Good morning. Happy Thursday.

The Asian/Pacific markets closed mixed. Japan and Singapore led to the upside with gains near 0.85%; China dropped 0.7%. Europe is currently mostly down, but not index has moved more than 1%. Green (down 0.9%), Russia (down 0.7%) and Stockholm (down 0.5%) are posting the biggest moves. Futures here in the States point towards a flat open for the cash market.

The dollar is flat. Oil and copper are down. Gold and silver are down.

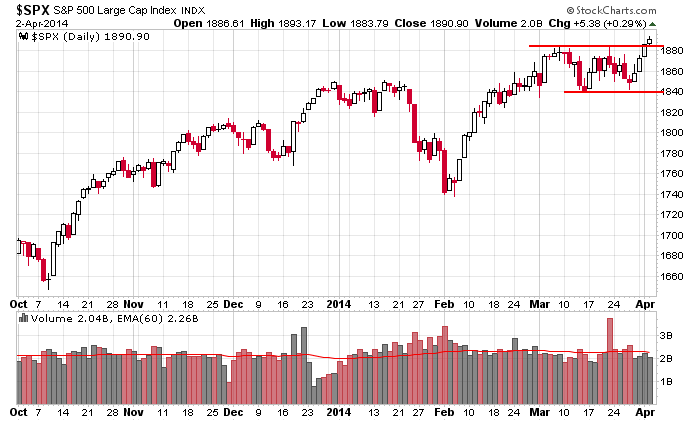

For the first time since the S&P rallied 140 points off the February low, the market has rallied four straight days. Volume has been light, but anyone who pays attention to the market’s hints isn’t surprised. Several indicators had reversed coarse, and at the very least, recognition needed to be paid to the possibility the path of least resistance was up because the supply/demand balance had shifted too far to one side.

Here’s the daily S&P 500 chart. This is new high territory, and the Dow isn’t far behind. The bears were out in full-force last week, and here we are, once again, just a few days later at new highs.

I’m not all in…far from it. There are still hurdles to climb before I’m a believer the current move will become a full-blown rally. A few indicators are lagging, and of course the Nas and small caps still have resistance overhead to deal with. For now, so far, so good, but there’s work to do.

Tomorrow, 60 minutes before the open, we’ll get the latest employment data, so today may be on the slow side.

Stock headlines from barchart.com…

Monsanto (MON +0.38%) was upgraded to ‘Overweight’ from ‘Neutral’ at JPMorgan Chase.

Eli Lilly (LLY +0.56%) was upgraded to ‘Outperform’ from ‘Market Perform’ at Cowen.

Citigroup (C +0.92%) was downgraded to ‘Neutral’ from ‘Buy’ at Sterne Agee.

Norfolk Southern (NSC -0.41%) was downgraded to ‘Neutral’ from ‘Overweight’ at Atlantic Equities.

National Retail Properties (NNN +0.06%) was downgraded to ‘Sell’ from ‘Neutral’ at UBS.

Deutsche Bank (DB +0.35%) was downgraded to ‘Neutral’ from ‘Overweight’ at JPMorgan Chase.

The Charlotte Business Journal reported that Family Dollar (FDO -0.40%) cut 135 jobs, or roughly 6% of the staff, at its corporate headquarters in North Carolina.

Gilead Sciences (GILD +0.43%) rose nearly 3% in European trading after it announced topline results from a Phase 3 clinical trial in Japan evaluating the once-daily nucleotide analog polymerase inhibitor sofosbuvir in combination with ribavirin for the treatment of the genotype 2 chronic hepatitis C virus infection.

Cheniere Energy (LNG +0.14%) was downgraded to ‘Neutral’ from ‘Outperform’ at Credit Suisse.

CACI International (CACI +0.68%) fell more than 10% in after-hours trading after it lowered guidance on fiscal 2014 EPS view to $5.12-$5.51 from $5.59-$5.98, well below consensus of $5.78.

Intel (INTC -0.38%) was upgraded to ‘Overweight’ from ‘Neutral’ at Piper Jaffray.

Broadcom (BRCM -0.92%) was downgraded to ‘Neutral’ from ‘Overweight’ at Piper Jaffray.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

7:30 Challenger Job-Cut Report

8:30 Gallup US Payroll to Population

8:30 Initial Jobless Claims

8:30 Trade Balance

9:45 PMI Services Index

9:45 Bloomberg Consumer Comfort Index

10:00 ISM Non-Manufacturing Index

10:30 EIA Natural Gas Inventory

11:00 Global Composite PMI

11:00 Global Services PMI

4:30 PM Money Supply

Notable earnings before today’s open: GBX, PERY, RPM, SCHN

Notable earnings after today’s close: GPN, MU, SEAC, SNX

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers