Good morning. Happy Wednesday.

The Asian/Pacific markets closed mostly up. China, Indonesia and Singapore did well; Japan dropped. Europe is currently down across-the-board. Austria and Russia are down more than 1%; Switzerland, London and Germany are also down. Futures here in the States point towards a moderate gap down open for the cash market.

The dollar is flat. Oil is up, copper is flat. Gold and silver are down.

Yesterday the Dow and S&P traded quietly in a range while the Nas, small caps and mid caps trended up and posted decent gains for the day.

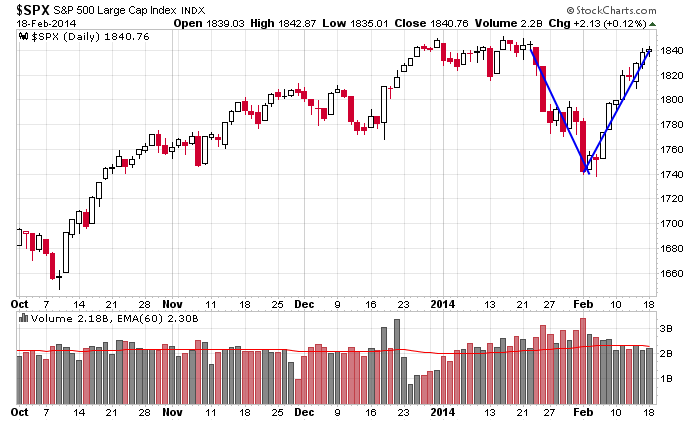

Here’s an update of the daily S&P. The index dropped 100 points in 8 days and then rallied 100 points in 8 days. Volume on the way up has been much lighter than on the way down – in fact other than the first two days, there have been no above-average volume days – and the index has moved up 7 of 8 days. A correction – either with time or a price decline – is due.

The trend is up, but in the very near term we have to be a little more conservative going long. A rest is due. The same stock patterns produces different results in different market environments. Today is different than two weeks ago. Overall I still like the upside and think the market will make new highs, but in the very near term, you have to expect at least a little chopping and churning before the next leg begins. More after the open.

Stock headlines from barchart.com…

Con-way (CNW -0.08%) was downgraded to ‘Hold’ from ‘Buy’ at Wunderlich.

Zale (ZLC -0.20%) surged over 40% in pre-market trading after it agreed to be acquired by Signet Jewelers for $1.4 billion or $21 per share.

Garmin (GRMN +2.37%) reported Q4 EPS of 76 cents, stronger than consensus of 62 cents.

Host Hotels & Resorts (HST -0.68%) reported Q4 EPS of 33 cents, better than consensus of 31 cents.

Crossroads (CRDS -1.27%) filed patent infringement suits against Cisco (CSCO -0.66%) , NetApp (NTAP -0.25%) and Quantum (QTM +4.35%) .

Forest Labs reported a 13.2% stake in Trevena (TRVN +0.87%) .

Oceaneering (OII +1.85%) reported Q4 EPS of 86 cents, better than consensus of 84 cents.

CF Industries (CF -2.36%) reported Q4 EPS of $5.71, well ahead of consensus of $4.49.

Panera Bread (PNRA -2.83%) reported Q4 EPS of $1.96, better than consensus of $1.94.

Herbalife (HLF +3.83%) gained 3% in after-hours trading after it reported Q4 adjusted EPS of $1.28, higher than consensus of $1.25.

Flowserve (FLS -0.21%) reported Q4 adjusted EPS of $1.10, stronger than consensus of $1.01.

Fluor (FLR +0.58%) reported Q4 EPS of $1.01, higher than consensus of 98 cents.

Analog Devices (ADI +0.91%) reported Q1 EPS ex-items of 49 cents, better than consensus of 48 cents.

Bruker (BRKR -0.64%) reported Q4 adjusted EPS of 31 cents, higher than consensus of 28 cents.

Columbia Sportswear (COLM +2.21%) reported Q4 EPS of $1.05, stronger than consensus of 92 cents.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

7:00 MBA Mortgage Applications

7:45 ICSC Retail Store Sales

8:30 Producer Price Index

8:30 Housing Starts

8:55 Redbook Chain Store Sales

2:00 PM FOMC minutes

Notable earnings before today’s open: CCC, CNK, DVN, DX, EV, GEO, GRMN, HCN, HL, HST, LAD, LL, MDCO, MGM, NM, NOR, OCR, SAVE, SIX, SUNE, TX, WAB, XEC, ZBRA

Notable earnings after today’s close: ACHC, AMTG, ARII, ARRS, ASGN, AVG, AWAY, AXLL, BAS, BJRI, CAR, CSGP, CW, CXO, DENN, ELNK, EPAM, EQIX, ESV, ETE, ETP, GDP, HAWK, HLS, HLX, HOS, HR, IAG, IVR, JACK, LGCY, LOCK, MANT, MAR, MM, OIS, PGTI, PVA, RBCN, REXX, RGP, SNPS, STR, SWY, SXL, TILE, TRN, TSLA, TSRO, UNTD, VECO, VVC, WMB, WPZ

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Feb 19)”

Leave a Reply

You must be logged in to post a comment.

Believe whatever you like, but the housing market has taken a hit, and it was evident in the history of housing starts, and sales two months ago. It seems possible that consumer over spending v. consumer income is important. Could this affect Fed logic? Possible.

Seeing more up in the SnP and Dow, but we are coasting on lower volume. “The Second Machine Age….” AMZN makes an effort to say why. Seems likely technology may have as much to do with

market performance as liquidity.

Appears 1850,1891 are possible on the SnP this month.

Futures have bounced off support which equates to SPX 1833. 1830 lower limit. If 1830 is broken, can pull back to 1815, where it should find support. If this level holds, target is 1847.

Long term target still at 1900.

Resistance is presently being felt at 1836. If that’s broken, there will be more at 1838 up thru 1840. If that resistance holds, near term target is 1830 and could possibly cause cascading moves which could take us down to 1815.

Range overnight: +.75 to -7.50 Now: – 5.00