As the market continues to move up and I maintain my bullish bias, I’m constantly on the lookout for a “canary in the coal mine.” Most of the time nothing exists; every once in a while something pops up that gets my attention. Right now it’s the retailers. Many – not just a couple, many – have suffered big moves down lately, so I’m wondering if this hints at a weakening consumer.

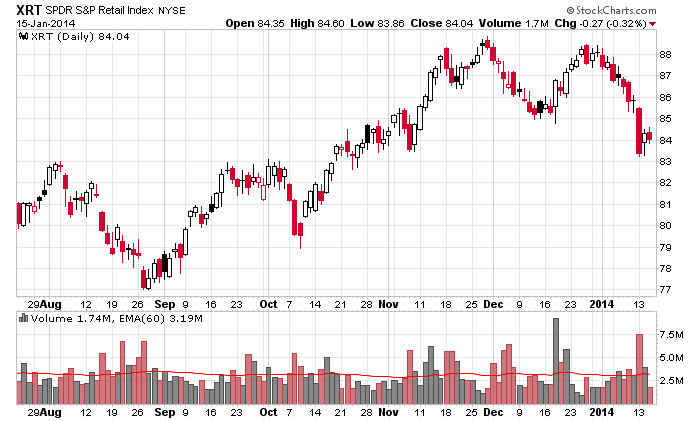

XRT – in the grand scheme of things, this pullback is no big deal, but close up, it’s noteworthy the market is near its highs and XRT has made a lower high and lower low.

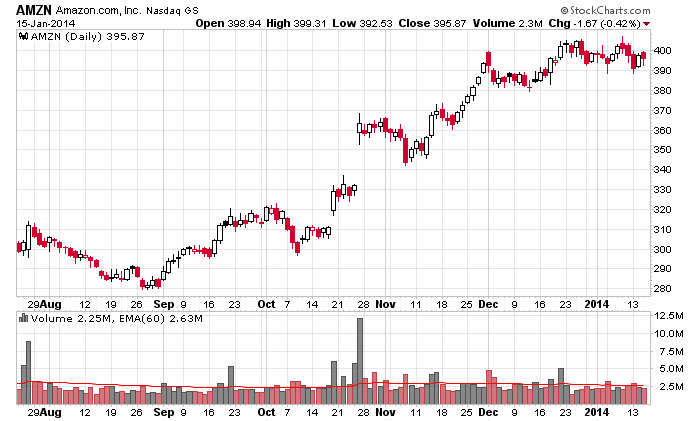

AMZN – obivously not a pure retail play. It’s doing great.

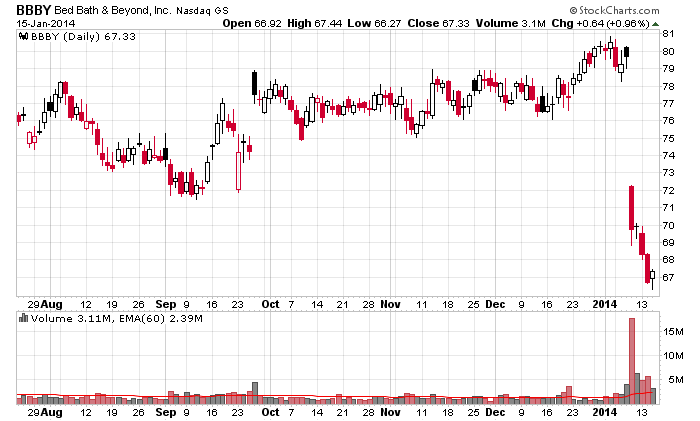

BBBY – a rock solid company that suddenly took a big hit.

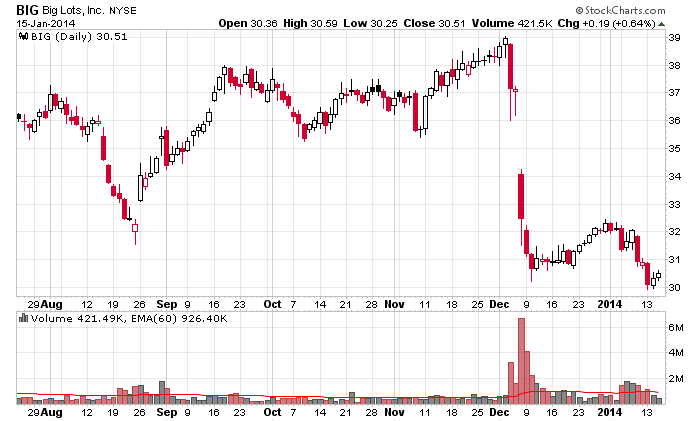

BIG – 25% drop in six weeks.

