Good morning. Happy Friday.

The Asian/Pacific markets closed mostly up. Hong Kong and Indonesia led the way followed by Japan and India. There were no big down markets. Europe is currently mostly up. Russia, Spain and Italy are up more than 1%; Belgium, Amsterdam, Prague and Germany are also doing well. Futures here in the States point towards a moderate gap up open for the cash market.

The dollar is up. Oil and copper are up. Gold is up, silver is flat.

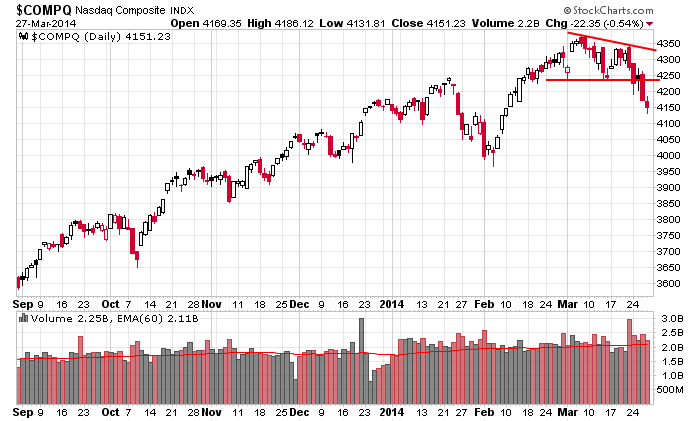

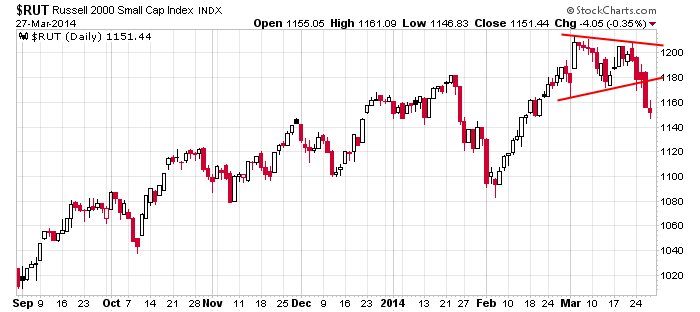

It’s been a rough week for Wall St…it’s been especially rough for the Nas and small caps.

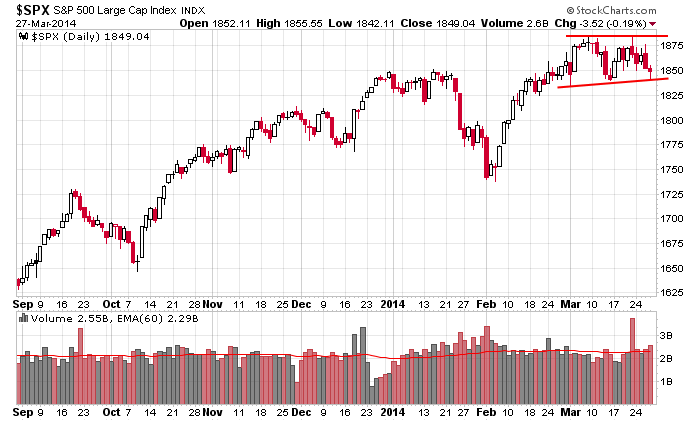

Here’s the S&P daily…an ascending triangle within an uptrend. This isn’t so bad.

But the Nas broke support on Monday.

And the Russell followed soon after.

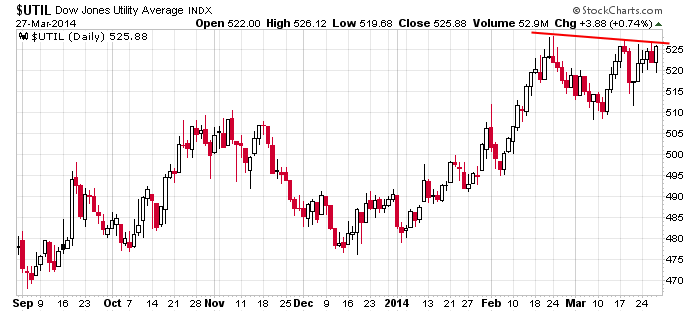

And the market’s most attractive group right now is the utilities. Not good.

On a short term basis, anything goes. This is always the case. On any give day, anything can happen. But on an intermediate term basis (the next couple weeks), the path of least resistance is down. The Nas and small caps need to firm. Also many breadth indicators need to cycle further to signal more of a washout.

I don’t think we’re in the beginning stages of a big move down, but further declines are certainly in the cards for the next couple weeks.

Stock headlines from barchart.com…

Finish Line (FINL -3.29%) reported Q4 EPS 87 cents ex-items, better than consensus of 85 cents.

BlackBerry (BBRY -1.20%) rose nearly 5% in pre-market trading after it reported a Q4 adjusted EPS loss of -8 cents, a much smaller loss than consensus of -55 cents.

Jefferies keeps its ‘Buy’ rating on Amgen (AMGN +1.82%) and raises its price target for the stock to $145 from $138.

El Paso Pipeline (EPB +0.62%) was upgraded to ‘Buy’ from ‘Neutral’ at Citigroup.

PG&E (PCG -1.45%) was downgraded to ‘Hold’ from ‘Buy’ at Deutsche Bank.

Stadium Capital reported a 9.1% stake in Insperity (NSP +0.27%) .

Alcoa (AA +6.16%) was upgraded to ‘Neutral’ from ‘Underperform’ at Macquarie.

Netflix (NFLX -2.18%) fell 3% in after-hours trading after the WSJ reported that Amazon will offer a free streaming media service in the coming months.

Gabelli reported a 5.28% stake in Chemtura (CHMT -3.04%) .

Restoration Hardware (RH +0.55%) reported Q4 adjusted EPS of 83 cents, right on consensus, although Q4 revenue of $471.7 milion was below consensus of $493.09 million.

Red Hat (RHT +0.27%) reported Q4 EPS of 39 cents, higher than consensus of 37 cents.

Earnings and Economic Numbers from seekingalpha.com…

Friday’s economic calendar:

8:30 Personal Income and Outlays

9:55 Reuters/UofM Consumer Sentiment

1:15 PM Fed’s George: Economic Outlook

3:00 PM USDA Ag. Prices

Notable earnings before today’s open: BBRY, FINL

Notable earnings after today’s close: none

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Mar 28)”

Leave a Reply

You must be logged in to post a comment.

The layer of support at 1842 was tested twice. To be judgmental, although the second test held, the bounce was less than spectacular. Still, that level held.

Futures were bullish overnight. -1.25 early on, then steadily higher to +7. At +4.00 after the 830 reports.

Today: The support at 1842 extends down to 1831. As long as that holds, target at 1909 is valid.

Resistance will be encountered at 1855 up thru 1858.

If you want to see a horror show, look at GOOG; lost almost 100 points since 3/18. A drag on the SPX and COMP. Til that changes, GOOG’s an anchor around our neck. It’s +4 to 5 premarket.

GOOG +16 at this time.

I would like to see the PC ratio a tad higher before I burn all my cash long.