Good morning. Happy Friday.

The Asian/Pacific markets closed mostly up. Japan dropped 1.5%; China, Australia, India and South Korea did well. Europe is mostly up. Italy, Germany, Russia, Belgium and the Czech Republic are leading. Futures here in the States point towards a flat open for the cash market.

The dollar is down. Oil is down, copper up. Gold and silver are up.

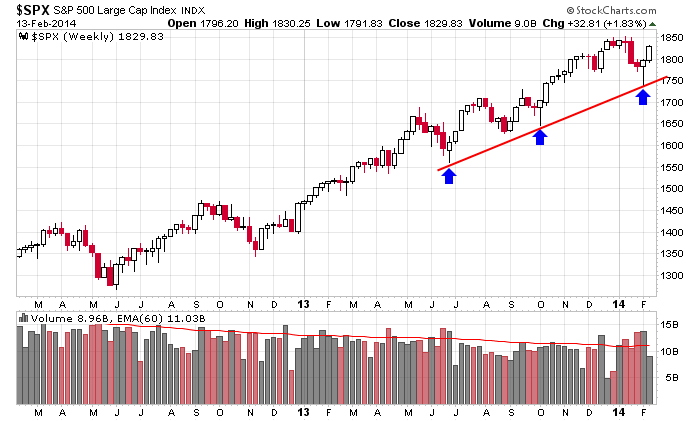

There are two big stories right now. 1) The market keeps going and going and going. I’m not surprised. Way back on Feb 4, the day after the market suffered one of its worst down days of the last year, I stated rallies often last long and go further than anyone expects…it happens because so few people think it’s possible. Here we are a week later, and sure enough the rally has gone much further than what would be considered a normal bounce within a downtrend. But now that the market has rallied so much, the trend is no longer down. Here’s the weekly S&P. The index is following last week’s big reversal candle with a solid gain so far this week. Hopefully you weren’t trapped short. I stated early last week the path of least resistance in the near term was up.

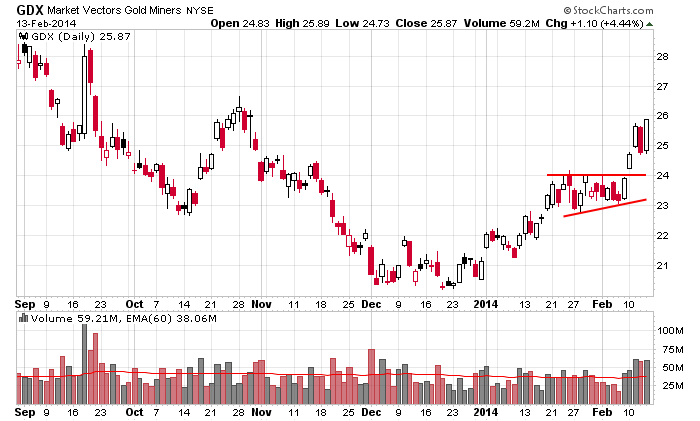

The other big story is gold and silver. I started posting gold set ups on the Long List two weeks ago, and this continued this past weekend. Gold and silver are on fire right now. They are the market’s strongest groups. Here’s GDX.

After completely ignoring gold and silver for a couple years, they’ve provided some really nice trading opps the last two weeks.

3-day weekend coming up…the market is closed Monday for Washington’s birthday.

Stock headlines from barchart.com…

Campbell Soup (CPB +0.27%) reported Q2 EPS of 76 cents, higher than consensus of 73 cents.

Scripps Networks Interactive (SNI -0.50%) reported Q4 EPS of 90 cents, below consensus of 97 cents.

Mattel (MAT +0.73%) was downgraded to ‘Hold’ from ‘Buy’ at Argus.

JM Smucker (SJM +1.53%) reported Q3 EPS of $1.66, below consensus of $1.68.

Bloomberg reported that a Tesla Model S (TSLA +2.21%) caught fire while sitting in a Toronto garage earlier this month that was about four months old and not plugged in to an electric socket.

Cliffs Natural (CLF -0.41%) reported Q4 adjusted EPS of $1.22, well ahead of consensus of 79 cents.

SunPower (SPWR +4.97%) announced a three-year agreement to offer high efficiency SunPower solar power systems at Meritage Homes communities nationwide.

GNC Holdings (GNC +0.42%) slid 14% in after-hours trading after it reported Q4 adjusted EPS of 63 cents, below consensus of 64 cents.

Cray (CRAY -0.07%) reported Q4 EPS of $1.48, better than consensus of $1.36.

United Stationers (USTR +1.55%) reported Q4 adjusted EPS of 86 cents, higher than consensus of 81 cents.

Agilent (A +0.32%) reported Q1 EPS of 67 cents, better than consensus of 66 cents.

Brocade (BRCD +1.40%) reported Q1 EPS of 24 cents, stronger than consensus of 20 cents.

Regal Entertainment (RGC -0.10%) reported Q4 adjusted EPS of 17 cents, below consensus of 25 cents.

AIG (AIG +1.12%) gained 3% in after-hours trading after it reported Q4 EPS of $1.15, well above consensus of 96 cents.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

8:30 Import/Export Prices

9:15 Industrial Production

9:55 Reuters/UofM Consumer Sentiment

Notable earnings before today’s open: ALE, BAM, COTY, CPB, DTE, ENB, H, IPG, IPGP, ITT, LECO, LPNT, POR, RRGB, SJM, SNI, TRW, VFC, VTR

Notable earnings after today’s close: none

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Feb 14)”

Leave a Reply

You must be logged in to post a comment.

not saying it will hapen

if the world can produce lower highs to the so called tops by next weeks opts ex

then a 87 or 29 crash can happen

if we get new highs all over then a broadening jaws of death will eat the bull

and a crash for 10 years

be willing to be a bear

Thurs was an ideal case for buying the open. Support was there. Blindly buying the open on gaps down or selling the open on gaps up can mutilate your account unless support/resistance is there to validate your plan.

For today: futures pulled back overnight quite a bit (-8) and their reaction to the 830 numbers was initially positive but there are some gyrations going on which cloud the picture.

They could drop after the open to tap support at 1825. If they go below 1821, that support is negated.

If they hold that support or if they start up from the open, they are targeting 1834-5 as I said yesterday.

Long term, target still 1900.

Futures now: -0.25

See ya Tues morning.

1835

well done Mike

its holding just under pit trader poviot R1 ,which is 1836.98

Tks. Was away for a while.

They’re overachievers today. Have to admit, I did not expect a climb of this magnitude so soon after hitting the short term target.

all is now completely obvious in hindsight

the nas 100 has now peaked in a 5 wave structure new high to complete its wave 1

spx and dji have come along for the ride and have just completed their corrective lower high wave 2

we may consolodate for a while before next week opts ex crash to zero

Well, I’m not THAT bearish on the market, and still am expecting higher prices. BUT. In case I’m wrong, I am always hedged. Am sure you are too.

is gold telling us the age of the bear is coming with high bond interest rates

how are the currency wars going

Jason could be right on the trend , but look at the volume carefully: rising prices on low volume says it will not last. The debt ceiling is interesting, if it gets done the debt burden is still there. Then look at the Nikkei. The EU says things are looking up, but our ongoing visit to see EU investors says they are reluctant by into our projects. I am seeing possible disinflation/deflation fears. Holding the index, particularly VHT and IBB, dividends and keeping the put options contracts. What do I fear? Things like topping action, the VIX and the Fed. Not much, but caution is my preference this month. The 1916 elections are near and the upheaval could be important to investors.