Good morning. Happy Thursday.

The Asian/Pacific markets closed mostly down. India and Japan dropped more than 1%; Hong Kong, China, Malaysia, South Korea and Taiwan also fell. Europe is currently mostly down. Italy and Spain are down more than 1%. London, Norway, Stockholm, Switzerland and Russia are down noticeably. Futures here in the States point towards a big gap down open for the cash market (about 10 S&P points).

The dollar is down. Oil and copper are down. Gold is down, silver is flat.

Snow on the East Coast is delaying Janet Yellen’s appearance before the Senate Banking Committee…not sure yet when she’ll be rescheduled.

Comcast is buying Time Warner. Less competition means higher prices, but Washington will have to OK this…not a given considering how big the companies are.

The S&P has rallied 80 points off its low in one week. Now things get tougher because 1) there’s a block of resistance sitting overhead in the form of traders who bought near the high and have been desperately hoping for a chance to get out even and because 2) the market has already moved up so much. It’s not easy building gains on top of gains.

The charts look much better than they did a week ago.

Chart of individual stocks also look better…although they aren’t exactly flashing an “all clear” sign.

Several indicators turned the corner and are now supporting more upside…others are trying.

Overall I’d say things are improved and the bears are again nervous, but for me to believe much more upside is coming, I’d like to see the indexes successfully do some backing and filling. The indexes practically went straight down and then straight up. They could go straight down again. I’d like to see enthusiastic buying after a break to prove the recent rally wasn’t just a one-time squeeze.

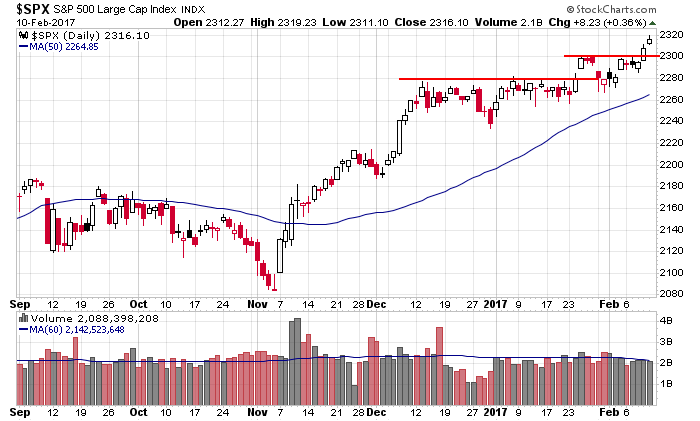

Here’s the S&P daily. Resistance sits between 1820 and 1850…and there should be some support down at 1800.

Stock headlines from barchart.com…

Molson Coors Brewing (TAP -0.36%) reported Q4 EPS of 68 cents, weaker than consensus of 72 cents.

Starwood Hotels & Resorts Worldwide (HOT +0.43%) reported Q4 EPS of 73 cents, better than consensus of 70 cents.

PepsiCo (PEP +0.30%) reported Q4 EPS of $1.05, stronger than consensus of $1.00.

Time Warner Cable (TWC +0.30%) jumped 13% in pre-market trading after Comcast agreed to buy the company for about $45.2 billion in stock.

General Cable (BGC +0.73%) reported Q4 EPS of 27 cents, weaker than consensus of 29 cents.

Apache (APA -0.12%) sold its Argentina operations to YPF Sociedad (YPF +6.12%) for $852 million.

CenturyLink (CTL +1.55%) reported Q4 adjusted EPS of 68 cents, better than consensus of 59 cents.

NVIDIA (NVDA +3.57%) reported Q4 adjusted EPS of 32 cents, well ahead of consensus of 18 cents.

MetLife (MET +0.24%) reported Q4 operating EPS of $1.37, better than consensus of $1.30.

SunPower (SPWR +1.61%) reported Q4 adjusted EPS of 47 cents, well above consensus of 28 cents.

Insight Enterprises (NSIT +0.43%) reported Q4 EPS of 57 cents, stronger than consensus of 53 cents.

Whole Foods Markets (WFM -0.75%) fell over 7% in after-hours trading after it reported Q1 EPS of 42 cents, lower than consensus of 44 cents, and then lowered guidance on fiscal 2014 EPS view to $1.58-$1.65, below consensus of $1.68.

Cisco (CSCO +0.62%) fell nearly 4% in after-hours trading after it reported Q2 adjusted EPS of 47 cents, higher than consensus of 46 cents, but said revenue in the current quarter will be $11.2 billion to $11.5 billion, at the low end of consensus of $11.3 billion.

Applied Materials (AMAT +0.73%) reported Q1 adjusted EPS of 23 cents, better than consensus of 22 cents.

NetApp (NTAP -2.52%) reported Q3 EPS of 75 cents, higher than consensus of 71 cents.

CBS (CBS +1.56%) rose 2% in after-hours trading after it reported Q4 adjusted EPS of 78 cents, better than consensus of 76 cents.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

8:30 Retail Sales

8:30 Initial Jobless Claims

9:45 Bloomberg Consumer Comfort Index

10:00 Business Inventories

10:30 Yellen delivers semi-annual monetary policy testimony (Postponed)

10:30 EIA Natural Gas Inventory

1:00 PM Results of $16B, 30-Year Note Auction

4:30 PM Money Supply

4:30 PM Fed Balance Sheet

Notable earnings before today’s open: ABB, ABX, ACOR, AFSI, APA, ASPS, AVP, BBW, BG, BKW, BWA, CAB, COR, CPN, CRNT, CVE, DBD, DISCA, ECA, EQM, EQT, FAF, GG, GNC, GNRC, GT, HIMX, HOT, IFF, JAH, LPX, LYG, MFA, MFC, MPEL, NGLS, NLSN, NTWK, O, OAK, OMG, ONE, ORB, OWW, PAG, PDS, PEP, PES, PVR, Q, RTIX, SHPG, SKYW, SON, STC, SYNT, TAP, TCK, TRGT, VNDA, VNTV, WBC, WSO

Notable earnings after today’s close: A, AIG, ALNY, ALSN, BRCD, CGNX, CLD, CLF, CRAY, ELLI, ENOC, GRT, IM, JCOM, KEG, KONA, KRFT, LBTYA, LLNW, LOGM, MASI, MOVE, NR, RATE, RGC, SAAS, STMP, TRLA, WOOF, WRI, WTW

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Feb 13)”

Leave a Reply

You must be logged in to post a comment.

Weakness in consumer buying for second month. The indices, less NDX, in the US are losing volume, China has strange reports on its exports and imports. The EU is ignoring weakness in PIIGS. But the debt ceiling went to vote in house,& is no opposition in the Senate, so debt levels do not matter – for now anyway.suspect today’s FTC report was unimportant – if anyone still cares. The market is topping out, best to be in cash or short for a time. The QQQs The Nas comp are last index showing any volume Pharma, tech, biotech, and maybe TimeWarner Comcast until FCC and DOJ rattle their merger plans.

The market did nothing yesterday in regards to correcting for the huge move prior. Overnight, we’ve gotten a nice pullback in the futures and the reaction to the 830 report is bullish. The reaction was to a layer of support at SPX 1808 equivalent. That support extends down to 1803. If it holds, they will target 1834-5. This is an “if….. then” call meaning if that support holds, then they’ll gun for it.

Surely we will gap down at the open, just watch to see if 1808 -1803 holds and take your cue accordingly.

Long term, target still at 1900.