Good morning. Happy Wednesday.

The Asian/Pacific markets closed up across-the-board. Australia, Hong Kong and Taiwan rallied more than 1%. Europe is currently mostly up. Italy and Greece are leading while Germany and Czech Republic are also doing well. Futures here in the States point towards a flat open for the cash market.

The dollar is up. Oil and copper are up. Gold is flat, silver is up.

The S&P tacked on another 20 points yesterday and is now about 80 points off its low from late last week.

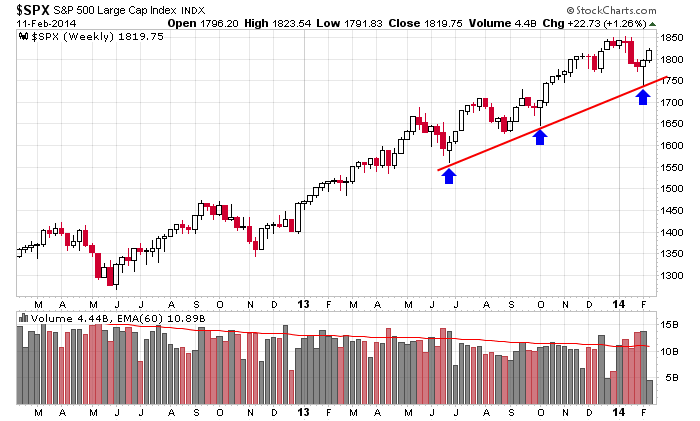

I posted this weekly chart last week as a reminder to not get overly bearish…that the long term trend was still up and last week’s bottoming candle was no different than previous bottoming candles.

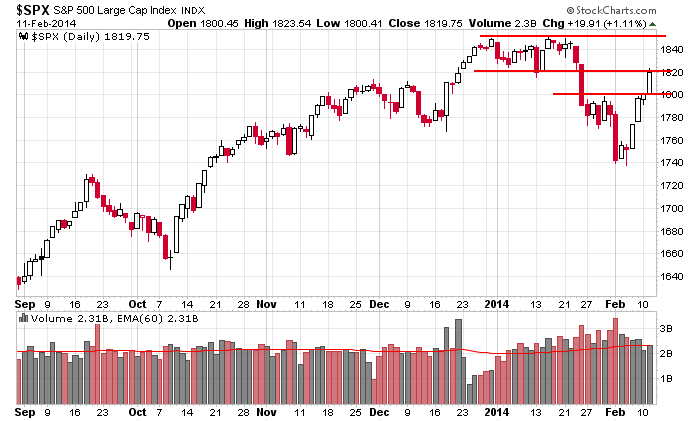

Zooming in with the daily, 1800 was easily taken out. Now the index is up against 1820.

If I had to bet, I’d say today will be a slow, range-bound day. Yesterday Yellen appeared before the House Financial Services Committee; today she goes before the Senate Banking Committee. After yesterday’s big rally, a rest is needed and well-deserved. More after the open.

Stock headlines from barchart.com…

Lorillard (LO +1.01%) reported Q4 EPS of 82 cents, below consensus of 85 cents.

Valspar (VAL -0.21%) reported Q1 adjusted EPS of 70 cents, better than consensus of 66 cents.

Deere (DE +0.11%) reported Q1 EPS of $1.81, well above consensus of $1.53.

Packaging (PKG +0.06%) reported Q4 ex-items EPS of $1.04, stronger than consensus of 89 cents.

Willis Group (WSH +1.26%) reported Q4 adjusted EPS of 42 cents, weaker than consensus of 49 cents.

Procter & Gamble (PG +1.04%) said it expects an 8 cent-10 cent a share charge due to the devaluation of Venezuela’s currency.

Midcoast Energy (MEP +1.01%) reported Q4 EPS of 6 cents, well below consensus of 16 cents.

Senior Housing (SNH -1.09%) was downgraded to ‘Sell’ from ‘Neutral’ at UBS.

Service (SCI +0.34%) reported Q4 EPS ex-items of 27 cents, higher than consensus of 24 cents.

Fossil (FOSL +1.70%) jumped 6% in after-hours trading after it reported Q4 EPS of $2.68, stronger than consensus of $2.43.

DaVita (DVA +0.77%) reported Q4 adjusted EPS of $1.10, above consensus of 98 cents.

Andersons (ANDE +0.97%) reported Q4 EPS of $1.08, well below consensus of $1.61 as Q4 revenue was $1.6 billion, lower than consensus of $1.74 billion.

Team Health (TMH -1.73%) reported Q4 adjusted EPS of 46 cents, better than consensus of 44 cents.

Western Union (WU +1.53%) fell 3% in after-hours trading after it reported Q4 EPS of 31 cents, below consensus of 32 cents.

Intuit (INTU +1.78%) fell 2% in after-hours trading after it lowered guidance on Q2 EPS to 1 cent-2 cents, well below consensus of 26 cents.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

7:00 MBA Mortgage Applications

10:30 EIA Petroleum Inventories

1:00 PM Results of $24B, 10-Year Bond Auction

2:00 PM Treasury Budget

Notable earnings before today’s open: AAWW, AB, ACCO, ANR, BGCP, COT, CSTE, CYNO, DE, DPS, EZCH, HSP, INCY, LO, MSA, OC, PNK, RCI, SBGI, SPW, TLM, TMHC, TRI, VAL, VG, VICL, VOYA, WCG

Notable earnings after today’s close: ACC, AEM, AMAT, ANGI, BGC, BGS, CAKE, CBS, CJES, CSCO, CTL, CTRP, CXW, DDR, ECOL, EFX, EXL, FNF, INT, IO, IPI, ITRI, KGC, LF, LPSN, MDLZ, MET, NEWP, NRP, NTAP, NTES, NVDA, REG, RKUS, ROVI, SKX, SPRT, SPWR, STAG, TAL, TCO, TNGO, WFM, Z

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Feb 12)”

Leave a Reply

You must be logged in to post a comment.

Why the rally on the 11th, perception that the Fed is easy and accommodative – very little that Yellen did not endorse or hope for that affects investors, governments, and banks. She thinks deflation is not an issue. She is wrong. In reality we may have topped the equities this month (within 100 points?), and deflation can come anytime, probably out of the EU banking system. The Fed’s international obligations are eternal, but never discussed openly. China says their imports rose, maybe; lots of fudging to get money into China’s black market banking. Caution is probably the best policy, the enthusiasm of the pro traders should not mislead the retail investor to do much – but buy some puts. Four days of wild buying is enough. Avoid Atlanta, we were refused tickets by Delta due to weather.

Overnight futures have bounced from a level equivalent to SPX 1817 and presently are at the same level as Tues’ close. If that bounce holds, they will be targeting 1828.

However. There are several levels of support which Tuesday’s run generated. The easiest way to put it is to say it would not be bearish for them to pull back even all the way to 1800.

Based on the support made at 2/5’s lo, expect them to be targeting SPX 1900.

Overnight range: +5.50 to -1. Now +2.50