This is a follow up to last week’s post where I wondered out loud if the declining retail group was a “canary in a coal mine.” Here are more stocks from the group that support my claim that something may be going on with the consumer. A few stocks are doing well (AMZN, M), but most are struggling and some are in very bad shape.

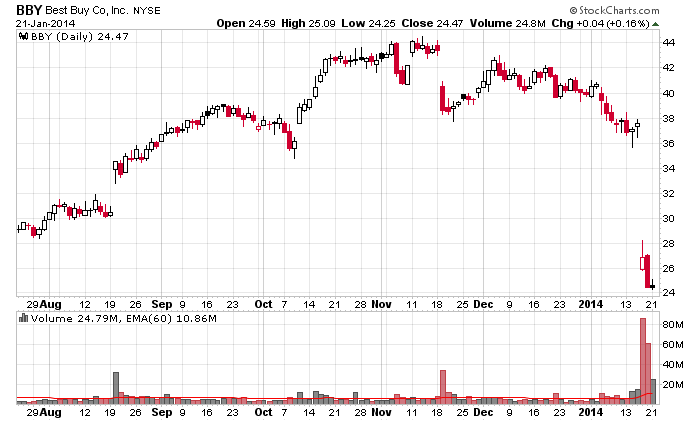

BBY – one of last year’s big winners got clobbered last week.

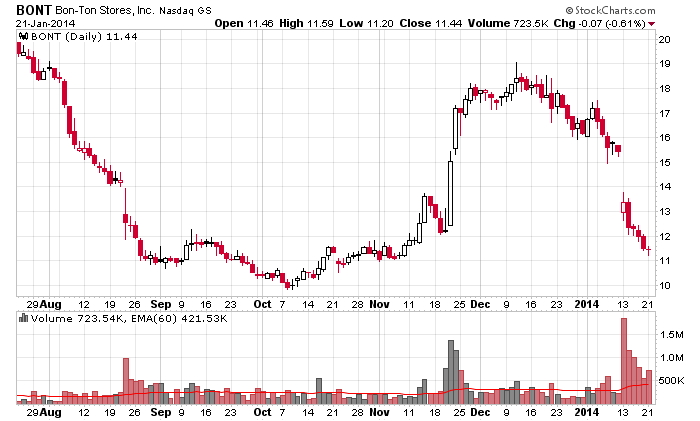

BONT – has fallen almost 50% in the last month.

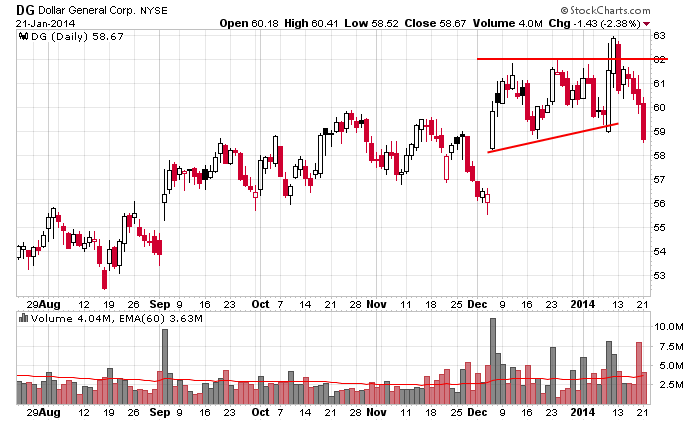

DG – broke out and then gave it all back.

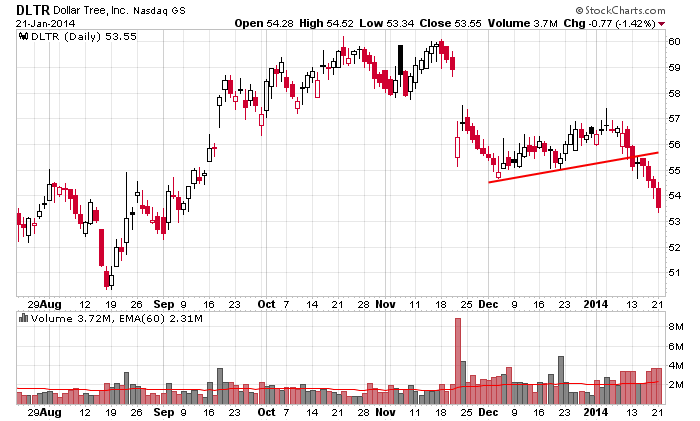

DLTR – broke down in November, formed a bear rectangle, broke down again.

