Good morning. Happy Friday. Happy Employment Numbers Day.

The Asian/Pacific markets closed up across the board. Hong Kong, Indonesia, Japan and Taiwan led the way. Europe is currently mostly up. Norway rallied 1.4%; Austria also did well. Most gains are small. Futures here in the States point towards a moderate gap up open for the cash market, but this is likely to change when the employment numbers are released.

The dollar is up. Oil is down, copper is up. Gold is up, silver is down.

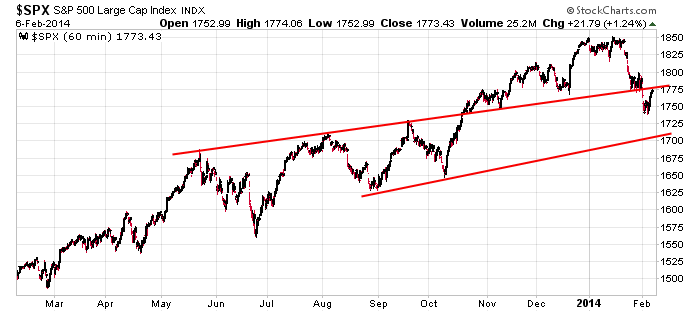

The S&P has rallied right back to the former support level. Funny how the market magically moves to a key level into an important announcement.

Here are the employment numbers…

unemployment rate: 6.6% (was 6.7% last month)

nonfarm payrolls: +113K

private payrolls:

average workweek: flat at 34.4

hourly wages: up 5 cents to $24.21

labor participation rate drops to 63.0%

The market’s initial knee-jerk reaction was down (S&P futures dropped about 15), but it has re-captured about half the losses.

The numbers aren’t great, but the unemployment rate (which I’ve said many times involves some funny math and some impossible-to-quantify variables) dropped closer to the Fed’s magical 6.5% level. More likely than not this will continue the tapering process, but there will be another report next month before the next Fed meeting.

The market is in no-man’s land. It fell a bunch and then rallied back some. My overall bias remains to the downside. Near term though, I still think 1800 is doable for the S&P.

Stock headlines from barchart.com…

Moody’s (MCO +2.98%) reported Q4 EPS of 85 cents, higher than consensus of 76 cents.

Towers Watson (TW -8.25%) was upgraded to ‘Overweight’ from ‘Neutral’ at JPMorgan.

Cigna (CI +0.35%) reported Q4 EPS of $1.39, below consensus of $1.49.

AOL (AOL -0.88%) was downgraded to ‘Neutral’ from ‘Buy’ at BofA/Merrill.

Fitch Ratings said it has downgraded the long-term ratings of McKesson (MCK +2.24%) , including the long-term Issuer Default Rating, to ‘BBB+’ from ‘A-‘

WellCare (WCG -0.40%) signed a contract to provide medicaid services to Medicaid recipients in eight Florida regions as part of the state’s Managed Medical Assistance program.

Illinois Tool Works (ITW +0.68%) announced that it will sell its Industrial Packaging Segment to The Carlyle Group (CG +4.81%) for $3.2 billion.

Republic Services (RSG +1.01%) reported Q4 adjusted EPS of 53 cents, better than consensus of 46 cents.

ON Semiconductor (ONNN +2.59%) reported Q4 EPS of 17 cents, better than consensus of 14 cents.

News Corp. (NWSA +2.63%) rose 2% in European trading ater it reported Q2 adjusted EPS of 31 cents, well ahead of consensus of 20 cents.

Activision Blizzard (ATVI +1.66%) climbed 8% in after-hours trading after it reported Q4 adjusted EPS of 79 cents, stronger than consensus of 73 cents.

LinkedIn (LNKD +4.24%) slid over 8% in after-hours trading after it reported Q4 adjusted EPS of 39 cents, higher than consensus of 38 cents, but then lowered guidance on its fiscal 2014 revenue estimate to $2.02 billion-$2.05 billion, below consensus of $2.16 billion.

Expedia (EXPE +1.89%) jumped 13% in after-hours trading after it reported Q4 EPS of 92 cents, better than consensus of 86 cents.

Lionsgate (LGF +3.42%) reported Q3 adjusted EPS of 70 cents, well above consensus of 44 cents.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

8:30 Non-farm payrolls

3:00 PM Consumer Credit

Notable earnings before today’s open: APO, AXL, BPL, CBOE, CI, FLIR, GSM, IMN, LH, LQDT, MCO, MSG, MT, SIRO, UFS, WYN

Notable earnings after today’s close: CCJ

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Feb 7)”

Leave a Reply

You must be logged in to post a comment.

The market does not like the trend in NFP. The participation rate, and unemployment are also confirmation of poor economic performance: workers are giving up on finding jobs and leaving the marketplace. Some bonds are probably OK, maybe some G Maes and short term bonds. I am holding the indexes, and still short via some puts. What is next? Up for a while, then a correction of some sort. What is new, not a hell of a lot. AAPL thinks its stock is cheap and is buying. What is an ICard?

BLS has spoken. Whidbey and I agree as to interpretation of the numbers.

Futures performed their typical gyrations. Went to +20 initially which is huge and typical for the non-farm report.

Here’s what I see. Market put in a low on Monday. Target based on that level is quite large, near 1900, which will be validated when / if SPX can take out 1807-1808. Before that, it needs to take out last Friday afternoon’s high around 1794. Requires a big move from yesterday’s close.

When/if SPX breaks those levels, look for a subsequent pullback, which will provide a low risk Long entry. Or you can Short on a sell signal when those levels are breached, then reverse Long when the pullback level is reached. That’s a few trading days away. I’ll provide further info as we (if we) get there. I think we will, but I’ve been known to be wrong.

For today, at this moment, futures are up. They might run down to close yesterday’s gap at 1773.50, which would be normal, but if they go much below 1770, something unusual is happening and all I said is out the window.

Have a nice weekend.

At 9:15 futures are +10.50

up-down-up

now i’ve said my wave 2 abc