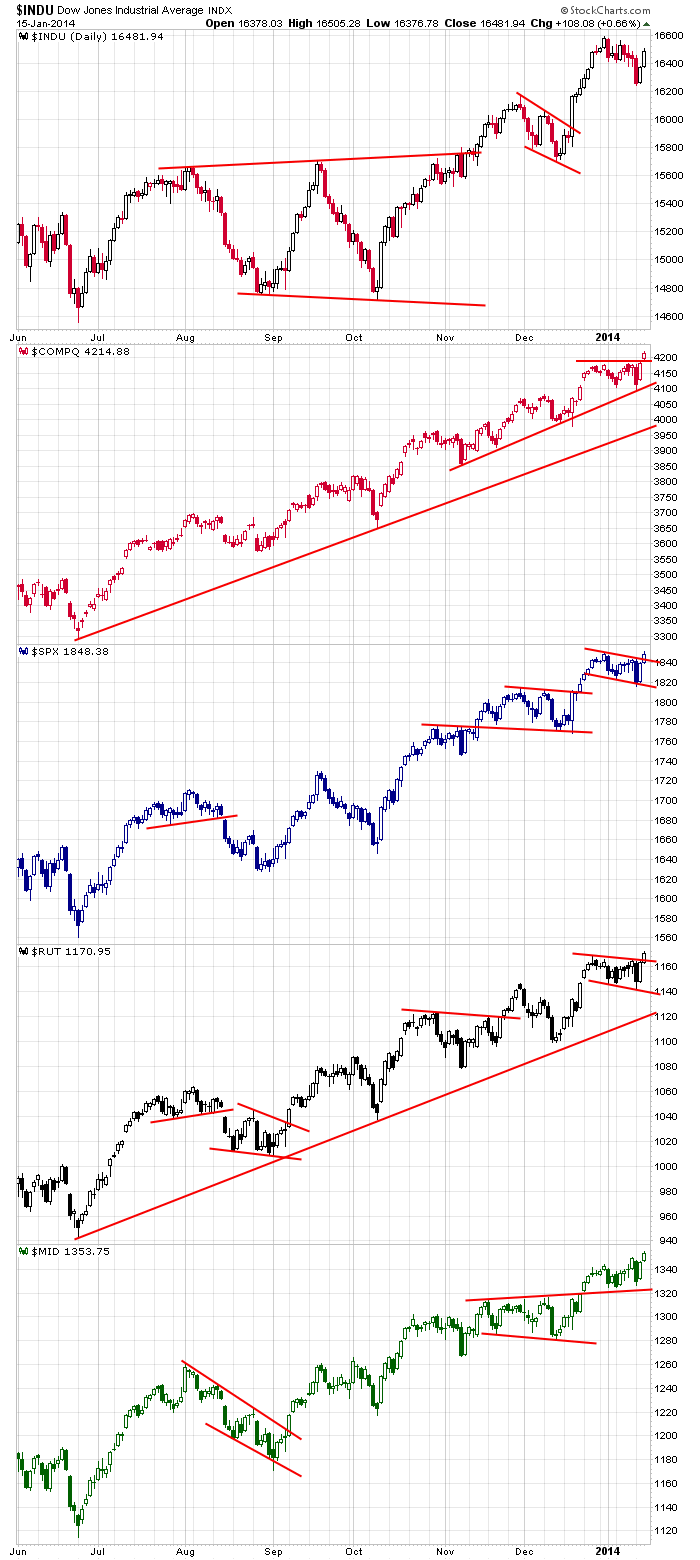

Yesterday the market followed through on the previous day’s gains. The Nasdaq, S&P 500, Russell 2000 and S&P 400 hit new highs. The Dow is lagging some, but that’s not a surprise considering it went vertical the last two weeks of December. Here are the dailies.

Continuing the theme of my write-up yesterday about retailers possibly being a canary in a coal mine, Best Buy (BBY) is down almost 30% this morning.

I’ve seen a significant improvement in the charts of individual stocks lately. We actually have many good set ups to play, so my bottoms-up approach tells me the market is strong.

