Good morning. Happy Tuesday.

The Asian/Pacific markets leaned to the downside. Japan, Malaysia and New Zealand led to the downside; Hong Kong and China did well. Europe is down across-the-board. Italy, Spain, Greece and Prague are down more than 1%; Belgium, Amsterdam, Norway, London, Germany and France aren’t far behind. Futures here in the States point towards a down open for the cash market.

The dollar is down. Oil is up, copper is down. Gold and silver are up.

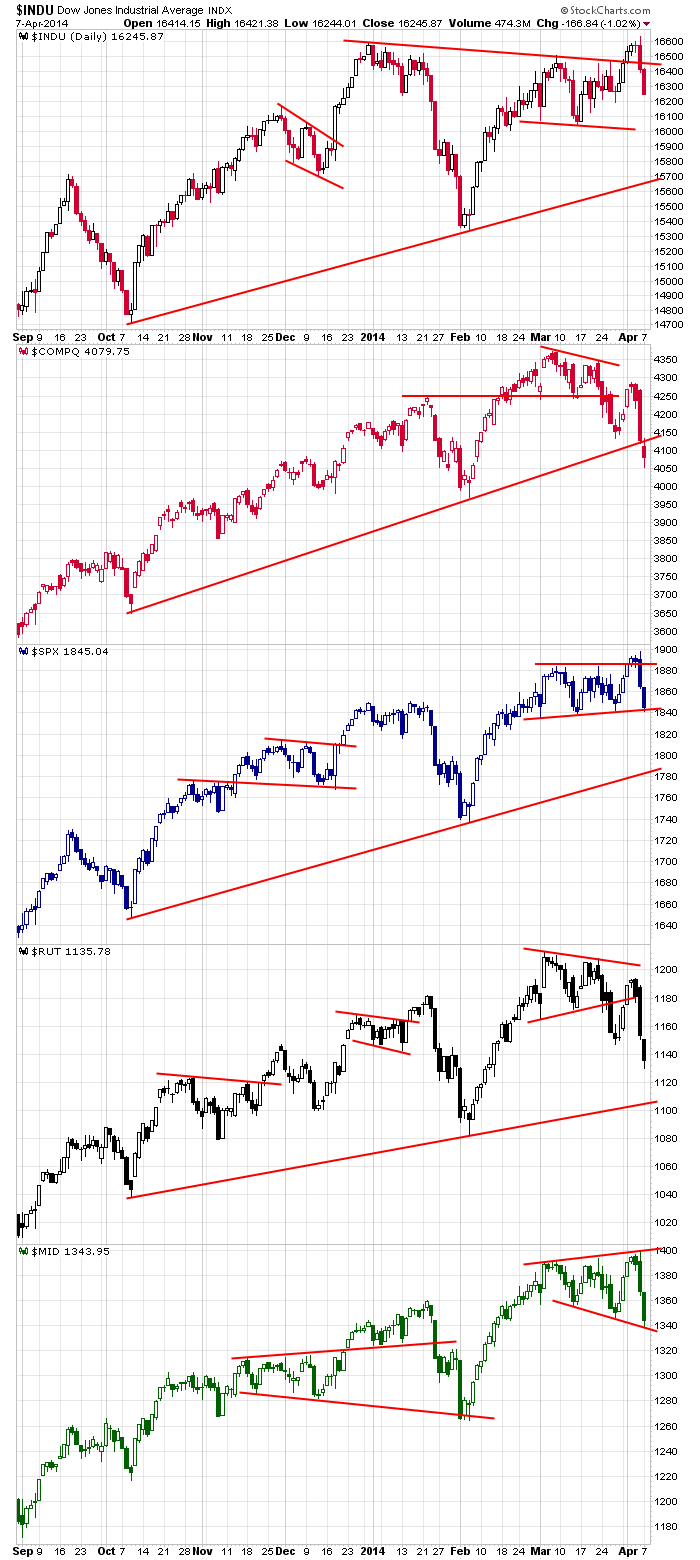

The market has suffered two consecutive days of stiff selling. The Dow and S&P 500 hit all-time highs on Friday and are now back in their patterns. The S&P 400 also pushed to a new high and is already sitting at a 7-week low. The Nasdaq and Russell 2000 put in lower highs last week and are also sitting at multi-week lows. Here are the daily charts.