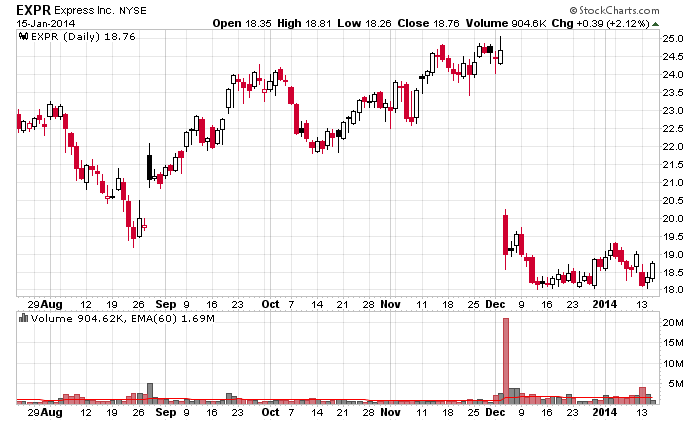

EXPR – they sell to young men and women, so is their weakness a reflection of the economy as seen through the eyes of a 25-yo?

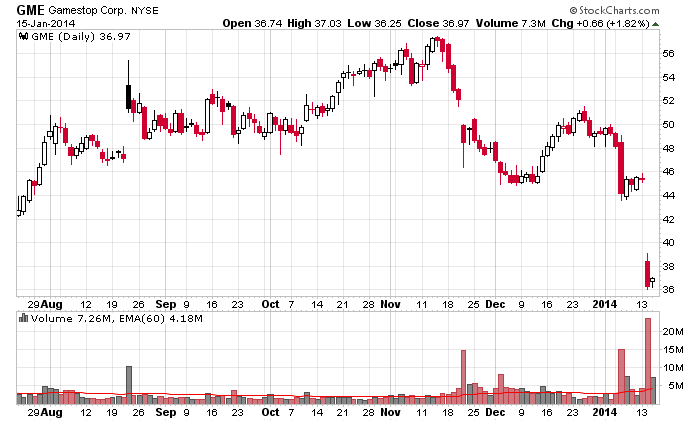

GME – a specialty store that has given back a big chunk of its 2012 gains.

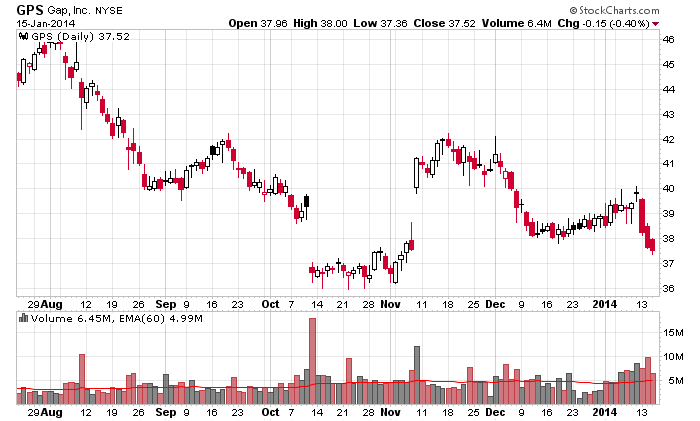

GPS – it’s been struggling for a while.

