Good morning. Happy Monday. Hope you had a nice weekend.

The Asian/Pacific markets closed mostly up. Japan, Singapore, Taiwan and Australia did the best. Europe is currently split. London, Belgium, Switzerland, Russia and Spain are doing well. Prague is the only noticeable down market. Futures here in the States point towards a moderate gap up open for the cash market.

The dollar is down. Oil and copper are down. Gold is flat, silver is down.

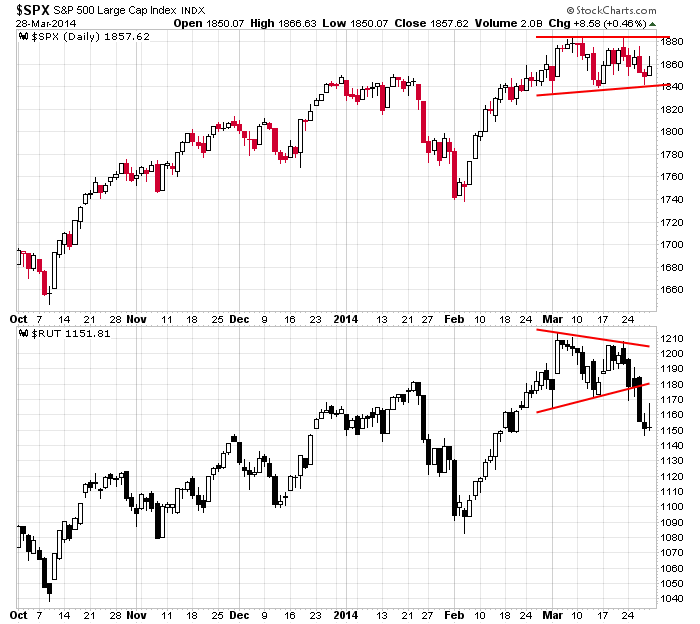

My conclusion from this weekend’s Index Report was that the market was in slightly better shape than expected. The S&P and Dow remain in consolidation patterns while the Russell small caps and Nas have already broken down. It’s a battle that should be resolved sooner rather than later. A few indicators that dropped to low level have curled up and now support a bounce. Sometimes bounces are just that, bounces that get sold into. But it’s not uncommon for bounces to keep going and going and before you know it, a full-blown rally has materialized and the bears are crushed again. I’m not making any predictions…all I’m saying is to not get overly bearish because I’m seeing little signs of strength.

Here’s the battle…big caps vs. small caps. The SPX is a couple good days from a new high. The small caps have a moderate block of resistance over head to contend with. Vertical rallies are more common than most traders think, so the bears need to be just as careful as the bulls. More after the open.

Stock headlines from barchart.com…

Travelers (TRV +0.60%) was upgraded to ‘Neutral’ from ‘Sell’ at Guggenheim.

Edison International (EIX +2.60%) was upgraded to ‘Buy’ from ‘Neutral’ at UBS.

Cal-Maine Foods (CALM +1.05%) reported Q3 EPS of $1.77, well above consensus of $1.41.

Heartland Express (HTLD +0.98%) and Knight Transportation (KNX +0.41%) were both upgraded to ‘Buy’ from ‘Neutral’ at Longbow.

Men’s Wearhouse (MW +1.26%) was upgraded to ‘Buy’ from ‘Neutral’ at Mizuho.

DTE Energy (DTE +0.37%) and Big Lots (BIG +1.92%) were both upgraded to ‘Buy’ from ‘Hold’ at KeyBanc.

Moody’s Investors Service placed Russia’s Baa1 government bond rating on review for downgrade.

Lockheed Martin (LMT +1.04%) was awarded a $610.9 million government contract modification for production of 92 one pack missiles, 50 launcher modification kits and associated ground equipment for the PATRIOT missle system.

Integrated Core Strategies reported a 4.8% passive stake in Penn Virginia (PVA +1.48%) .

Wexford Capital reported a 6.73% passive stake in Famous Dave’s (DAVE -4.39%) .

The U.S. Food & Drug Administration approved Biogen’s (BIIB -5.05%) drug Alprolix for patients with Hemophilia B.

Cascade Investment reported an 8.2% passive stake in the Thai Fund (TTF +1.03%) .

Target’s (TGT +0.40%) credit rating was cut to A from A+ by Standard & Poor’s, although the outlook was raised to Stable from Negative.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

9:45 Chicago PMI

10:30 Dallas Fed Manufacturing Outlook

3:00 PM Janet Yellen speech

Notable earnings before today’s open: CALM, GLP, IOC

Notable earnings after today’s close: none

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Mar 31)”

Leave a Reply

You must be logged in to post a comment.

can someone please tell me when next usa reporting season starts with alcoa

both the bulls and bears carry to much risk atm and can only be daytraded for pleasure and profit

but with this long consolidation the bulls may have a edge,but how long ago did the dji top

i dont have the constitution for long term trades

Aussie,

Bookmark this: http://www.earningswhispers.com/stocks.asp?symbol=aa

It’s April 8 for Alcoa

Thanks Mike

then bulls may run to 18th-25th april,with volitility i hope

but still the trend is not certain atm

has it exhausted or still in exhaustion with last streight up coming

Steady as she goes.

Futures very bullish overnight. Gapped +6 at the open last night and have held up. Now +10 at 9 am.

SPX can retreat to 1854. If SPX breaks 1850 ish, bulls use this as near term warning.

Repeating what I said Friday: The support at 1842 extends down to 1831.

As long as that holds, target at 1909 is valid.

Big non-farm payroll report coming Friday.