Good morning. Happy Tuesday.

The Asian/Pacific markets closed up across-the-board. Hong Kong and Japan rallied 1.8%; China also did well. Europe is currently up across-the-board. Austria, Germany and Stockholm are up more than 1%; Belgium, France, London and the Czech Republic are also doing well. Futures here in the States point towards a moderate gap up open for the cash market.

The dollar is down. Oil is up, copper is down. Gold and silver are up.

Janet Yellen appears before the House Financial Services Committee today. Her prepared remarks will be released at 8:30 am, and she’ll do a question and answer session at 10:00 am. This is her first such appearance since taking over as Fed Chair. Wall St. will be watching and listening for not only policy clues but also personality traits that may hint at the kind of Fed we’ll be dealing with for the next couple years.

If you’re a day trader, know that at any time the market could quickly move regardless of the technicals.

Yellen then speaks on Thursday in front of the Senate Banking Committee.

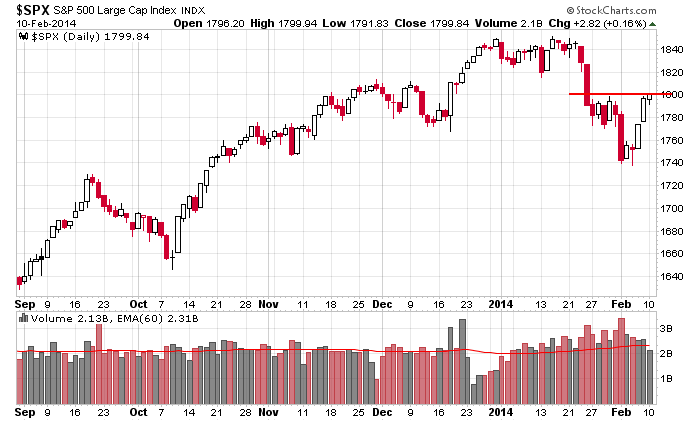

Here’s a simple S&P 500 daily chart. The index has recaptured about half the drop off its high and now sits right at 1800 (although futures suggest it’ll open about 6 points above this level). This is a perfectly normal bounce (from a technical standpoint). If the next move is to be up, the bulls need to step up and push price up further. A drop here may begin the next round of selling pressure. Keep level here.

Stock headlines from barchart.com…

Regeneron Pharmaceuticals (REGN +1.40%) reported Q4 EPS of $2,24, better than consensus of $2.09.

IntercontinentalExchange Group (ICE -1.59%) reported Q4 EPS of $1.58, well below consensus of $1.95.

CVS Caremark (CVS +0.75%) reported Q4 EPS of $1.12, highe than consensus of $1.11.

Reynolds American (RAI +0.10%) reported Q4 EPS of 77 cents, weaker than consensus of 80 cents.

General Motors (GM -3.35%) gained 1% in European trading after the automaker reported that its China Jan auto sales jumped +12% to a record 348,061 units.

Owens & Minor (OMI +1.20%) reported Q4 adjusted EPS of 52 cents, better than consensus of 49 cents.

Masco (MAS -1.45%) reported Q4 EPS of 15 cents, below consensus of 16 cents.

Yacktman Asset reported 5.5% passive stake in Sysco (SYY -0.34%) .

Talisman Group reported a 15.61% stake in Endeavour (END +2.04%) .

Vanguard reported a 5.79% passive stake in Align Technology (ALGN -0.04%) .

Amkor Technology (AMKR +2.50%) reported Q4 EPS of 18 cents, higher than consensus of 14 cents

Molina Healthcare (MOH -0.80%) reported a Q4 EPS loss of -20 cents, a much bigger loss than consensus of -4 cents.

Ionic Capital reported a 5.07% passive stake in GenCorp (GY -0.95%) .

T. Rowe Price reported a 7.2% passive stake in Array BioPharma (ARRY +6.78%) .

Nuance (NUAN +0.25%) reported Q1 adjusted EPS of 24 cents, better than consensus of 21 cents.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

7:30 NFIB Small Business Optimism Index

7:45 ICSC Retail Store Sales

8:55 Redbook Chain Store Sales

10:00 Wholesale Trade

1:00 PM Results of $30B, 3-Year Note Auction

Notable earnings before today’s open: ALLT, CBM, CVS, DF, DWRE, ETR, GWR, HCP, HNT, HSIC, HUN, ICE, IR, LGND, LPLA, MGI, MMC, MOS, NNN, OMC, PCG, PRLB, RAI, REGN, SCOR, SPAR, TGH, ZTS

Notable earnings after today’s close: ACGL, ANDE, BDE, CALX, CEB, CNVR, CRL, CSOD, CUTR, CVA, DIOD, DVA, EEFT, EGN, FEYE, FOSL, FRT, HTS, JIVE, MKTO, MRIN, MX, PHH, PKG, PL, QDEL, RLOC, RPXC, SCI, SGEN, SGMO, SKT, SSNC, TRIP, TRMB, TWTC, VSAT, WSH, WU

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Feb 11)”

Leave a Reply

You must be logged in to post a comment.

Yellen’s statement could have been written by Bernanke: nothing new, no policy changes. Just more of the same with no idea how to clear the balance sheet. The economists say let the bonds mature, no more taper needed. Chronic suicide

By my models of price and volume I suspect that somewhere 1821 is the top of the B point in an ABC down in the SNP. The comps looks strong but could top 4193. I think a correction is near but the uptrend is not yet dead maybe 150 Dow pts to the edge. The debt ceiling pressures could be disruptive, better known as short run bankruptcy. Some gold miners are looking stronger, but its not clear where they want to go. Maybe up. China still a strong buyer of gold – internal problems it appears. Eyeballing GDXJ and AEM, silver ? SRRI maybe. Still holding puts and the indexes.

Futures overnight is the big story.

They broke the layer of resistance that runs from 1794 thru 1808 I’ve been yapping about.

Futures reached +9.50, but since then, they’ve melted significantly (Yellen’s remarks created a gyration at 830 when her remarks were released).

So, what to watch: bulls are in the process of pulling back to 1800 which is near term support. If they let the bears push them below 1798, the bears can take this lower to about the mid 1770s.

This action should happen after the opening bell.

If bulls succeed in holding 1800 -1798, they will target 1810-1813.

Futures at 9 am +1.50.

my dead cats –gruesome ans awesome now have arthritis after 4 days of little volume

and tell me that fantasy PONSIES find it hard to hold they selfs upright after 4 days in a bear trend

if have now changed sides and am a teddy bear