Good morning. Happy Tuesday.

The Asian/Pacific markets leaned to the downside, but only Taiwan (up 1%) moved much from its unchanged level. Europe is currently mostly up. Russia is up 2%; Switzerland, Amsterdam, London, Germany, France and Italy are up 1% or more. Futures here in the States point towards a moderate gap up open for the cash market.

The dollar is up. Oil is up, copper down. Gold and silver are up.

The market got hit hard yesterday…although it bounced during the afternoon session. Considering Mondays are the weakest day of the week and the market sold off Friday afternoon, it should not have been a big surprise. Now it’s “turnaround Tuesday.” Tuesday’s are by far the market’s strongest days…and they’re especially strong when the Monday is weak, as it was yesterday. I guess you can call this a test. If the market can’t rally on the strongest day of the week while the overall trend is still solidly up, then it’s weaker than we think.

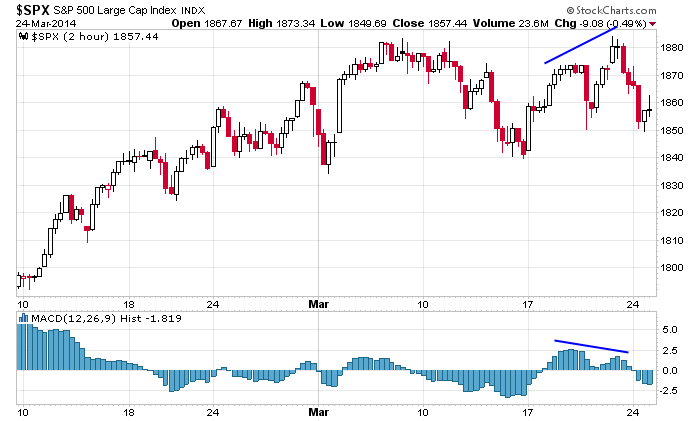

On the technical front, the S&P has dropped enough to work off this negative divergence…

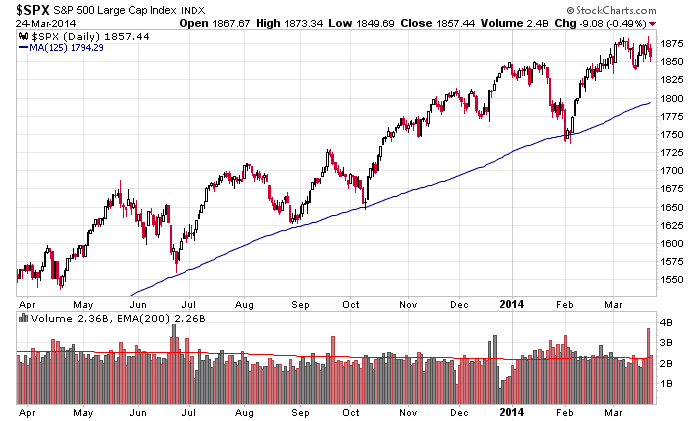

The long term trend remains solidly up, and the near term has probably seen enough selling to re-balance the supply/demand balance. But the intermediate term is less encouraging. There are several signs (many of which I covered in the weekend write-up) that suggest a local top is being formed…not THE top, just a top that may last long enough to really scare the bulls. If this is the case, 1800 is my downside S&P target.

If the market bounces today, Wednesday will be key. Do the gains immediately get given back…or will the bulls be in enough control to push the market to new highs? More after the open.

Stock headlines from barchart.com…

BofA/Merrill added CSX (CSX -0.24%) to its top stock pick list for 2014.

Walgreens (WAG -0.68%) reported Q2 adjusted EPS of 91 cents, below consensus of 93 cents.

AT&T (T +0.47%) was downgraded to ‘Neutral’ from ‘Overweight’ at HSBC.

The NYT reports that General Motors (GM +0.37%) told its customers and families of accident victims that it did not have sufficient evidence to determine that there were defects in its cars, even after the company had definitive evidence of such a defect.

Arch Coal (ACI +3.08%) was downgraded to ‘Hold’ from ‘Buy’ at Jefferies.

Navistar (NAV +0.06%) was downgraded to ‘Neutral’ from ‘Buy’ at UBS.

KBR (KBR -0.98%) was downgraded to ‘Neutral’ from ‘Buy’ at Goldman Sachs.

