Good morning. Happy Wednesday.

The Asian/Pacific markets closed mostly up. Hong Kong, Australia, New Zealand and India led the way with gains greater than 0.7%. Japan dropped 2%. Europe is currently mixed. London, Italy and Norway are posting gains greater than 0.6%. Austria and Greece are down 0.8%. Futures here in the States point towards an up open for the cash market.

The dollar is up. Oil is up, copper down. Gold and silver are down.

The market bounced yesterday…turnaround Tuesday came through exactly when the bulls needed it most. The bounce was decent, not great. Volume was strong overall but lighter than the two previous days. It’s a start (if you’re a bull). All moves have to start with a single small step.

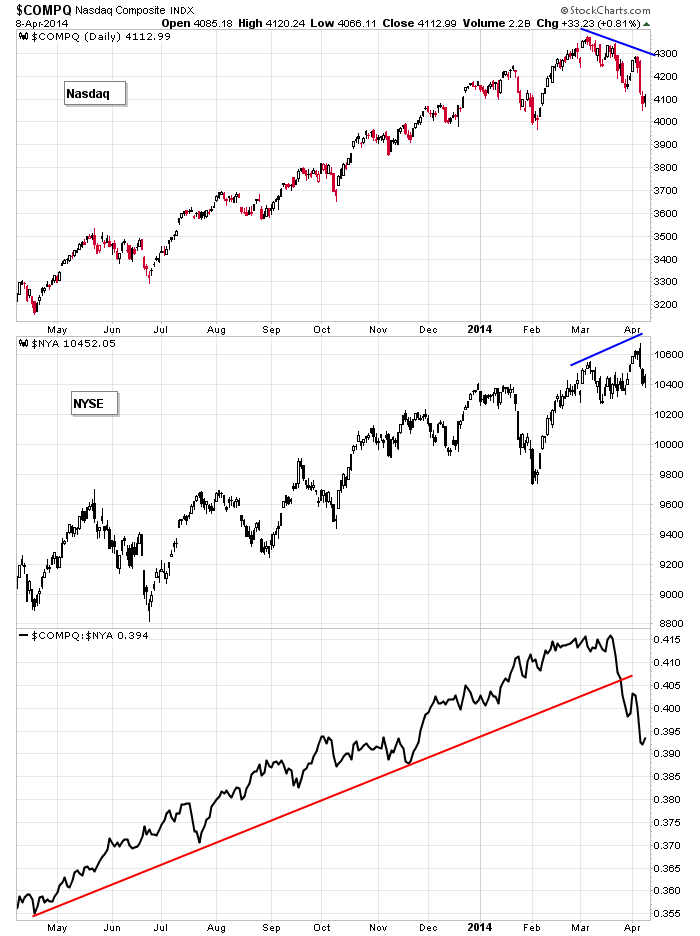

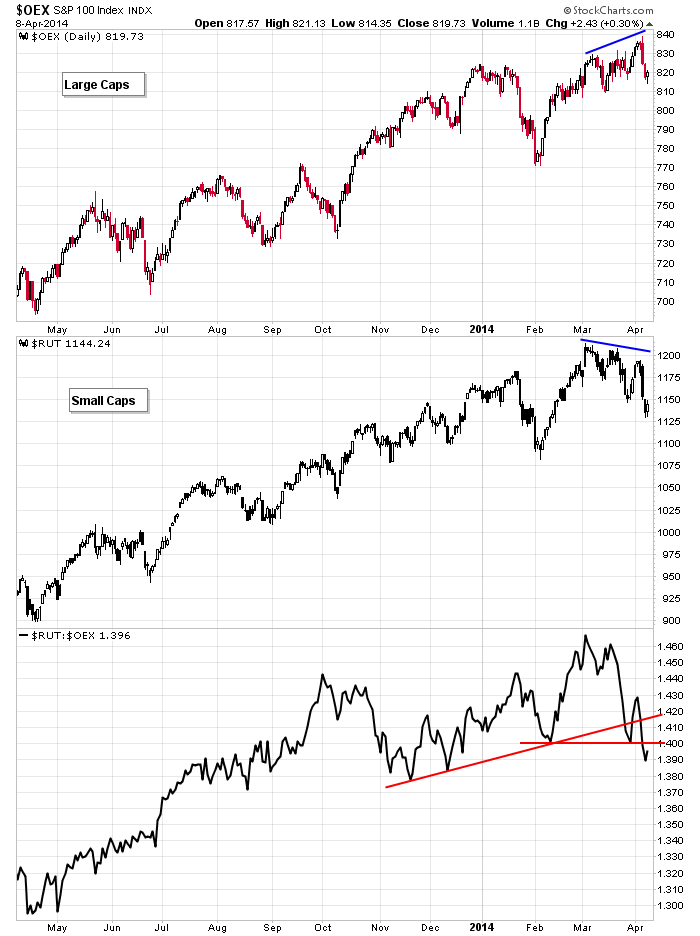

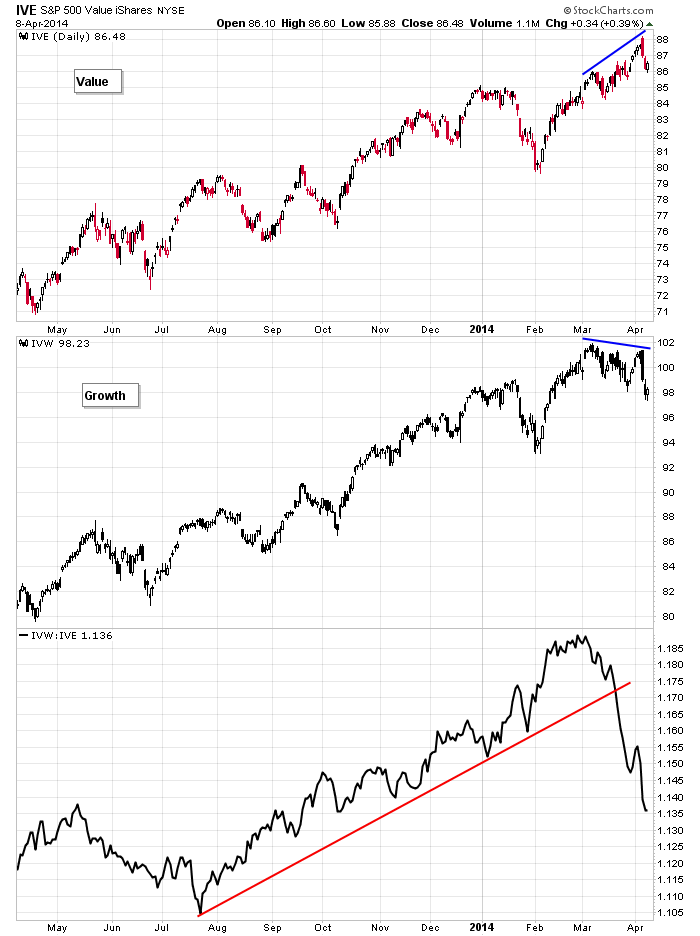

A lot of technical damage has taken place the last couple weeks – damage that is different than previous pullbacks. In the past I warned that bounces often keep going and going and going and before you know it, the market is in rally mode and the bears are frustrated again. The same scenario could play out again, but I’ll need to see the small caps start leading, growth stocks start out-performing value stocks and the Nas lead the NYSE (see charts below).

Whatever happens – whether we get another leg down or a local bottom has been put in place – I do not expect a big move in either direction. Maybe the S&P can rally back to 1900 or even 2000. Or perhaps it’ll fall to 1800 or 1750. In either case, I don’t expect a repeat of 2013, and I’d be surprised if the market completely fell apart. More after the open.

Stock headlines from barchart.com…

Constellation Brands (STZ +0.84%) raised guidance on fiscal 2015 adjusted EPS to $3.95-$4.15, above consensus of $3.95.

Arch Coal (ACI +3.19%) and Walter Energy (WLT +4.77%) were both downgraded to ‘Sell’ from ‘Neutral’ at UBS.

General Motors (GM +1.23%) was downgraded to ‘Underweight’ from ‘Equal Weight’ at Morgan Stanley.

The WSJ reports that Apple (AAPL -0.01%) seeks $2.2 billion in damages from Samsung (SSNLF +6.56%) in patent infringement charges that covers more than 37 million smartphones and tablets sold by Samsung in the U.S. from 2011-2013.

