Good morning. Happy Thursday.

The Asian/Pacific markets closed mostly up. Australia, Indonesia, Singapore and South Korea rallied nicely. Europe is up across the board. Belgium, France, Germany, Stockholm, Switzerland, London, Italy, Spain, Greece and the Czech Republic are posting solid gains. Futures here in the States point towards a moderate gap up open for the cash market.

The dollar is up. Oil and copper are up. Gold and silver are up.

Twitter (TWTR) had earnings yesterday after the close. Their financials were pretty good, but Wall St. is not happy about their lack of ability to sign up new people and keep them. They’re a social network whose growth has slowed – not good. Wall St. is punishing the stock right now; it’s down 22% in premarket trading.

Coke (KO) is taking a 10% stake in Green Mountain (GMCR), which is up 42% before the open.

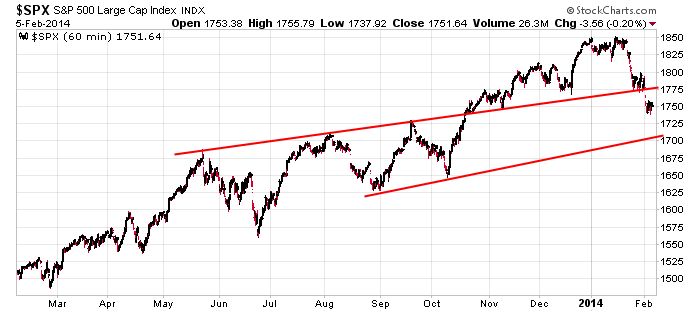

The market got clobbered Monday…rallied Tuesday…closed down yesterday but well off its low. I stated yesterday during the day I could sense some short term strength and was encouraged with the market’s ability to bounce off intraday lows. I still believe this. Overall I think lower prices are coming (my first target (1750) has been hit, next target is 1710 per the chart below), but in the near term, the path of least resistance is up.

Employment numbers come out tomorrow 60 minutes before the open.

Stock headlines from barchart.com…

Aetna (AET +1.50%) reported Q4 EPS of $1.34, below consensus of $1.36.

O’Reilly Automotive (ORLY +0.05%) reported Q4 EPS of $1.40, higher than consensus of $1.34.

Assurant (AIZ +0.74%) reported Q4 operating EPS of $1.42, better than consensus of $1.41.

Green Mountain (GMCR +0.92%) soared over 40% in after-hours trading after Coca-Cola (KO +0.35%) said it will buy a 10% stake in the company for $1.25 billion.

Everest Re (RE +0.11%) reported Q4 EPS ex-items of $6.28, well above consensus of $4.97.

Con-way (CNW -0.51%) reported Q4 adjusted EPS of 23 cents, stronger than consensus of 21 cents.

Standard Pacific (SPF +0.12%) reported Q4 EPS of 16 cents, higher than consensus of 14 cents.

CBRE Group (CBG -0.22%) reported Q4 adjusted EPS of 67 cents, better than consensus of 66 cents.

Disney (DIS +1.00%) rose nearly 4% in pre-market trading after it reported Q1 EPS ex-items of $1.04, well ahead of consensus of 92 cents.

Brookdale Senior Living (BKD +0.60%) reported a Q4 EPS loss of -1 cents, worse than consensus of a 2 cent gain.

Mettler-Toledo (MTD -0.82%) reported Q4 adjusted EPS of $3.82, better than consensus of $3.74.

Allstate (ALL -0.70%) reported Q4 EPS of $1.76, well above consensus of $1.38.

Prudential (PRU +0.24%) reported Q4 EPS of $2.20, weaker than consensus of $2.23.

Akamai (AKAM +2.00%) reported Q4 adjusted EPS of 55 cents, higher than consensus of 52 cents.

Twitter (TWTR -0.53%) reported Q4 EPS of 2 cents, better than consensus of a -2 cent loss and then said it sees 2014 revenue of $1.15 billion-$1.2 billion, above consensus $1.13 billion.

Cincinnati Financial (CINF -0.32%) reported Q4 EPS of 74 cents, better than consensus of 69 cents.

Fiserv FISV reported Q4 EPS of 79 cents, below consensus of 81 cents.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

Chain Store Sales

7:30 Challenger Job-Cut Report

8:30 International Trade

8:30 Initial Jobless Claims

8:30 Productivity and Costs

9:45 Bloomberg Consumer Comfort Index

10:30 EIA Natural Gas Inventory

4:30 PM Money Supply

4:30 PM Fed Balance Sheet

Notable earnings before today’s open: AAP, ADS, AET, AINV, ALR, AMAG, AMSC, AOL, AZN, BCE, BDC, BR, CFX, CMI, CS, CSL, DNKN, DO, EXC, FLO, FOXA, GBDC, GM, GPK, HCLP,HERO, HLSS, INGR, IT, K, KKR, MDSO, MMS, MNK, MPW, MSCI, MWIV, MWW, NBL, NGD, NILE, NJR, NU, NUS, NVDQ, NYT, ODFL, OZM, PENN, PPL,PRGO, PTEN, RFP, RSTI, SALE, SBH, SEE, SIAL, SMG, SNA, SNE, SPH, SPR, TDC, TEVA, TW, USG, VMC, WEC

Notable earnings after today’s close: AAN, ACET, ADNC, AIV, ASYS, ATHN, ATVI, AVNW, BEBE, BKH, BRKS, BYI, CATM, DCT, ECHO, ECOM, EGOV, ELON, ENH, EXPE, FET, FTI, FWM, G, HME,IMPV, LCI, LGF, LNKD, LSCC, MITK, NBIX, NCR, NFG, NTGR, NUAN, ONNN, OPEN, OUTR, PDM, PM, RSG, SREV, THRX, TPX, UBNT, VRSN, WWWW

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Feb 6)”

Leave a Reply

You must be logged in to post a comment.

FTC down. Tomorrow matters most.

While I was gone, the markets broke all support I had delineated.

As a result, there’s a ton more of resistance overhead in addition to that which existed last week, so until it is taken out, we will head lower.

Futures had a bullish night (+9.50), but the reaction to the weekly baloney from BLS has been mediocre (futures melted to a mere +.25).

Bulls need to take out yesterday’s high (1755.6) and then some — they need to take out 1762. If, on the other hand, 1762 holds, bears will be targeting 1727.

Today could be all about positioning because the traders are waiting for the BS that comes from BLS tomorrow at 830.

Futures now +4.50

i am looseing my bullish tendencies from y/day and have now a big furry tail and cats eyes

but i dont feel very alive

perhaps i am dead