A development is building that is reminiscent of 2007. Let’s check out some charts from February 2007 (which aren’t available today) and then see how they relate to today. My argument back then was the broker/dealers had predictive value…at least much more predictive abilities than the semis or a few other groups traders liked to key in on at the time.

Join our email list here.

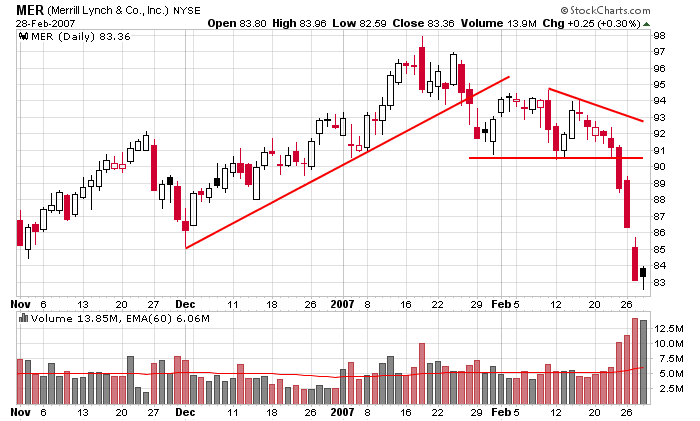

Here’s Merrill Lynch. It broke down Feb 25.

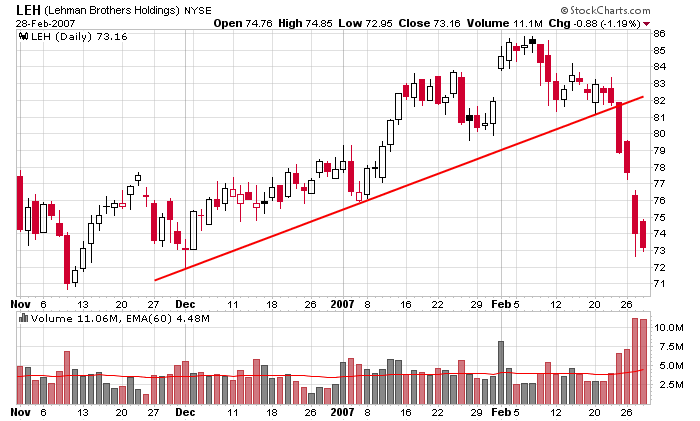

Here’s Lehman Brothers. It also broke down Feb 25.

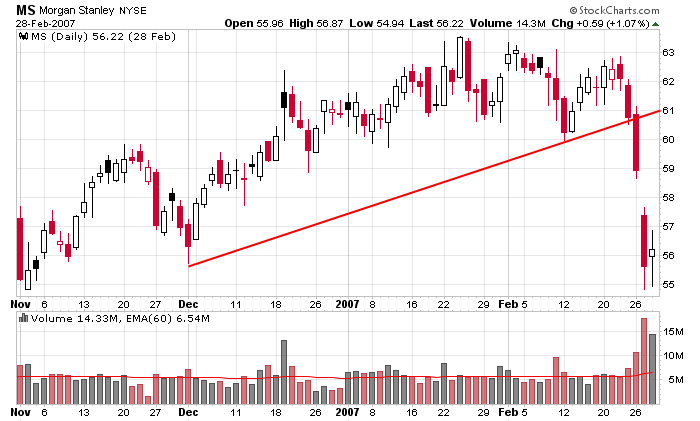

And here’s Morgan Stanley. It broke down Feb 26.

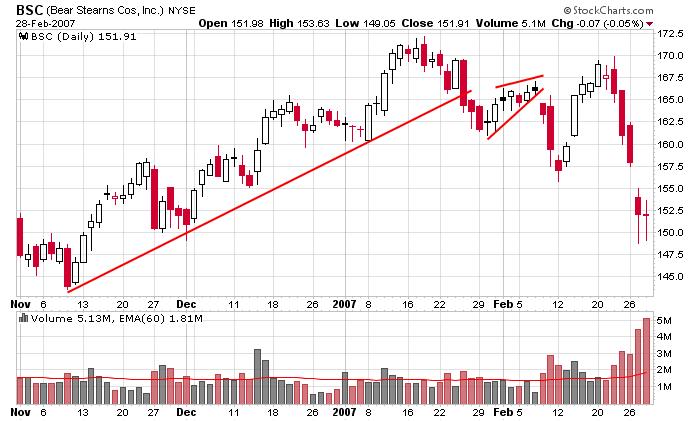

Bear Stearns didn’t break a key support level, but it did move down with force at the same time.

