Good morning. Happy Wednesday.

The Asian/Pacific markets are mostly down. Japan is down 2.6%, Hong Kong, Singapore and South Korea more than 1%. Europe is currently down across the board. London, Germany, France, Italy, Amsterdam, Norway, Russia and Prague are down more than 1%. Futures here in the States point towards a down open for the cash market.

The dollar is flat. Oil and copper are down. Gold and silver are up.

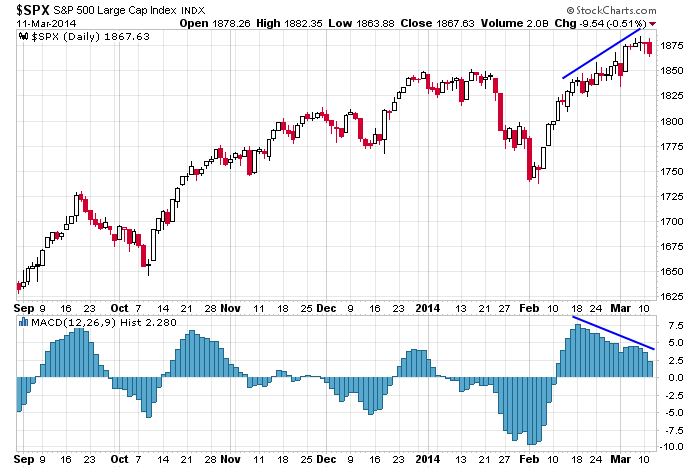

For the first time since the end of January, the market has fallen on consecutive days. Today won’t be any easier with many of the overseas markets posting solid losses and this Histogram divergence on the daily still playing out

On a short term basis, we need to be careful. Warnings have popped up the last week in the form of indicators cycling down and leadership stocks hitting targets at nose-bleed levels.

The risk/reward is not the same, so you must adjust your expectations. At the beginning of a run, you can use a loose stop and give positions time and space to play out. But after a big run – as we’ve had the last month – you gotta be content with quicker trades and smaller profits.

Longer term, I still like the upside and believe new highs will be made again. More after the open.

Stock headlines from barchart.com…

Express (EXPR -0.92%) reported Q4 EPS of 57 cents, weaker than consensus of 59 cents.

MRC Global (MRC -2.14%) was upgraded to ‘Buy’ from ‘Neutral’ at Longbow.

Toll Brothers (TOL -0.68%) and PulteGroup (PHM -0.35%) were both downgraded to ‘Neutral’ from ‘Outperform’ at Credit Suisse.

PharMerica (PMC -0.80%) was upgraded to ‘Outperform’ from ‘Neutral’ at Credit Suisse.

Deutsche Bank kept its ‘Buy’ rating on Delphi Automotive (DLPH +1.36%) and raised its price target on the stock to $90 from $75.

UBS kept its ‘Buy’ rating on Walgreen’s (WAG -0.39%) and raised its price target on the stock to $90 from $67.

Citigroup kept its ‘Buy’ rating on Las Vegas Sands (LVS -1.31%) and raised its price target for the shares to $97 from $92.50 citing strong growth trends in Macau and Las Vegas.

Reuters reported that China’s central bank, the PBOC, is prepared to cut bank reserve requirementsthe if growth slips below 7.5% towards 7%, citing sources involved in internal policy discussions.

Barron’s reported that the CEO of Ross Stores (ROST -0.15%) sold 150,673 shares of the company and two other Ross insiders sold shares as well for a total of 193.079 shares.

Riley Investment reported a 7.6% stake in STR Holdings (STRI -3.07%) .

Men’s Wearhouse (MW +4.71%) reported a Q4 adjusted EPS loss of -10 cents, a smaller loss than consensus of -13 cents.

Caesar’s (CZR +0.12%) reported a Q4 EPS loss of -$12.83, a much bigger loss than consensus of -$1.49 as Q4 revenue was $2.08 billion, weaker than consensus of $2.12 billion.

VeriFone (PAY -0.24%) climbed over 5% in after-hours trading after it reported Q1 EPS of 31 cents, higher than consensus of 27 cents.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

7:00 MBA Mortgage Applications

10:00 Quarterly Services Report

10:30 EIA Petroleum Inventories

1:00 PM Results of $21B, 10-Year Bond Auction

2:00 PM Treasury Budget

Notable earnings before today’s open: AMED, EXPR, QIWI, SCLN

Notable earnings after today’s close: ADUS, CPE, DCTH, DEPO, EOX, GERN, HMIN, IRET, KKD, MTDR, MTN, SGMS, SUPN, WSM

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Mar 12)”

Leave a Reply

You must be logged in to post a comment.

They followed the plan up to 1882 yesterday, then opened the trap door. Can’t say for sure, but they might be getting a head start on rolling over their contracts (the “boyz”)as I mentioned y’day.

There is a lot of resistance which starts at 1863. For today, if we get above 1870, it could turn things bullish short term.

Support, there are multiple layers, too. All depends which one they decide to use. The nearest one is 1860 and extends down to 1853. If that one is broken, it’s very possible we stair step down (with false rallies in between) to 1837.

I have no short term long targets, long term 1900 still valid.

Futures range overnight: +1.25 to -7.75, currently -5.75

The Euro is up again, 139. The implications are not good, EU exports are hurt just when circulation of the Euro is already depressed, and the disinflation is evident. China has loans going non-pay, while the employment numbers are down, and exports are down. None of this is good or tolerable for long without hitting all global plays.

The Ukraine is just beginning with lots of crazy ideas. As the last two days show the US markets are nervous but the decline will be mixed with rallies. How low can it go. Maybe 1750 initially. My puts are in the money and contributing. A few negative index ETFs may be interesting for those who have raised cash and hate just watching.

i will ask the quad witches for a short term repreive to the end of the world and that spx 1850 hold

providing the good intraday volitility holds and increases

itra day swings have been good and clear but i would like 500 intraday dow point swings

dont know what they will say

Did not see this plea for just the good news. Sorry Aussie, But nothing anyone says here affects your portfolio.