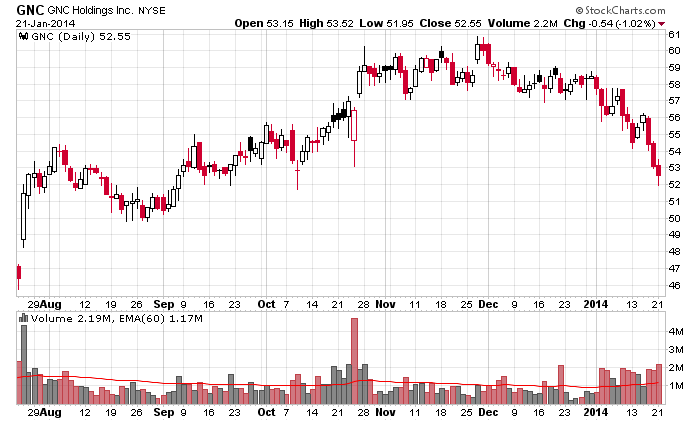

GNC – no trendlines here…just a stock which has been falling for two months and is almost 20% off its high.

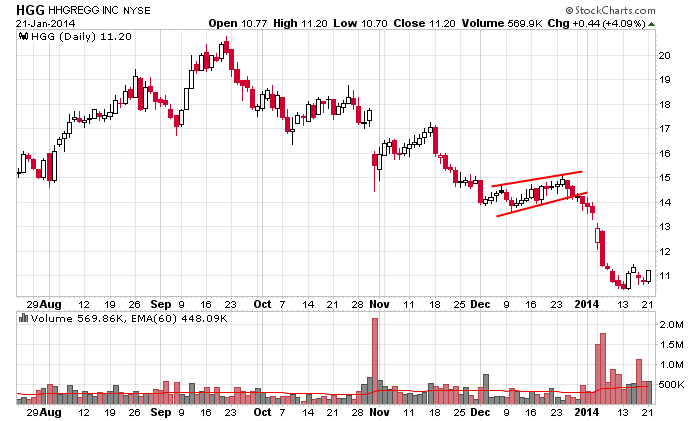

HGG – the stock tripled in 2013 but has since dropped 50%.

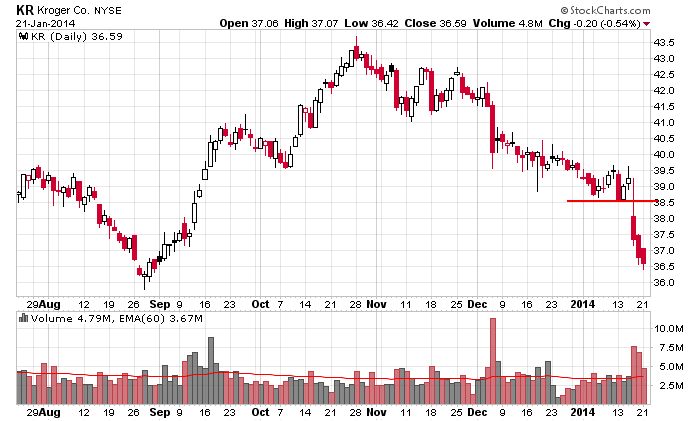

KR – broke down last week.

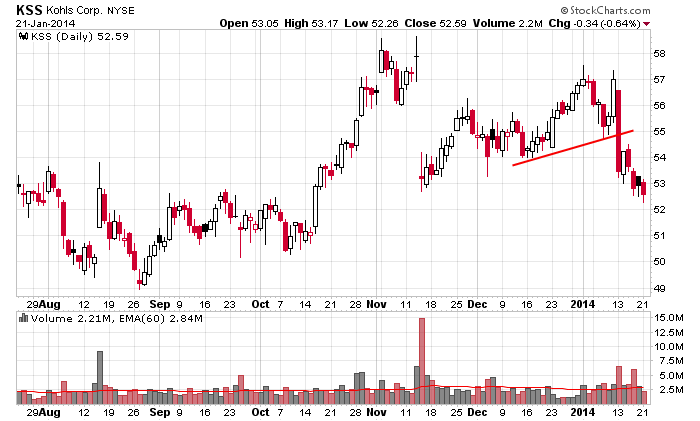

KSS – broke support and is now at a 3-month low.