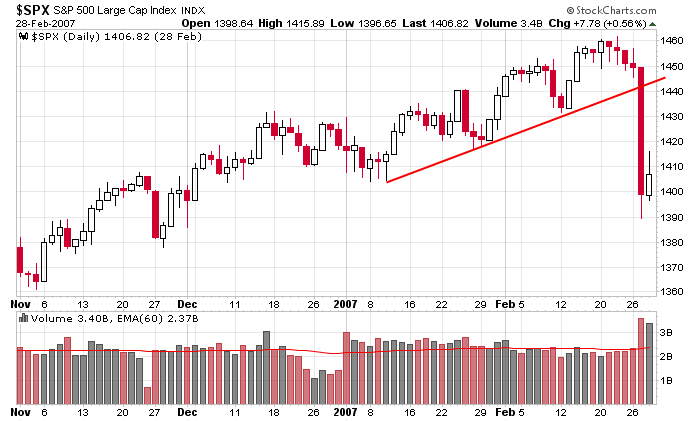

Then, on Feb 27, the entire market broke down in a big way.

Now let’s check out some current charts.

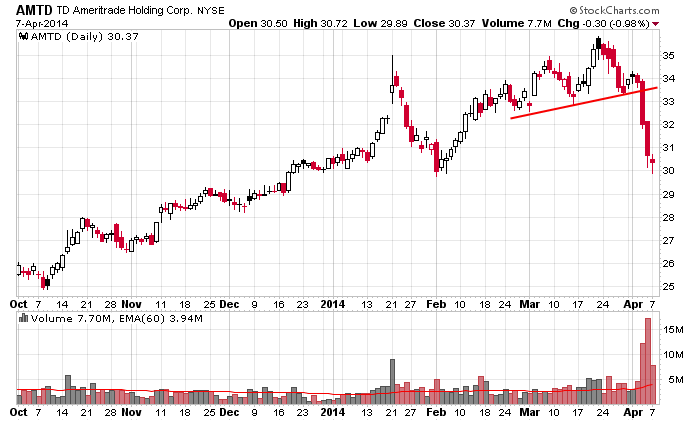

TD Ameritrade sliced through support Friday and followed through today.

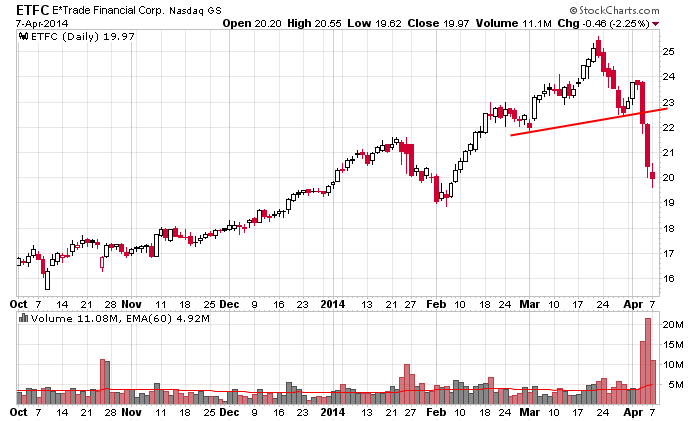

Ditto for E-Trade.

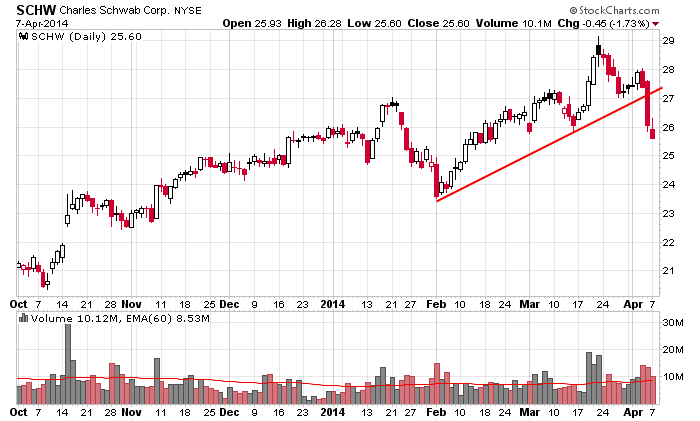

Schwab held up okay Friday but got hit hard today.

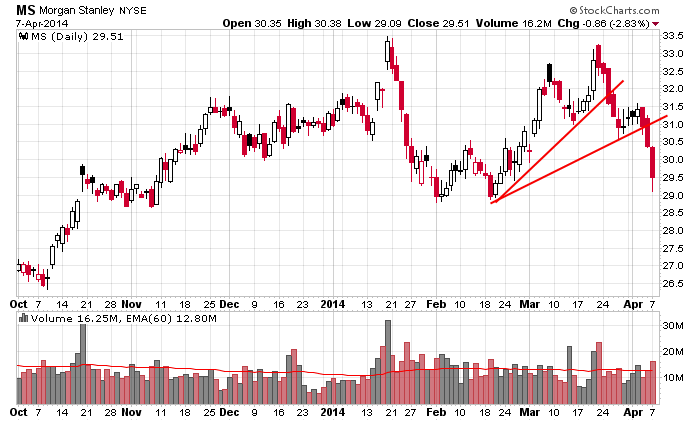

Morgan Stanley failed to match the market’s recent new high. Then it broke support Friday and followed through today.

