Good morning. Happy Friday.

The Asian/Pacific markets closed mostly down. Japan dropped 2.4%; Hong Kong and Australia nearly 1%. Indonesia rallied 1.1%. Europe is currently down across the board. London, Germany, France, Italy, Spain, Amsterdam, Norway, Stockholm, Switzerland, Prague and Greece are all down more than 1%. Futures here in the States point towards a moderate gap down open for the cash market.

The dollar is up. Oil is down, copper up. Gold is up, silver down.

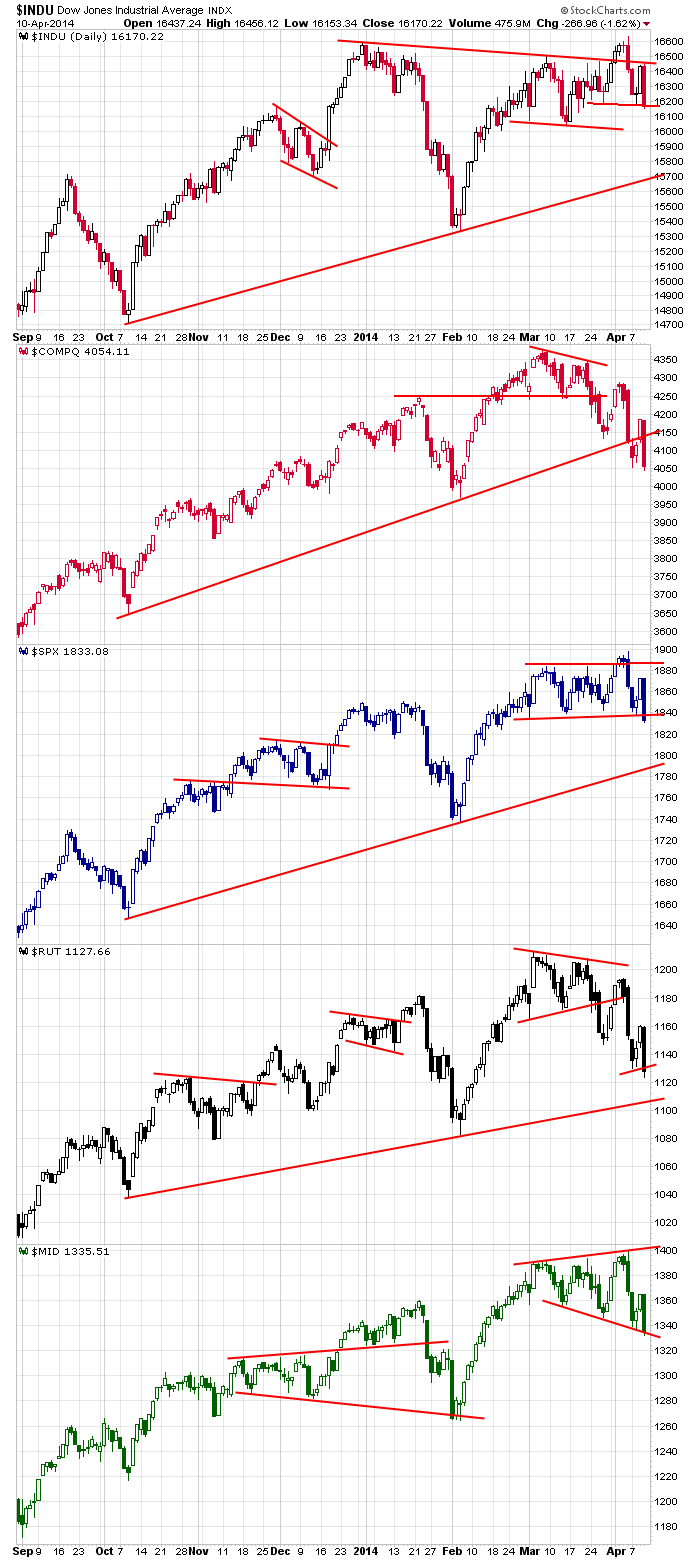

The market got crushed yesterday. There’s no way to spin it. It was a total bloodbath where nothing was spared. All the indexes took out their lows and are now sitting at their lowest levels since the first week of February. Here are the dailies…

The weight off all the technical deterioration was too much to overcome. Growth stocks have been lagging value stocks…small caps have been lagging large caps…the Nas has been lagging the NYSE. Throw in a declining bullish % index and a lagging AD line, and there has been too much to overcome. The market can move in either direction in the near term, but the sum total of these developments over the last several weeks has been too much.

Some people are predicting a crash is in the works…the same people who’ve been predicting a crash for a couple years. I’m not in that camp. A healthy pullback, sure, but an outright crash? Na. The market has been strong enough for long enough that the bulls deserve the benefit of the doubt in the long term.

I’ll call it as I see it. For now, you don’t want to be long in the near term. More after the open.

Stock headlines from barchart.com…

JPMorgan Chase (JPM -3.16%) fell nearly 2% in pre-market trading after it reported Q1 EPS of $1.28, below consensus of $1.38.

ConocoPhillips (COP -2.56%) was upgraded to ‘Equal Weight’ from ‘Underweight’ at Morgan Stanley.

Corning (GLW -1.84%) was downgraded to ‘Neutral’ from ‘Buy’ at UBS.

Gap (GPS -1.73%) was downgraded to ‘Neutral’ from ‘Buy’ at Janney Capital.

Ford (F -1.33%) was upgraded to ‘Buy’ from ‘Hold’ at Deutsche Bank.

Fastenal (FAST -0.41%) reported Q1 EPS of 38 cents, right on consensus.

Horton Capital Partners reported a 9.4% passive stake in Wireless Telecom Group (WTT +2.02%) .

Bed Bath & Beyond (BBBY -6.17%) was downgraded to ‘Neutral’ from ‘Buy’ at Citigroup.

Southpoint Capital reported a 5.07% passive stake in Nexstar (NXST -2.11%) .

Qualcomm (QCOM -2.33%) was initiated with a ‘Strong Buy’ at ISI Group with a price target of $90.

Gap (GPS -1.73%) reported that March Same-Store-Sales were down 6% y/y.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

8:30 Producer Price Index

9:55 Reuters/UofM Consumer Sentiment

Notable earnings before today’s open: FAST, JPM, WFC

Notable earnings after today’s close: none

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Apr 11)”

Leave a Reply

You must be logged in to post a comment.

I expect a bounce today Probably early in the day. I will be watching the PC ratio if the bounce happens. If the PC ratio drops under .8 over the next few days my longs are gone.

cpc now at 1.43…im a little long with calls on dia…