Good morning. Happy Tuesday.

The Asian/Pacific market close mostly up. Indonesia fell 1.5%; New Zealand, South Korea, Japan and Hong Kong did well. Europe is currently mostly up. Russia is up 2.4%; Belgium, Italy, Spain, Switzerland, Greece and France are doing well. Futures here in the States point towards a moderate gap up open for the cash market.

The dollar is down slightly. Oil is up, copper down. Gold and silver are down.

After falling 4 of 5 days and suffering one of its worst weeks in several months last week, the market bounced back in a big way yesterday. Today’s open will add to those gains.

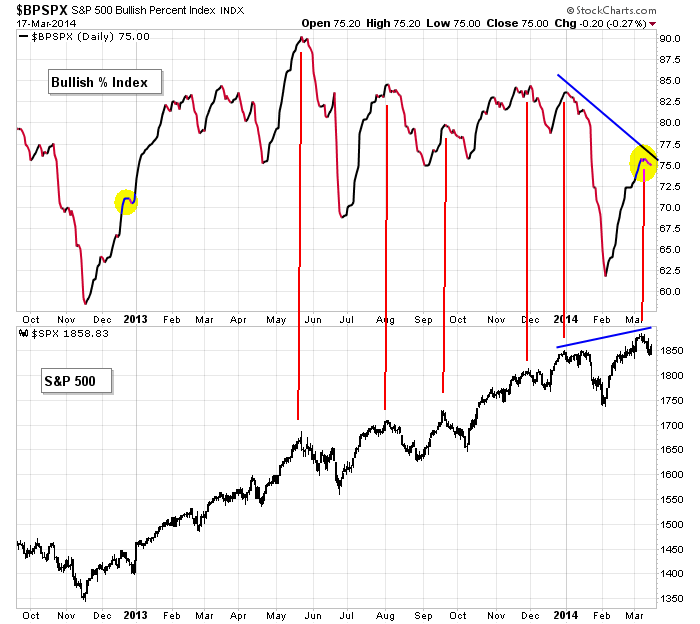

From a technical standpoint, the bulls want to see indicators such as the bullish % (shown below) reverse back up very soon. If this happens, the market will be free to leg up again, but if it doesn’t, the deteriorating technicals are likely to pull prices down further.

But as we know, news trumps the charts. News can come out of eastern Europe, where Russia has started the annexation process to make Crimea Russian land. Or news could come tomorrow during the next FOMC meeting. No rate change is expected, and continued tapering should be announced…but if the Fed fears the economy will be disrupted by the situation in eastern Europe, they’ll have an excuse to hold off a month. I doubt that happens. More after the open.

Stock headlines from barchart.com…

Cisco (CSCO +0.75%) was downgraded to ‘Equal Weight’ from ‘Overweight’ at Barclays.

DSW (DSW +1.16%) reported Q4 adjusted EPS of 31 cents, better than consensus of 29 cents.

Starting Wednesday, March 26, Walmart (WMT +0.54%) said that customers will be able to trade in their video games and apply the value immediately towards the purchase of anything sold at Walmart and Sam’s Club.

Universal Health (UHS -0.32%) was upgraded to ‘Buy’ from ‘Hold’ at KeyBanc.

Hewlett-Packard (HPQ +1.41%) was upgraded to ‘Overweight’ from ‘Equal Weight’ at Barclays.

Hertz (HTZ +4.77%) reported Q4 EPS of 26 cents, weaker than consensus of 32 cents, and then lowered guidance on fiscal 2014 adjusted EPS to $1.70-$2.00, below consensus of$2.07. The board of Hertz then announced plans to separate into two independent, publicly traded companies.

Prosensa Holding N.V. (RNA -0.59%) reported encouraging 48-week data from its U.S.-based, Phase 2 placebo-controlled study, DMD114876 or DEMAND V, of its lead compound, drisapersen, for the treatment of Duchenne Muscular Dystrophy.

The Verge reports that Microsoft (MSFT +0.93%) will introduce Microsoft Office for Apple’s (AAPL +0.39%) iPad at a press event later this month.

Moody’s Investors Service downgraded Argentina’s government bond rating to Caa1 from B3, and changed the outlook to stable from negative.

Con-way Freight (CNW +0.79%) announced that it will institute a general rate increase of 5.4% applicable to non-contractual business, effective March 31.

Castle Creek reported a 9.45% passive stake in Guaranty Federal Bancshares (GFED +0.63%) .

Gabelli reported a 5.59% stake in Xyratex (XRTX +0.08%) .

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

FOMC meeting begins

7:45 ICSC Retail Store Sales

8:30 Consumer Price Index

8:30 Housing Starts

8:55 Redbook Chain Store Sales

9:00 Treasury International Capital

Notable earnings before today’s open: CCL, DSW, FDS, HTZ, YGE

Notable earnings after today’s close: ADBE, ORCL, PSUN, RENN

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Mar 18)”

Leave a Reply

You must be logged in to post a comment.

Running late, will be brief. No need to elaborate anyway. Target remains 1909. FOMC tomorrow afternoon.

Futures now: +4.75 after blasting up to +8 at 730 am.

The Fed matters today. Relief that Putin is happy with this Crimea move seems to support the market, and housing seems to suggest that cold weather does matter. Indexes still doing well, but holding puts as a hedge. The dividend portfolio is holding its own, but there is weakness in large dividend paying stocks. Hold what you like, but be defensive.