Good morning. Happy Monday. Hope you had a good weekend.

The Asian/Pacific markets closed mostly up. Japan, India, Hong Kong, China and Singapore all did very well. Europe is currently mostly down. France, Austria, Stockholm, Switzerland, Italy and Russia are doing the worst. Futures here in the States point towards an up open for the cash market.

The dollar is up. Oil and copper are up. Gold and silver are down.

We begin the week with a couple headwinds. 1) The market sold off Friday and closed near its low – not a great way to finish the week (especially after the S&P 400 and 500 hit new all-time highs). 2) Monday’s are the worst day of the week. 3) There has been a tendency for the market to move in one direction into options expiration and then reverse immediately after. 4) And finally, the lack of leadership is obvious. For example, biotech and solar rallied big time for 12+ months, but those groups are now in mini declines. This is fine, no group can lead forever. But a few new groups need to step up and take a leadership role.

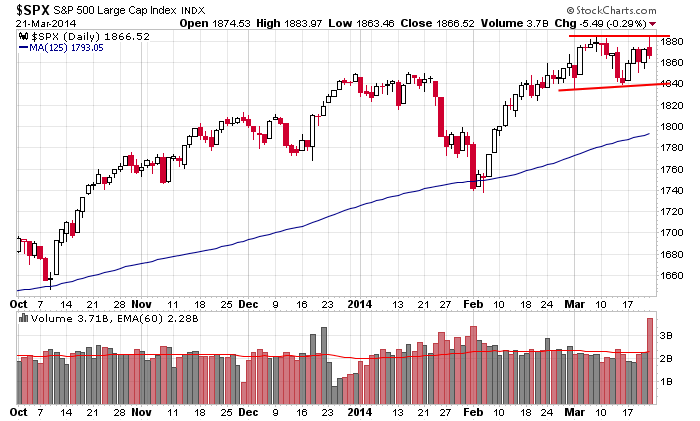

Here’s the S&P daily. Long term the chart looks great. The index is consolidating within an uptrend; the pattern measures up to 2000. But in the near term, things remain iffy (as I’ve been saying for the last week.

Don’t force trades right now. More after the open.

Stock headlines from barchart.com…

Apple (AAPL +0.79%) rose nearly 1% in pre-market trading after the WSJ reported that Comcast has discussed providing preferential access to its cables for video content sent to Apple’s set-top boxes.

Wells Fargo (WFC +0.18%) and U.S. Bancorp (USB +0.28%) were both upgraded to ‘Neutral’ from ‘Underweight’ at Atlantic Equities.

VMware (VMW -1.32%) was upgraded to ‘Buy’ from ‘Neutral’ at Sterne Agee.

Bank of America (BAC -2.01%) was downgraded to ‘Neutral’ from ‘Overweight’ at Atlantic Equities.

Manitowoc (MTW +1.94%) was downgraded to ‘Underperform’ from ‘Hold’ at Jefferies.

Loews (L +0.73%) was downgraded to ‘Hold’ from ‘Buy’ at Deutsche Bank.

American Electric (AEP +0.29%) was downgraded to ‘Hold’ from ‘Buy’ at Jefferies.

Moody’s Investors Service lowered its outlook on Croatia’s government bonds to negative from stable and raised its outlook on Cyprus’ government bonds to positive from negative.

Bryant Keil reported a 5.05% passive stake in Potbelly (PBPB -1.78%) .

Stockbridge Partners reported a 5.2% passive stake in RealPage (RP -1.89%) .

Discovery Group reported a 5.3% stake in ReachLocal (RLOC +1.44%) .

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

8:30 Chicago Fed National Activity Index

9:45 PMI Manufacturing Index Flash

1:45 PM Fed’s Fisher: “Forward Guidance: Fad or the Future of Monetary Policy”

Notable earnings before today’s open: SOL

Notable earnings after today’s close: SONC

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Mar 24)”

Leave a Reply

You must be logged in to post a comment.

Yield curve is still very steep making a major pullback unlikely.

My calculations tell me 4175 for the NASDAQ is a buying opportunity. Short term VIX is up but P/C ratios do not justify going long.

Buy low sell high.

If you sell enough puts sooner or later you will end up with some shares.

Friday proved OPEX can be wild. 20 SPX point swing.

Outlook: If Friday’s low ~1863 holds, we’ll head to 1890s.

If it breaks, expect support 1855-57.

Resistance at 1873 up thru 1877.

LT Tgt 1909 remains valid unless market moves down to ~1830.

Futures moved up all night. High was +7.50, at 9 am +5.00.

“Long term the chart looks great, iffy short term.” Jason

“In the long run we are all dead.” Keynes

“Hold a portion of your portfolio in 1)Index funds, 2) Dividend paying stocks, and 3) some cash or bonds” Whidbey. What works better for survival? Tell me, I need to know.

The Chicago Numbers were up today which means its up compared to last low, but better than down. China is down on manufacturing and Yuan is down. The G7 meets to deal with Russia. I am betting on Russia out smarting the EU and USA, again. Best.