Domtar (UFS +0.08%) was upgraded to ‘Buy’ from ‘Neutral’ at Goldman Sachs.

RealD (RLD -3.39%) and Wanda Cinema Line Corporation announced an extended agreement to install an additional 780 RealD 3D Cinema Systems in China.

Integrated Core Strategies reported a 6% passive stake in Stone Energy (SGY +0.08%) .

Standard & Poor’s Ratings Services lowered its long-term foreign currency sovereign credit rating on Brazil to ‘BBB-‘ from ‘BBB’ with a stable outlook on its long-term credit rating.

PL Capital reported a 5.2% stake in Metro Bancorp (METR +0.98%) .

Disney (DIS -1.07%) has agreed to acquire Maker Studios for $500 million.

BioMarin (BMRN -0.30%) was downgraded to ‘Neutral’ from ‘Buy’ at Goldman.

Blackstone Holdings I reported a 6% passive stake in Ardmore Shipping (ASC -1.77%).

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

7:45 ICSC Retail Store Sales

8:55 Redbook Chain Store Sales

9:00 S&P Case-Shiller Home Price Index

9:00 FHFA House Price Index

10:00 New Home Sales

10:00 Consumer Confidence

10:00 State Street Investor Confidence Index

10:00 Richmond Fed Mfg.

1:00 PM Results of $32B, 2-Year Note Auction

4:00 PM Fed’s Lockhart: U.S. Economic Outlook

7:00 PM Fed’s Plosser: Monetary Policy and Economic Outlook

Notable earnings before today’s open: CCL, GIII, HDS, IKGH, MKC, NEOG, WAG

Notable earnings after today’s close: FIVE, GERN, GEVO, GOMO, LNDC, PVH, SCS

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Mar 25)”

Leave a Reply

You must be logged in to post a comment.

Mon mkt broke support at the 1855-57 region. Found new support just below at 1850

and the lower limit of this level is 1844 ish.

Futures were -1.50 to +9 just a few minutes ago, +8.50 here at 9 am.

Expect a pullback after the open to 1855-57 and an upward move thereafter.

Tgt still 1909.

nothing but permaBull excuses for the drop. Why can’t you be honest and call a spade a spade and acknowledge the weakness of the markets? It’s absolutely ridiculous.

I am thrilled to be called a perma bull while the market is experiencing one of the greatest bulls runs in history. 🙂

Fine and good, but past history is not a guarantee of future results. If the market is showing bearish signs (which it is), call it what it is. If you want to live in the past, so be it, but it makes your commentary worthless to be making flimsy excuses for bearish moves, much less saying what is happening in Crimea doesn’t affect us in the USA and around the world. I see bullish rose-colored glasses in your commentary, not an accurate appraisal of the CURRENT situation.

Do you remember Greece? They were going to leave the EU and reform their own currency.

Do you remember Italy?

Do you remembers Spain and their 25% unemployment…and 50% unemployment among 18-24 year olds?

Do you remember when the euro was doomed to failure…was going to cease to exist?

The coast is never clear. There’s always stuff going on in the world. You can’t get bearish every time something happens in the world. Otherwise you’d always be either short or on the sidelines.

Guess what, when the market tops, I can go short. 🙂 I’m not married to my position. And if the market trends down for a while, I’ll ride the bulk of it. I don’t need to nail the first 5%. There’s always plenty of money to be made grabbing a big chunk out of the middle.

BTW, did you even read what I wrote above? I stated there are several signs a local top may be forming.

good debate 86

my take on the world markets is that they are in a rig a mourtis state

dow hasnt been able to take out its dec/jan highs

nas 100 and composite look weak –maybe sector rotation

spx strugling with the 1900

japan 225 spiked and turned down,but risky as japan govt can buy stocks

auusie xjo spiked and cant get back

ftse same

german dax droped 1000 points from high

instos would love to take it higher on no volume to get set short,for what they know has to happen

these are all exhaustion style markets that once spike top in they just fall –no distribution needed as the distribution was the spike

with uncle bens help world equities have been traded like commodity spike markets

uncle ben was the ponsi china japan europe followed

im still worried about the euro when that falls look out carry trade

NEW TOPS HERE WOULD NOT BE BULLISH BUT VERY BEARISH

99 says hollow

what is a exhaustion style trend

usually 4th fan trend line streight up ,with corrections getting smaller and smaller in time /price

see gold /silver/oils chart history