Options expire tomorrow. It’s a meaningless day in my view because anyone who needed to square off positions or roll to a new month has already done so. Then we get a 3-day weekend…the market is closed Monday for MLK day.

I see no reason to change my MO. The lagging retail sector is notable; otherwise things look pretty good…good enough to keep trading long. More after the open.

Stock headlines from barchart.com…

Goldman Sachs (GS +1.22%) reported Q4 EPS of $4.60, well ahead of consensus of $4.18.

CSX (CSX +1.21%) was upgraded to ‘Buy’ from ‘Hold’ at Argus.

Best Buy (BBY +1.40%) fell over 9% in pre-market trading after it reported holiday sales for the nine weeks ended Jan 4, 2014 were down -0.8% compared to teh same period last year.

UnitedHealth Group (UNH +1.11%) reported Q4 EPS of $1.41, right on expectations.

PNC Financial Services Group (PNC +1.08%) reported Q4 EPS of $1.83, better than consensus of $1.64.

BlackRock (BLK +0.72%) reported Q4 EPS of $4.92, well ahead of consensusu of $4.33

Reuters reported that an advisory panel to the U.S. FDA concluded that Merck’s (MRK -0.91%) experimental blood clot-preventing drug vorapaxar should be approved to reduce the risk of further heart problems in people who have suffered a heart attack recently.

H.B. Fuller (FUL -0.36%) reported Q4 adjusted EPS of 68 cents, well below consensus of 75 cents.

Hirzel Capital reported a 6.0% passive stake in Aeropostale (ARO +0.65%) .

SAC Capital reported a 5.0% passive stake in Textura (TXTR -3.77%) .

J.C. Penney (JCP +1.15%) rose nearly 2% in after-hours trading after ut said it will close 33 stores and cut 2,000 jobs.

Kinder Morgan (KMI -0.03%) reported Q4 EPS of 33 cents, weaker than consensus of 35 cents.

CSX (CSX +1.21%) fell over 3% in after-hours trading after it reported Q4 EPS of 42 cents, below consensus of 43 cents.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

8:30 Consumer Price Index

8:30 Initial Jobless Claims

9:00 Treasury International Capital

9:45 Bloomberg Consumer Comfort Index

10:00 NAHB Housing Market Index

10:00 Philly Fed Business Outlook

10:30 EIA Natural Gas Inventory

11:10 PM Bernanke: ‘Conversation on challenges facing central banks’

4:30 PM Money Supply

4:30 PM Fed Balance Sheet

Notable earnings before today’s open: BBT, BLK, C, FRC, GS, HBAN, IGTE, IIIN, PNC, PPG, PVTB, TSM, UNH

Notable earnings after today’s close: ASBC, AXP, COF, INTC, OZRK, PBCT, SLM, SWKS

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jan 16)”

Leave a Reply

You must be logged in to post a comment.

What a shock, Citi has a soft sport, or more. Best Buy appears to be dying (Down 29% in premarket). But it is just the start. The House sent a trillion$ plus budget to the Senate, it exceeds tax revenues by a tad, but no problems just put on my bill. GS says they made their numbers if you just look at it right, oh yes, we did cut pay and new business was off about 17%. Fastest hands in Wall Street.

A fall in same store sales for Christmas is the big news, either AMZN is getting it all, or consumers are not spending. That shows up in CPE< Cap EX< profits. So is the start of something. Be careful the train is slowing.

Bernanke speaks on "my life and times as a savior" at the Washington a Tank. Not much expected.

I think down today, and maybe Friday too. Have I mentioned stops recently?

Morning all. Commitment prevented earlier posting.

After the move up from Monday’s low which was 36 points straight up, normal to do a giveback. Add in the gyrations accompanying OPEX and max pain, we could easily move back down 10 points from where we are at the moment, or to 1832 and as low as 1827.

SPX index options effectively close at 4 pm today (settlement based on opening print tomorrow morning).

Resistance currently at the high at 10 am today, and will begin at 1844.

Tgt still 1865 as long as 1827 not violated.