Good morning. Happy Tuesday. Hope you enjoyed your day off. My 19 days of visitors ended, and we moved to a new house in the mountains. I’ll post pictures later.

The Asian/Pacific markets closed mostly up. Japan rallied 1%; Australia, China, New Zealand and South Korea also did well. Europe currently leans to the upside. Greece is down, but Germany, Amsterdam and Switzerland are doing well. Futures here in the States point towards a moderate gap up open for the cash market.

The dollar is up. Oil is up, copper is down. Gold and silver are down a bunch.

Let’s keep things simple and remind ourselves of what’s going on.

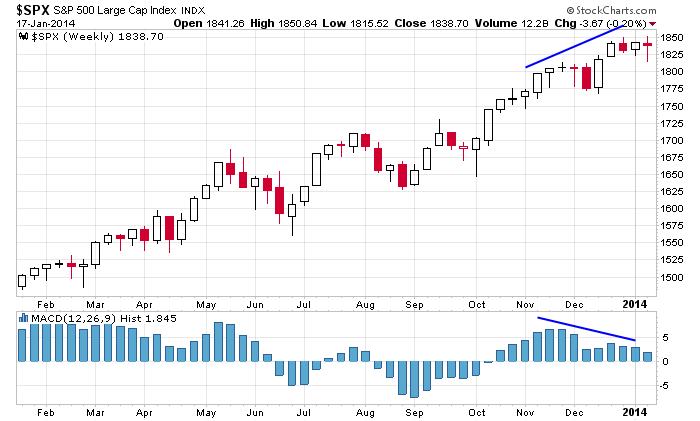

The weekly S&P is solidly trending up and has been working off a negative histogram divergence by moving sideways instead of moving down.

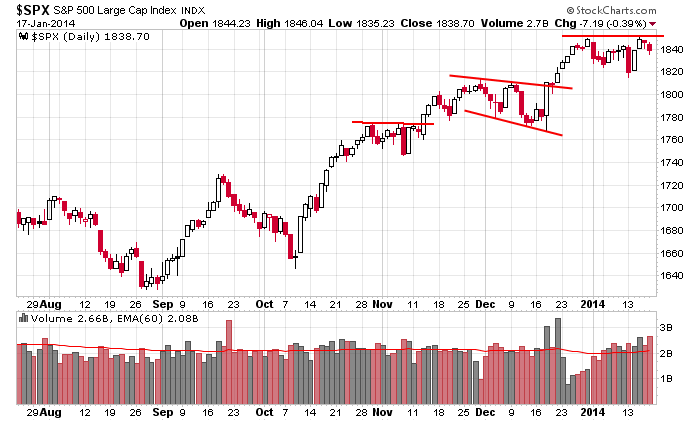

The Daily S&P has moved from one pattern to the next. Last week it tested its previous high and got pushed back. Volume has been equally strong/week on up and down days, so it appears to be an equal battle. The index is essentially unchanged this year.

Couple things on my mind…

Earnings season will ramp up this week…many stocks have gotten crushed after missing expectations.

Options expired last Friday, so with the invisible force that tends to pin prices at certain levels, the technicals may not matter as much as they typically do for the next day or so.

I like the market. I don’t love it, I just like it. But that’s the nature of an uptrend. It puts off enough negative signals to keep people on the sidelines while it climbs and climbs and climbs. More after the open.

Stock headlines from barchart.com…

Verizon Communications (VZ -0.37%) reported Q4 EPS of 66 cents, higher than consensus of 65 cents.

Delta Air Lines (DAL -1.61%) reported Q4 EPS of 65 cents, stronger than consensus of 63 cents.

Rockwell Collins (COL +0.69%) reported Q1 EPS of 91 cents, below consensus of 94 cents.

Halliburton (HAL -0.47%) reported Q4 EPS of 93 cents, better than consensus of 89 cents.

Travelers (TRV -0.88%) reported Q4 EPS of $2.68, well ahead of consensus of $2.16.

Regions Financial (RF +0.86%) reported Q4 EPS of 21 cents, stronger than consensus of 20 cents.

Baker Hughes (BHI +0.76%) reported Q4 EPS of 62 cents, better than consensus of 61 cents.

YRC Worldwide (YRCW +2.26%) rose more than 8% in after-hours trading after the Teamsters Union announced a tentative agreement with thwe company.

D. E. Shaw & Co reported a 5.1% passive stake in Tesoro (TSO -0.34%) .

Litespeed reported an 8.1% passive stake in RadioShack (RSH unch) .

Schlumberger (SLB +1.81%) was upgraded to ‘Outperform’ from ‘Neutral’ at Credit Suisse.

JoS. A. Bank (JOSB +0.66%) board rejected the tender offer from Men’s Wearhouse (MW -1.25%) to acquire all outstanding common shares of Jos A. Bank at a price of $57.50 per share in cash, saying the offer is inadequate from a financial point of view and not in the best interest of Jos. A. Bank’s stockholders.

Southpaw Asset reported 6.8% passive stake in Comtech (CMTL -1.58%) .

Luxor Capital reported a 6.1% passive stake in AMC Entertainment (AMC -0.30%) .

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

No major events scheduled.

Notable earnings before today’s open: AMTD, BHI, COL, DAL, EDU, FRX, HAL, IRWD, JNJ, PETS, RF, SAP, SNV, TRV, VZ

Notable earnings after today’s close: ADTN, AMD, CA, CREE, FNB, FULT, IBKR, IBM, TXN, XLNX

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jan 21)”

Leave a Reply

You must be logged in to post a comment.

Earnings appear to dragging the indices up. Still long the index funds, looking for the dollar to rise, Gold and Silver looking like UP for a time, particularly the miners, ie GDX.

Long the bonds since it appears that 134 on the 30 year is within reach. TLT works for a swing trade, but this might go on for a while. EU seems ready to lurch into financial confusion. Leaving it alone for a while.

Listened to Harry Dent, he is very negative on the US, and China for this year and 2015, so I turned him off. I did a jacket endorsement for his first book, and it appears he has nothing new to say about demographics. I’ll learn someday maybe.

We are still in the middle of the move that began a week ago Monday. Risk is high entering here unless you know how to control your stops.

Target remains 1865 as long as 1827 is not violated.

Futures were boringly quiet yesterday morning, but last night zoomed to +10. Are +8.50 now.

I would expect, but don’t guarantee, an intraday move down, but it should hold 1837. If it does break that, it could go to 1830-32, but go lower than 1827.

If it does, the up move is in trouble.

If you have questions, contact me at straddle2003@yahoo.com and post a note here telling me to check my email. Back-up account, not normally monitored.

Have a good day.

hi pls update your earnings list for the week. thanks.

Hey-you were prob glad the 19 days ended !!….Look fwd to seeing pics of your new abode…..We’ve only just mooved ourselves…..Enjoy : ]