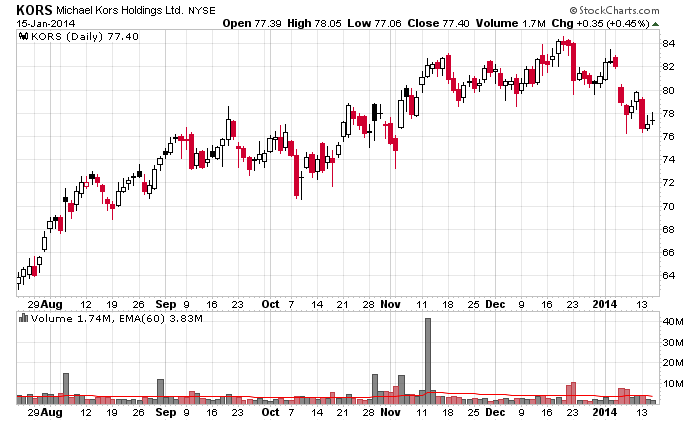

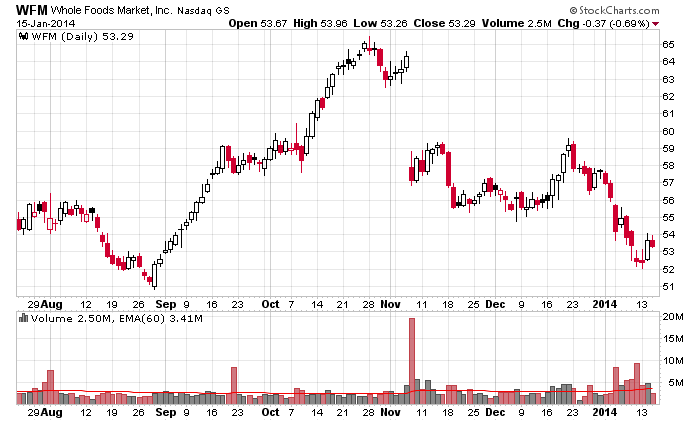

KORS – higher end retailer still doing well over all, but it’s off its highs. When combined with WFM, you gotta wonder about the recession-proof rich.

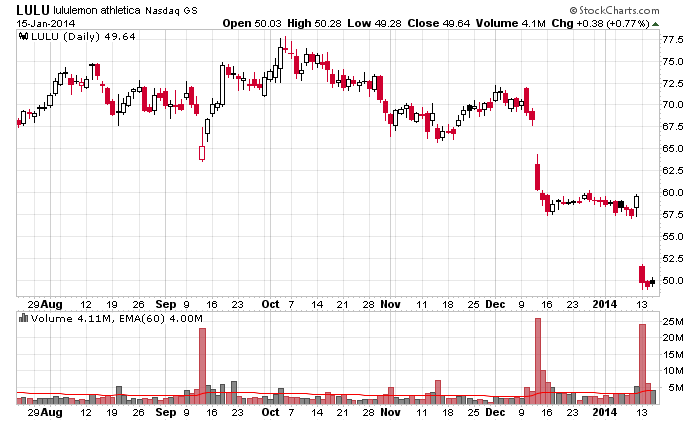

LULU – lots of company-specific issues here, but GPS is weak too, so maybe it’s broader than people think.

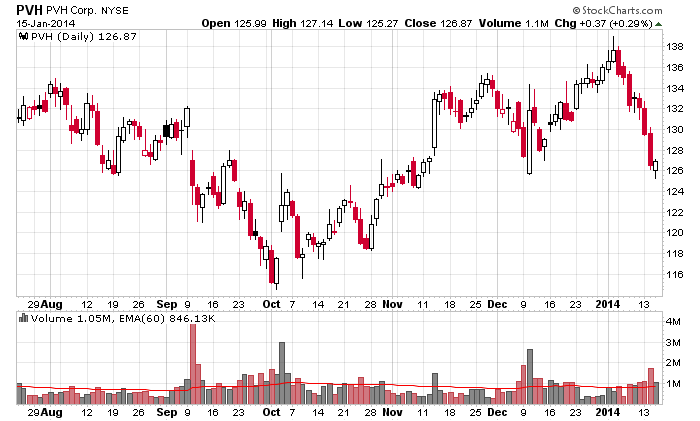

PVH – still doing well overall but couldn’t match the market’s recent new high.

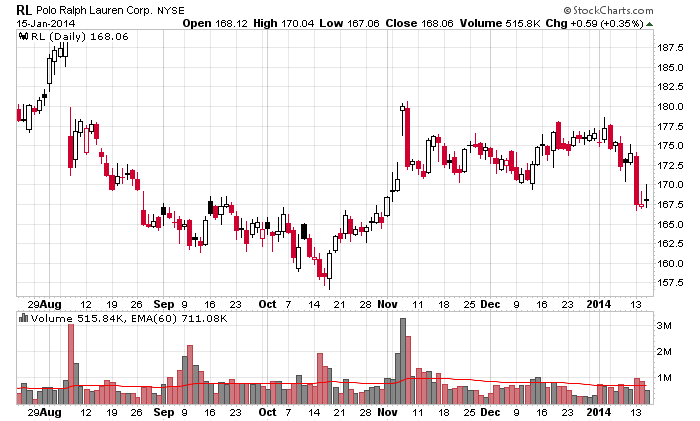

RL – has been flat for two years.

