Good morning. Happy Friday. Happy Employment Numbers Day.

The Asian/Pacific markets closed mixed. India and Indonesia dropped 0.7%; China rallied 0.7%. Europe is currently mixed. Russia, London and Germany are up; Greece and Switzerland are down. About 15 minutes before the employment data was released, futures in the States pointed towards an up open for the cash market.

The dollar is flat. Oil and copper are up. Gold and silver are up.

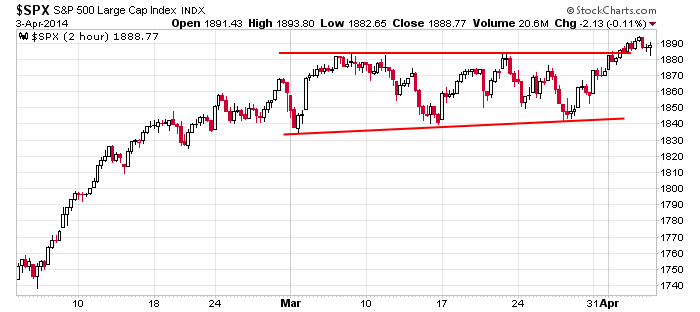

Here’s the 2-hour SPX. A solid rally was followed by one month of range bound movement, and now we have an attempt to bust out. This is textbook stuff, but the bulls want to see some follow through so they’ll have a cushion to work with.

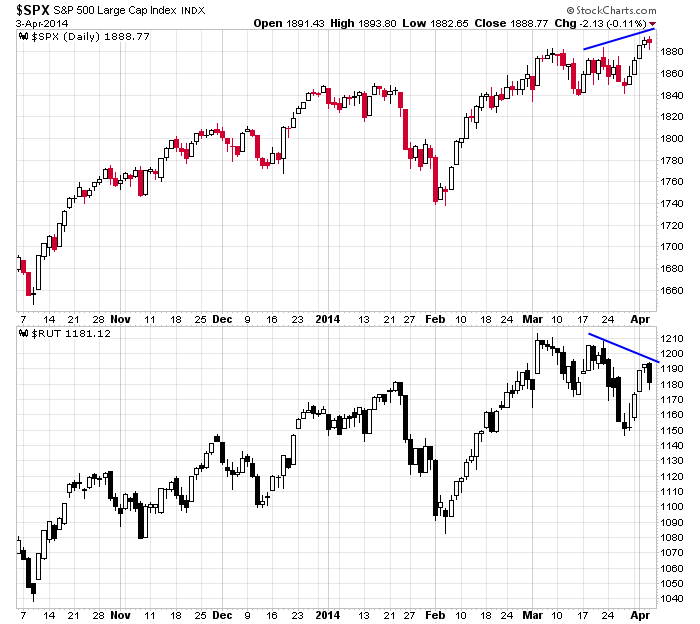

But this chart bothers me. It’s never good when the small caps lag. In the near term it’s no big deal, but over time, the small caps need to lead, not lag.

Here are the employment numbers…

unemployment rate: 6.7% (was 6.7% last month)

nonfarm payrolls: +192K

private payrolls:

average workweek: down 0.2 to 34.5 hours

hourly wages: down 1 cent to $24.30

labor participation rate drops to 63.2%

On the news, the S&P futures spiked about 5 points and then settled down.

The market improved this week, but there’s still work to be done. Lagging indicators, lagging small caps and a big pullbacks from some big cap tech stocks put a damper on the bullish SPX action.

Stock headlines from barchart.com…

JPMorgan Chase (JPM +0.30%) was upgraded to ‘Outperform’ from ‘Neutral’ at Macquarie.

CarMax (KMX -0.67%) reported Q4 EPS of 44 cents, weaker than consensus of 54 cents.

Genesco (GCO -0.62%) was upgraded to ‘Buy’ from ‘Neutral’ at Sterne Agee.

General Mills (GIS +1.18%) was downgraded to ‘Hold’ from ‘Buy’ at Argus.

Hasbro (HAS -0.92%) was downgraded to ‘Hold’ from ‘Buy’ at Needham.

GameStop (GME +2.35%) was upgraded to ‘Buy’ from ‘Neutral’ at BofA/Merrill.

Anadarko (APC +14.51%) was upgraded to ‘Overweight’ from ‘Underweight’ at JPMorgan Chase.

Fiat (FIATY +0.17%) was upgraded to ‘Buy’ from ‘Neutral’ at UBS.

Vodafone (VOD -1.25%) was downgraded to ‘Neutral’ from ‘Buy’ at Nomura.

David E. Lazovsky reported a 5.7% passive stake in Intermolecular (IMI +0.36%) .

SAC Capital lowered its passive stake in E-House (EJ -2.98%) to 2.2% from 5.6%.

Micron (MU -1.44%) reported Q2 adjusted EPS of 85 cents, better than consensus of 76 cents.

SYNNEX (SNX -1.53%) reported Q1 adjusted EPS of $1.25, well ahead of consensus of 94 cents.

Global Payments (GPN -0.31%) reported Q3 adjusted EPS of 96 cents, higher than consensus of 95 cents, and then raised guidance on fiscal 2014 EPS view to $4.06-$4.11 from $4.03-$4.10; consensus $4.10.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

00:30 Fed’s Fisher: U.S. Economy and Monetary Policy

8:30 Nonfarm payrolls

Notable earnings before today’s open: AZZ, KMX

Notable earnings after today’s close: none

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Apr 4)”

Leave a Reply

You must be logged in to post a comment.

The non farm / unemployment numbers are out. Futures spiked to +10 on the news release, now +8 at 9 am.

We will gap open and be very near 1900 on the SPX.

Have seen this scenario, everyone is giddy, then the rest of the day the market sells off. Not saying this will happen today, just saying don’t get too bullish (and don’t get too bearish if we do sell off.) The boyz are controlling this today and only after they show us their hand will we know which way they’ll take it.

Tgt 1909 remains valid.

Only worry if we break below 1860.

Jason, have not gotten your email last two days. Might want to check to see if that’s a widespread or limited problem.

where is everyone

last few days no emails before open

Roger that, Aussie.

“But this chart bothers me.” Yes and a few other things too. The market feels soft.

Yesterday the price action was different than I have seen in a few years.