Good morning. Happy Tuesday.

The Asian/Pacific markets closed mostly up, but gains were small. Japan, Indonesia, South Korea and Taiwan did the best. India lagged. Europe is currently mixed. Russia is down 2.2%, otherwise the indexes are little moved from their unchanged levels. Futures here in the States point towards a flat-to-down open for the cash market.

The dollar is up. Oil is down, copper is up. Gold and silver are up.

The market dropped yesterday. No big deal…Volume was light, and Monday is traditionally the weakest day of the week. Tuesday’s are the best day of the week, and given the market hasn’t had back-to-back down days since the end of January, odds favor a positive close today. It doesn’t have to happen, but if you’re a day trader, buying early weakness is what the stats tell you to do.

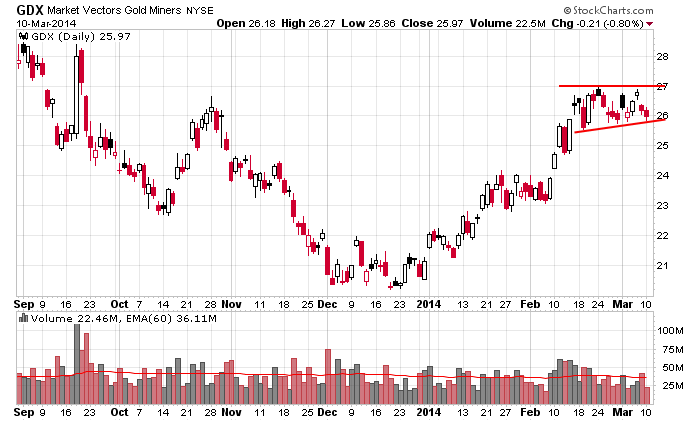

I continue to think gold and silver stocks present some compelling long trades. Many have rallied off their December lows and are now setting up in continuation patterns. The group needs a little nudge to breakout and begin its next leg up. Here’s GDX, an ETF.

Other groups we’ve played on a regular basis the last year need a rest. Solar, biotech, gambling – all groups we’ve had numerous trades from, all groups that are too stretched to chase higher. If these groups rest, who/what’s going to pick up the slack? Money rotates around the market…groups run hot and cold. We need a new crop of groups to step up and carry the baton. Without new leaders stepping up, the market will have a hard time continuing up. More after the open.

Stock headlines from barchart.com…

State Street (STT +0.09%) was downgraded to ‘Neutral’ from ‘Buy’ at UBS.

Northern Trust (NTRS +0.16%) was downgraded to ‘Sell’ from ‘Neutral’ at UBS.

Citigroup kept its ‘Buy’ rating on Cummins (CMI -1.18%) and raised its price target for shares to $163 from $145.

BNY Mellon (BK -0.51%) was upgraded to ‘Buy’ from ‘Neutral’ at UBS.

Apple (AAPL +0.09%) was upgraded to ‘Outperform’ from ‘Sector Perform’ at Pacific Crest.

Citigroup kept its ‘Buy’ rating on Facebook (FB +3.19%) and raised its price target on the shares to $85 from $70.

Macy’s (M +0.12%) was upgraded to ‘Outperform’ from ‘Market Perform’ at Wells Fargo.

Boyd Gaming (BYD -2.32%) rose over 8% in after-hours trading after Elliot announced a 4.99% stake in the company.

Coca-Cola reported a 10.1% stake in Keurig Green Mountain Coffee Roasters (GMCR -1.90%) .

Gramercy Funds reported a 19.9% passive stake in Banro Corporation (BAA -1.64%) .

La Jolla Pharmaceutical (LJJPC) surged over 50% in after-hours trading after it said its primary and key secondary endpoints were met in the Phase 2 trial of GCS-100 for chronic kidney disease.

United Natural Foods (UNFI +0.53%) reported Q2 EPS of 56 cents, right on consensus, but it reported Q2 revenue of $1.65 billion, better than consensus of $1.64 billion.

Urban Outfitters (URBN -0.13%) fell nearly 3% in pre-market trading after it reported Q4 EPS of 59 cents, better than consensus of 55 cents, but CEO Richard Hayne said he expects poor weather to contrbute to lower sales and profit margins in Q1.

Casey’s General Stores (CASY +2.29%) fell nearly 3% in after-hours trading after it reported Q3 EPS of 38 cents, well below consensus of 49 cents.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

7:30 NFIB Small Business Optimism Index

7:45 ICSC Retail Store Sales

8:55 Redbook Chain Store Sales

10:00 Wholesale Trade

10:00 Job Openings and Labor Turnover Survey

1:00 PM Results of $32B, 3-Year Note Auction

Notable earnings before today’s open: AEO, ARCO, BONT, BPI, CMN, DKS, EJ, GTN

Notable earnings after today’s close: CDXS, CODI, CZR, DMND, DRC, FURX, GNMK, HRZN, KTOS, MX, PAY

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Mar 11)”

Leave a Reply

You must be logged in to post a comment.

Nice bounce off 1867 as expected.

Resistance at 1882 remains. The good news is that additional resistance, which developed at 1877-1880, is being taken out pre-market. Based on this, one would expect the market to move lower initially, possibly as low as 1873-72, and then resume the climb.

As long as 1872 holds, target at 1883 is achievable

The tgt at 1890 mentioned yesterday is still valid as well. LT 1900.

Later this week, all futures will be rolling into the Jun contract, and that may cause some weird price action as traders close Mar positions and reopen new ones. With the market at highs, it wouldn’t be unusual to see some pullbacks.

Futures range overnight: -3.25 to + 2.25 At 9 am: +1.50

well todays commentary was completely off the mark – S&P500 tanked – this is what I read Tuesday’s are the best day of the week, and given the market hasn’t had back-to-back down days since the end of January, odds favor a positive close today

I didn’t make a prediction…I simply stated a fact…a fact that can be backed up by hard data. Tuesday’s are the best day of the week by a long shot…and they still are the best day.