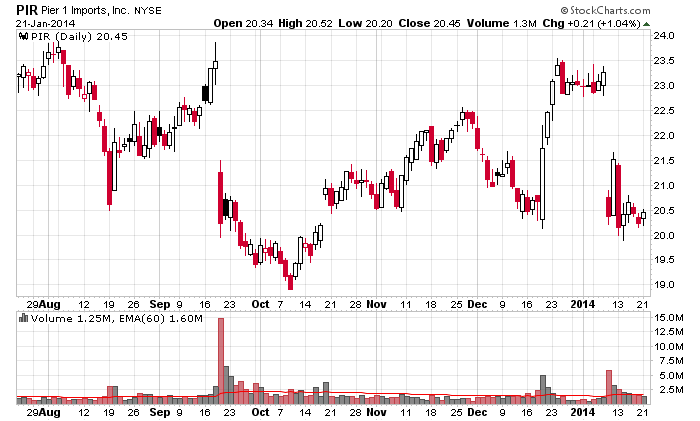

PIR – took a big dump.

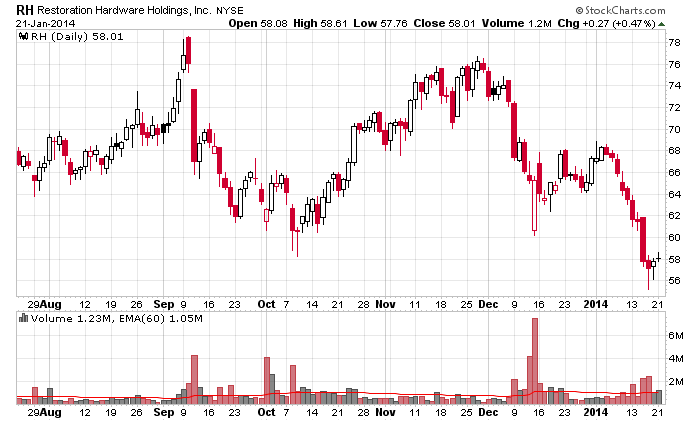

RH – doubled in 2013 but has since given half the gains back.

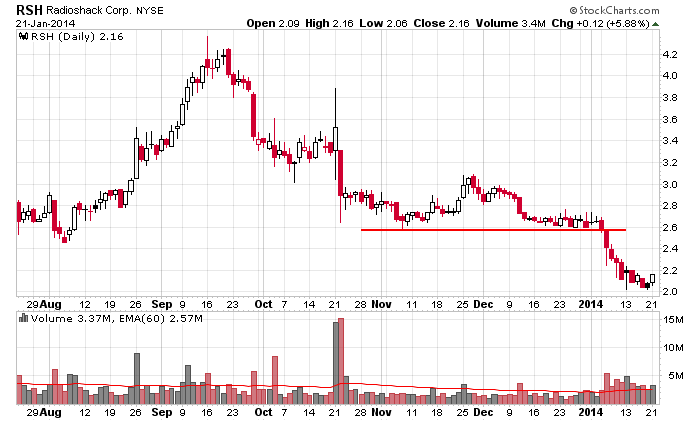

RSH – they’re still in business?

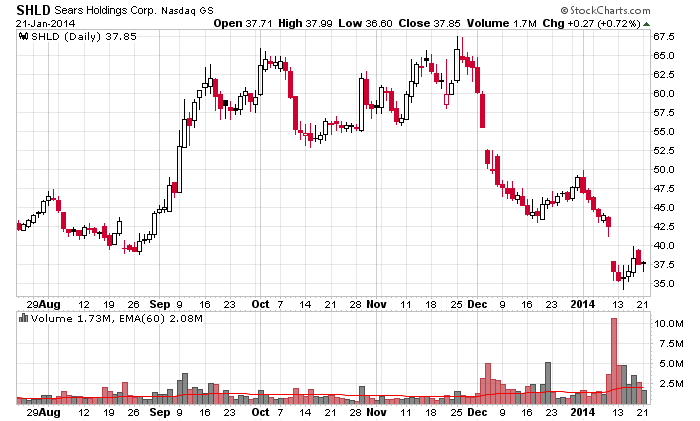

SHLD – is manic depressant. Big moves up, big moves down…currently near a 2-year low.

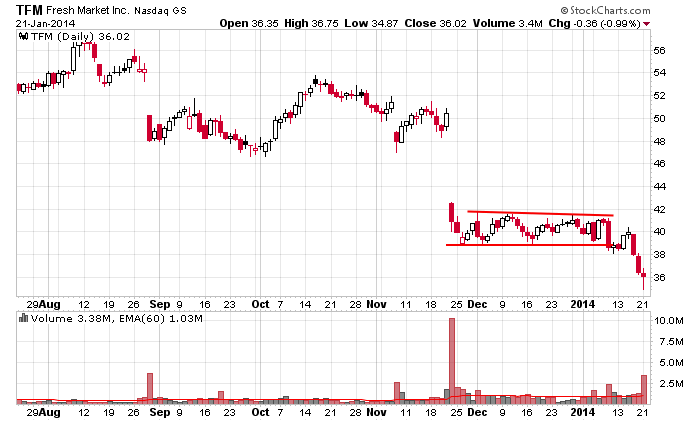

TFM – it’s following Whole Foods down.