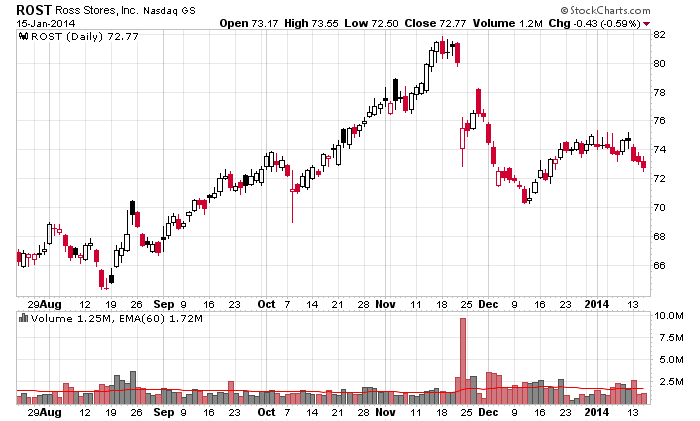

ROST – a minor hiccup if you look at a long term chart but noticeable that’s been lagging for two months.

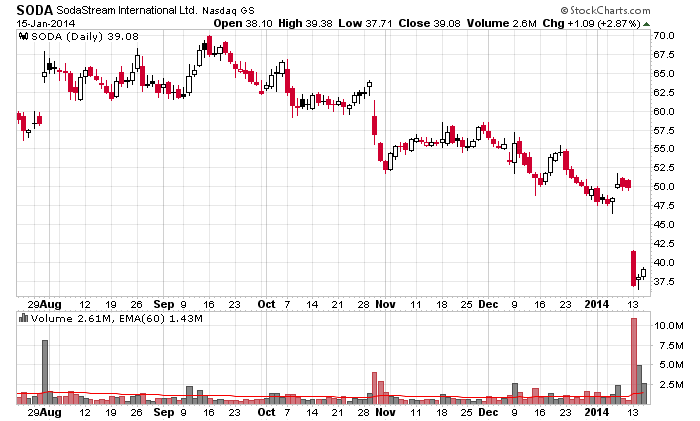

SODA – another higher end discretionary stock struggling.

VF – a great all-around company is doing very well.

WFM – there are signs the higher end is struggling.

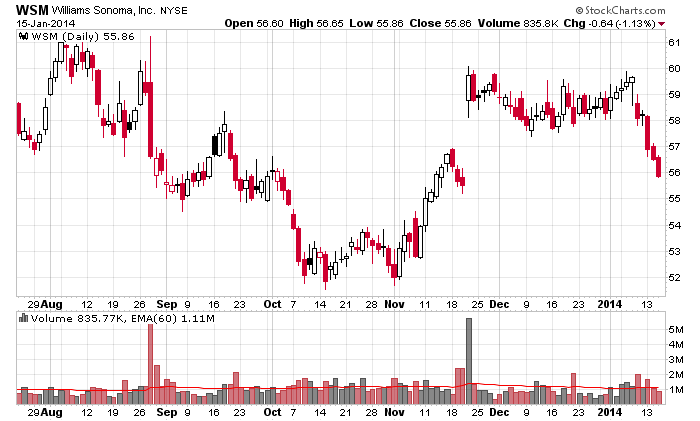

WSM – hasn’t kept up for several months.

Retail is worth keeping an eye on. If the group can’t firm and at least keep pace, you gotta wonder what consumers are thinking and doing.

0 thoughts on “The Retail Sector – A Canary in a Coal Mine?”

Leave a Reply

You must be logged in to post a comment.

Jason,

Bingo! and don’t forget about SHLD. Timberrrrrrrrrrr

http://stockcharts.com/h-sc/ui?s=SHLD

Thanks,

Jack

Obamacare! Does anybody think that having to spend money (or the threat of) for health care every month is not going to dig into discretionary spending?

As a fan of Livermore I follow a select few stocks which lead the market. One of the stocks I follow is TGT.

TGT is flat but under performing the market.

Good work here Jason. I enjoyed reading this. I am sure the weather is better where you are.