Good morning. Happy Wednesday.

The Asian/Pacific markets closed mostly up. Japan rallied 1%, China 0.6% and India 0.5%. Europe currently leans to the upside. Russia (down 1%) and Austria (down 0.8%) lead to the downside; Switzerland is up 0.6%. There are no other big winners. Futures here in the States are flat.

The dollar is flat. Oil is down, copper up. Gold and silver are up.

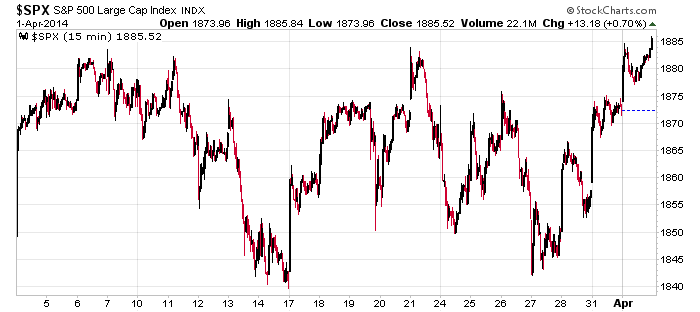

For the first time since the end of February, the market has moved in the same direction three consecutive days. Last Friday and the first two days of this week have been up. Here’s the 15-min S&P over the last months. Rallies have gotten sold, dips have gotten bought. No move has lasted very long. It’s been a mess…good thing we saw it coming. I’ve been saying for better than two weeks that the near term was iffy.

Yesterday the Dow attempted to bust out. The S&P 500 is knocking on the door. The Nas and Russell small caps have made progress but still have moderate blocks of resistance overhead.

We’ve been down this road many times. The bears think the bounce will be a dead-cat bounce within a newly formed downtrend…then the bounce keeps going and going and before you know it, the market is in full-blown rally mode.

The unexpected happens enough that you should at least consider it to be a legitimate possibility and have a plan just in case it happens.

Stock headlines from barchart.com…

Oppenheimer keeps an ‘Outperform’ rating on Yum! Brands (YUM +0.89%) as it raises its price target on the stock to $89 from $80.

Bernstein says shares of Google (GOOG +1.83%) are undervalued at current levels as it keeps an ‘Outperform’ rating on the stock and a price target of $1,500.

Carter’s (CRI -0.99%) was upgraded to ‘Overweight’ from ‘Neutral’ at Piper Jaffray.

Cognizant (CTSH +2.11%) was upgraded to ‘Buy’ from ‘Neutral’ at UBS.

Comerica (CMA -0.29%) was upgraded to ‘Market Perform’ from ‘Underperform’ at Wells Fargo, which cites improved commercial lending activity.

DSW (DSW +3.18%) was upgraded to ‘Hold’ from ‘Sell’ at Brean Capital due to valuation.

Urban Outfitters (URBN +0.49%) reports that its Q1 Same-Store-Sales to date are low single-digit negative.

MannKind (MNKD -16.77%) announced that a U.S. FDA advisory panel voted 13 to 1 to recommend that the Afrezza Inhalation Powder be granted FDA marketing approval to improve glycemic control in adults with type 1 diabetes.

Apollo Education (APOL +2.69%) fell over 3% in after-hours trading after it reported Q2 EPS ex special items of 28 cents, better than consensus of 19 cents, although it reported Q2 revenue of $679.1 mllion, below consensus of $689.04 million.

RA Capital reported a 8.0% passive stake in Enanta (ENTA -2.78%) .

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

7:00 MBA Mortgage Applications

8:15 ADP Jobs Report

8:30 Gallup U.S. Job Creation Index

10:00 Factory Orders

10:30 EIA Petroleum Inventories

12:30 PM Fed’s Lockhart: U.S. Economic Outlook

Notable earnings before today’s open: AYI, MON

Notable earnings after today’s close: DDC, MIND, TXI

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Apr 2)”

Leave a Reply

You must be logged in to post a comment.

New intraday high, new closing high on SPX.

intraday chart looks great

can we get a false break high or up up and away exhaustion

dont care witch