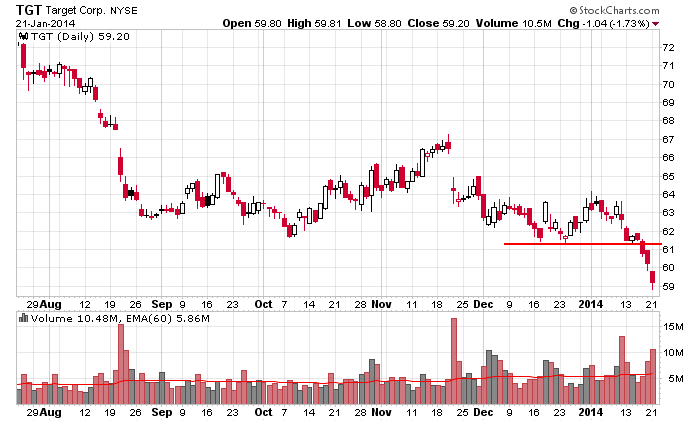

TGT – their credit card problems are covering up the fact that the stock has been struggle for a while.

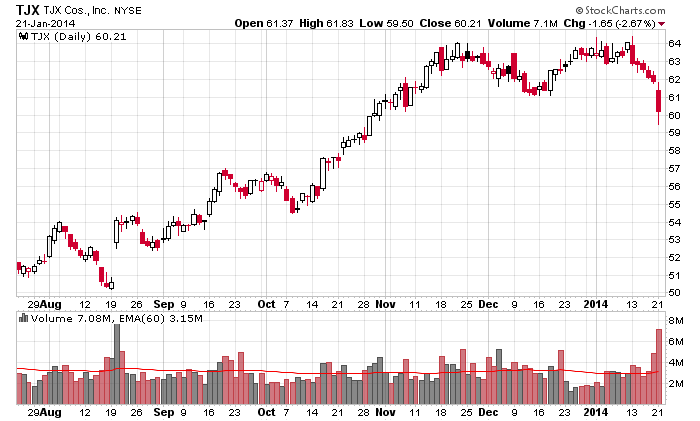

TJX – new high got sold into…now it’s made a lower low.

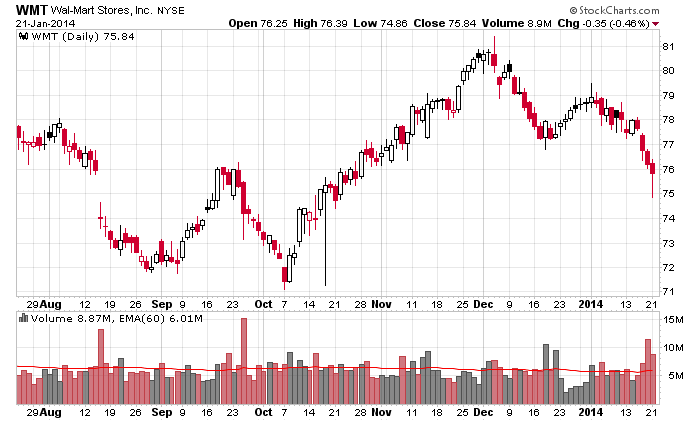

WMT – lower high, lower low.

It’s one thing when a specialty retailer struggles. It’s nother when Wal-Mart, Target, Dollar Tree, Dollar General, Kohl’s and TJX struggle. If that’s middle America, they’re in trouble.

0 thoughts on “The Warnings from the Retail Space Continue”

Leave a Reply

You must be logged in to post a comment.

healthcare costs and insurance have to hurting retail

Have you seen all the utter crap they are peddling in their stores? Any inkling of quality is gone. No wonder they are falling like rocks! Normal reaction to lousy products/sales.

This is usually a leading sector.

In an update to its “World Economic Outlook”, the IMF predicted global economic growth of 3.7 percent in 2014, up from the 3.6 percent growth forecast issued in October. It cited improving conditions in advanced economies for its upgrade. This is “happy talk” and is disgusting to see what they will do cover up the growing mess in the EU banks. Watch out for Putin’s Olympics show which could be a blood bath, and then think about the US Congress and the debt ceiling. Still in the indexes with 5% stops.

The US earnings failures are becoming a powerful drag on the market. The blue chips are hanging on or declining; is it the beginning of the end for the common stocks?

Exactly where is Australia?