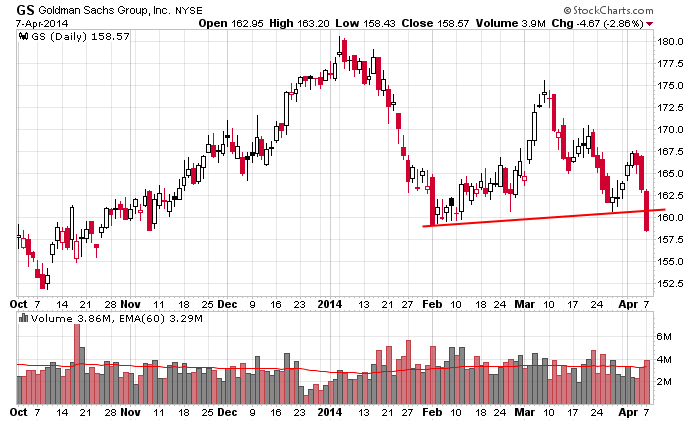

Goldman Sachs also failed to match the market’s recent high and is now breaking down.

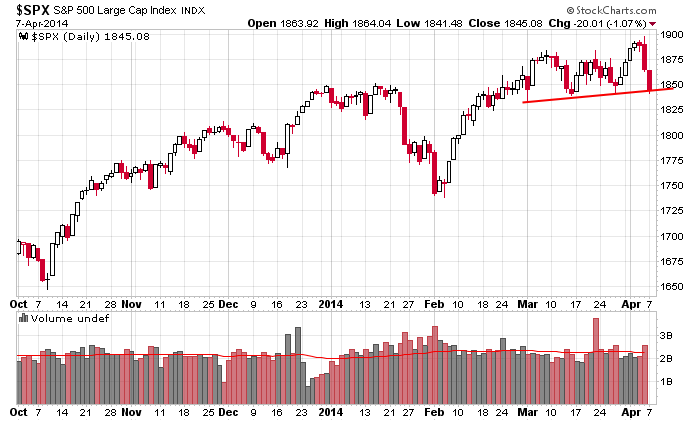

The Nasdaq has already put in two lower highs and a lower low. The S&P 500 is sitting at support.

One explanation for the weakness is the anti-HFT rhetoric floating around Wall St. on the heels of Michael Lewis’ new book Flash Boys.

Otherwise, since I had a front row seat in 2007, I couldn’t help immediately recognize the similarities between then and now.

Be on your toes.

0 thoughts on “Reminiscent of 2007”

Leave a Reply

You must be logged in to post a comment.

You have strengthened my similar opinion

Nice work. Thank you for sharing.

I had to look back into my data. March 2 and March 5 2007 were the last days I have generated buy signals two days in a row. The market recovered well in the next few months.

I am very suspicious of this being a bottom at this time as the PC ratio is too low.

Yes I calculated a buy signal last night based on the close. Yes if the market closes down slightly today there will be #2.

I think some major differences between 2007 and today is that many individual charts in nearly all sectors as well as index charts had huge topping patterns already formed or forming on their respective weekly and monthly charts accompanied by negative divergences on many technical indicators and then there was the associated housing bubble/finance travesty all coming together at the same time to form a perfect storm.

The daily charts are similar, but the larger and longer implications may not be.

Art

Interesting. All are financial intermediaries. No hard assets except furniture. Assets ride up and down the elevator every day.Lots of them around today. Indeed GS looks not only toppy but GM looks the same. Today there is one to look at that does not fit the minimal asset mold or the elevator mold. MCK has a very similar pattern and CAH is not far behind. The demographic profile says we are getting older. Should be a positive. 4 day action disputes it. I made a call to Cassandra but she is not answering. Should we tell Bush to take lessons from Bacon how to paint Putin? Is he the true predictor? The idiot/savant?

Fred Simons

Jason,

maybe short term correction here (IE end of the best 6months for stocks …Jeffery Hirsch Traders Almanac)

But according to your morning posts you remain bullish…if i am reading them correctly.

Thanks

Jack

Thanks for the charts.

The look and feel remind me of 2007. Also, look at biotech or other medicals. They have further to drop. But today’s environment is different in the sense that the Fed just keep dropping money which force the market to have only one direction to go at some point.

Don’t you think?

the end of the world is starting

shortly if not today the smart corrupt instos will go on cnbc or bloomberg and tell all the

dumb /gready know it all RETAILERS,that its time to buy

they will also tell their employee that they own —the fed –to buy

SPX had a outside month as did other indexes for a top –if the retailers cant get it to new top

then i will be very happy that the world is ending so as the instos and myself can make loads of money