CBOE Holdings (CBOE -1.08%) was upgraded to ‘Buy’ from ‘Neutral’ at BofA/Merrill.

NASDAQ (NDAQ -2.74%) was downgraded to ‘Neutral’ from ‘Buy’ at BofA/Merrill.

Tech Data (TECD +0.62%) reported Q4 adjusted EPS of $2.10, better than consensus of $1.93, although Q$ revenue of $7.97 billion was below consensus of $7.98 billion.

Toyota Motor (TM -2.06%) announced five recalls involving 27 Toyota models and over 6 million vehicles worldwide.

Aeropostale (ARO +1.19%) was downgraded to ‘Underweight’ from ‘Neutral’ at Piper Jaffray.

Intuitive Surgical (ISRG -1.45%) slumped over 10% in after-hours trading after it said it sees Q1 revenue of $465 million, well below consensus of $537.9 million.

SAIC (SAIC +1.50%) reported Q4 EPS of 66 cents, higher than consensus of 65 cents.

JP Morgan Chase reported a 10.7% passive stake in Malibu Boats (MBUU +0.41%) .

Philip Morris (PM +1.12%) was upgraded to ‘Neutral’ from ‘Reduce’ at Nomura.

Alcoa (AA +0.48%) rose over 3% in pre-market trading after it reported Q1 adjusted EPS of 9 cents, well ahead of consensus of 5 cents, although Q1 revenue of $5.50 billion was below consensus of $5.55 billion.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

7:00 MBA Mortgage Applications

10:00 Wholesale Trade

10:30 EIA Petroleum Inventories

1:00 PM Results of $21B, 10-Year Note Auction

2:00 PM FOMC minutes

3:30 PM Fed’s Evans: “Stabilizing Financial Systems for Growth and Full Employment”

7:00 PM Daniel Tarullo speaks on Stabilizing Financial Systems for Growth and Full Employment

Notable earnings before today’s open: MSM, PGR, STZ

Notable earnings after today’s close: ANGO, BBBY, RT, SIGM

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Apr 9)”

Leave a Reply

You must be logged in to post a comment.

Jason

I like your work. The charts are very illustrative.

This market is not typical.

I am long but very gingerly.

Paul

i expect a volitile next 2 weeks with a slightly up bias on lowered expectations for easy to beat earnings

wild after hours swings on earnings

then the end of the world can start taking 10 years to anileation zero

trade 24 hours a day and have fun

Trin 1.56 and the cpc is .49 with an up market..very odd stats..