Unlike previous bouts of weakness that were based on world events or what the Fed did or said, the recent weakness has been purely technical.

Money has rotated from growth stocks to value stocks.

Money has come out of the Nas and gone into the NYSE.

Many technical indicators ceased to support the bull’s case and many others diverged from the underlying price action.

Leading groups stopped leading.

Leading stocks topped and pulled back while the SPX pushed to a new high.

From a technical standpoint, there were warnings everywhere…hence why I’ve been saying the market was iffy.

When the trend is strong and being supported on most fronts, you can enter positions, put a stop in place and let the market do the work for you. But when things get iffy, being content with smaller 5% gains instead of bigger 10-20% gains must be your MO. As the market changes, you must make slight adjustments. Otherwise you’re doing the equivalent of swinging for the fences when the wind is blowing in. You may get lucky once in a while, but you’re better off just swinging for a single. More after the open.

Stock headlines from barchart.com…

Dr Pepper Snapple (DPS -0.06%) was downgraded to ‘Underperform’ from ‘Market Perform’ at Wells Fargo.

Nike (NKE -2.76%) was upgraded to ‘Buy’ from ‘Hold’ at Stifel.

Cisco (CSCO +0.62%) was downgraded to ‘Hold’ from ‘Buy’ at Wunderlich.

Estee Lauder (EL +0.48%) was upgraded to ‘Outperform’ from ‘Market Perform’ at Bernstein.

Statoil (STO -1.81%) was downgraded to ‘Hold’ from ‘Buy’ at Societe Generale.

Infineon (IFNNY -1.17%) was downgraded to ‘Underperform’ from ‘Neutral’ at BofA/Merrill.

Eli Lilly (LLY -0.66%) fell over 2% in European trading after a federal-court jury said that Eli Lilly and its partner Takeda Pharmaceutical must pay a combined $9 billion in punitive damages after they hid the cancer risks of their Actos diabetes medicine.

Glen Capital Partners reported a 7.1% passive stake in LMI Aerospace (LMIA +1.94%) .

Barron’s reported that four Oracle (ORCL -1.28%) insiders sold 1.69 million shares of the company’s stock for $69.5 million.

SAC Capital reported a 5.5% passive stake in Cytokinetics (CYTK +0.23%) .

AK Steel (AKS -5.20%) said that effective immediately for new orders it will increase the current spot market base price for its hot roll carbon steel to a minimum of $700 per ton.

A. Schulman (SHLM +0.25%) gained over 6% in after-hours trading after it reported Q2 EPS ex-items of 39 cents, better than consensus of 33 cents, and then raised guidance on fiscal 2014 adjusted EPS to $2.23-$2.28 from $2.08-$2.13, well above consensus of $2.16.

Whole Foods Markets (WFM -1.59%) was added to the Key Calls list at UBS who also has a ‘Buy’ rating on the stock with a $70 price target.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

7:30 NFIB Small Business Optimism Index

7:45 ICSC Retail Store Sales

8:55 Redbook Chain Store Sales

10:00 Job Openings and Labor Turnover Survey

1:00 PM Results of $30B, 3-Year Note Auction

1:30 PM Fed’s Kocherlakota Speech

2:45 PM Fed’s Plosser: “Enhancing Prudential Standards in Financial Regulations”

4:00 PM Fed’s Evans: “Managing the Transition to Normality”

Notable earnings before today’s open: none

Notable earnings after today’s close: AA, SAIC, WDFC

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Apr 8)”

Leave a Reply

You must be logged in to post a comment.

i would be cautious at automaticly being a buyer at spx 1835-40

this could be a capitulation move down and buy the dip may not work

but start of earnings season should be a stabalizing effect for next few weeks usually

be a daytrader and have fun